4 Stock Picks For A Rising Interest Rate Environment

4 Stock Picks For The Rising Interest Rate Environment

4 Stocks to Weather Rising Rates

Investors should look at companies that generate cash and don't need to borrow money, Kim Forrest of Fort Pitt Capital Group said Wednesday.

"We've been anticipating that we can't have these rates (TLT) that low for that long, so I wouldn't say we're anticipating the exact move, but we knew that this day would come, and here it is," she said.

Forrest said that she had been looking for more "growthier" names.

"Nobody who can pay back seems to want to borrow," she added, explaining why she was avoiding financial stocks (XLF) and instead focusing on cyclical shares of companies that are "probably not going to have to borrow money because they're generating cash."

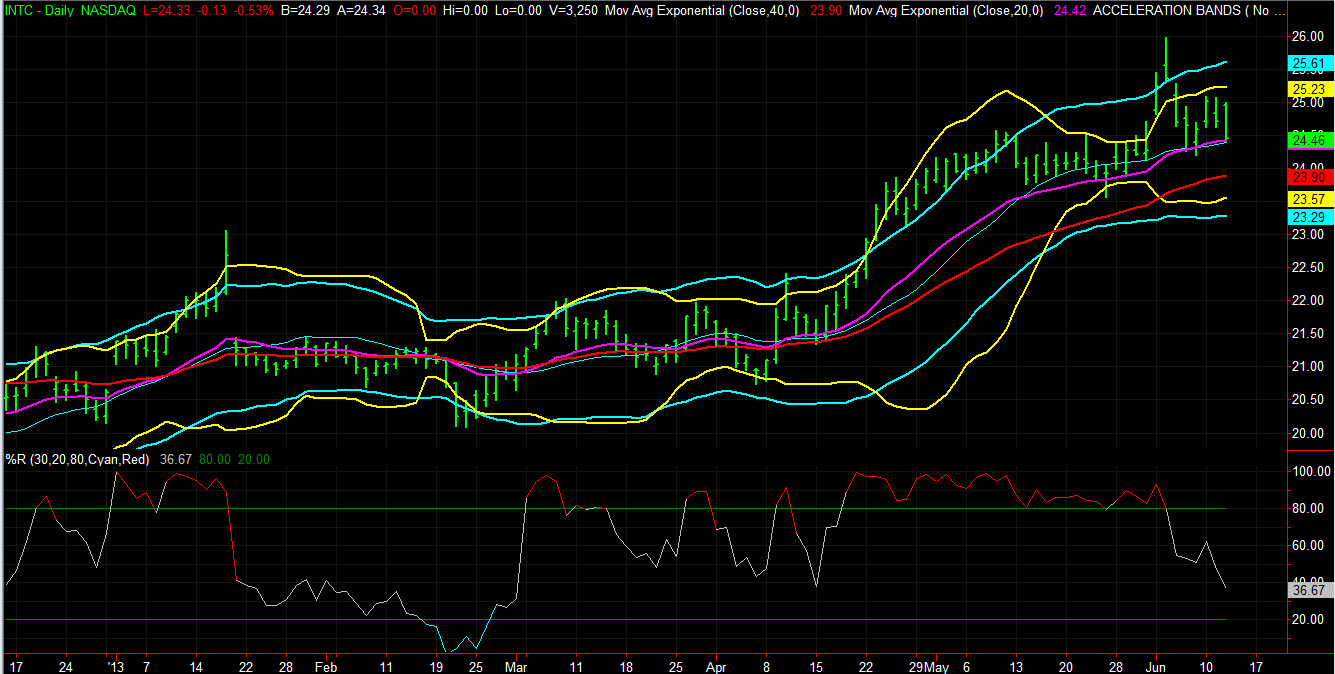

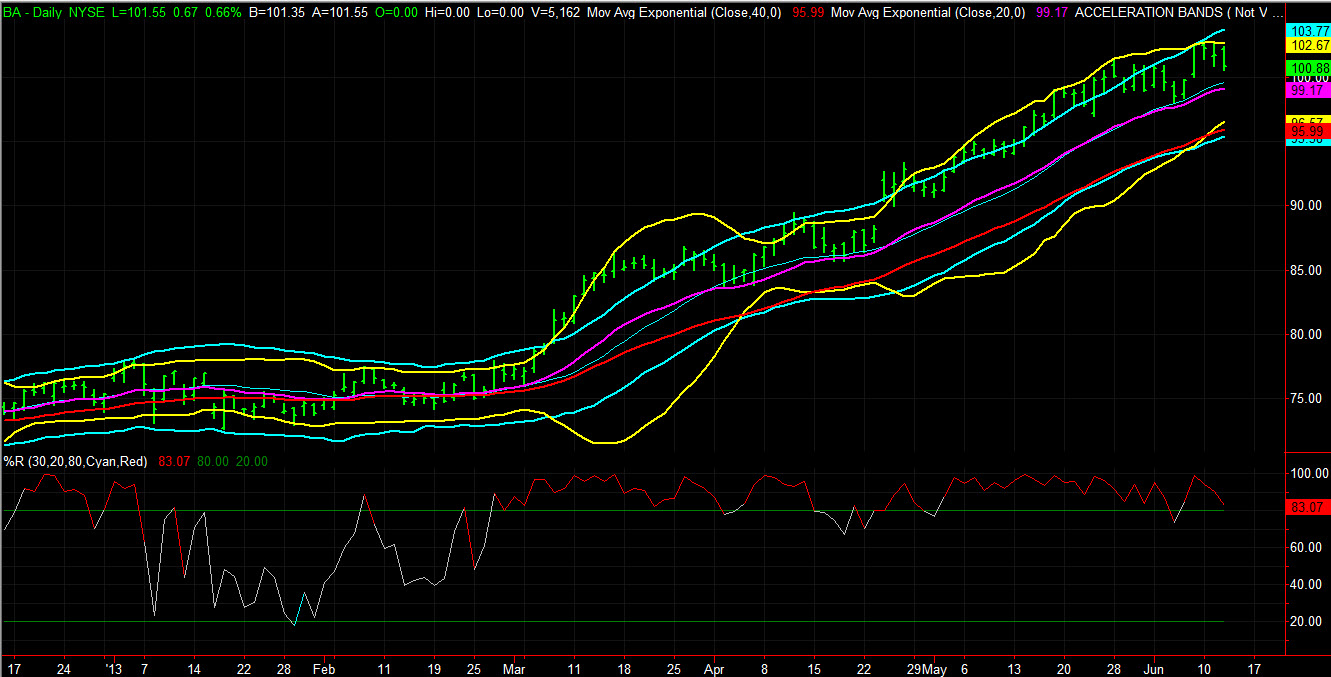

[BigTrends Editor's Note: We've added basic charts of the following 4 stocks with Percent R, Acceleration Bands, Bollinger Bands and Exponential Moving Averages. BA & MSFT are the strongest 2 of the 4 according to our chart analysis.]

Intel (INTC): "You can throw that baby out with the bathwater and say they're a PC-only company," she said. "We don't believe it. They' generate a whole lot of cash, they return it to shareholders, and they're not going to need to borrow to do what they do."

Microsoft (MSFT): "I love them because they are an IT play," Forrest said. "You're not going to boot them out of your data center. Sorry, Google (GOOG). You're not going to replace Word with Google Apps. They really are an IT proxy, and I think they're here to stay for the long haul."

Boeing (BA): "It still is bleeding cash, but they have plenty of very profitable planes that people want," she added. "They also do extremely well if book-to-bill is over 1, and we think that's going to happen through this year and into next year. So, Boeing is still on our list, and we really like Boeing."

Joy Global (JOY): "Joy's really a coal (KOL) play," she said, adding that the company would be "very, very big" in China and India. "Both of those markets need coal for electricity, and Joy has a really good track record of having operated there since 1979. They did an acquisition. Unlike (CAT), they actually bought a company that made stuff, and they're doing OK in that country."

Courtesy of Bruno J. Navarro, cnbc.com