A week ago, we updated a bullish call on oil [1] that extends all the way back to early November. That wasn't an easy time to be bullish crude, despite the rally that was underway at the time – most were counting on a quick correction that pulled oil prices back to the low $50's… where the pros were thinking it would remain through 2018.

We're glad we stuck our neck out. Since then, oil prices have rallied from $54.76 to their current value of $59.84. That's a monster-sized move by commodity standards.

It's not the most interesting part of the story, however. Most interesting right now is, despite the fact that it's technically overbought, oil prices are knocking on the door of a push through another critical resistance line that — if hurdled — could catapult crude prices even further. A meltup.

It seems implausible that oil prices could edge any further into highs not seen since 2015. Never say never though. Remember, the implosion in 2014 and 2015 'could never happen' either, but that didn't stave off a 65% selloff in oil prices during that time.

Take a look at the daily chart of crude prices below. Things could have gone either way as recently as a week ago, but they took a bullish turn on Tuesday, testing the $60 mark as a ceiling. Oil hasn't hurdled that level yet, but it hasn't backed down from that level either. The bulls are ready to clear that key resistance level, and if they do, it could light a fire under the rally in a big way.

Zooming out to a weekly chart of crude oil puts it all in perspective. On this chart we can see crude oil prices are at (and just a little above) a resistance line that tags all the highs made since mid-2016.

One of two things has to happen here. Those are, either the bulls are going to decide oil's been held back long enough and are going to push crude prices out of their narrowing trading range. Or, crude's going to peel back to the lower end of its trading range again. Both remain fair possibilities, though as implausible as it may seem right now, we're leaning in a bullish direction.

There's a very specific reason we're leaning bullishly, and it's rooted in market psychology. That is, crude prices have moved past the proverbial "point of no return" marked by Fibonacci retracement lines.

The weekly chart below plots those lines. As you can see, with this week's modest advance, crude prices have cleared the 38.2% retracement level based on the span of the entire meltdown between 2014 and 2016.

It's not a minor detail, though it's hardly a guarantee either. It's also not the only hint that crude prices are catching a tailwind. Also working in favor of crude prices are a falling U.S. dollar and a shrinking supply of crude oil.

The daily chart of the U.S. Dollar Index speaks for itself. For a short while in September and October it looked like the greenback might stabilize. It didn't though. The bigger downtrend that got started a year ago is underway again.

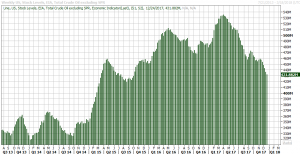

We also saw yet-another decline in the amount of oil stockpiled in the United States for last week.

While a soaring dollar is a key part of the reason crude prices unraveled in 2014 and 2015, it wasn't the only reason. With oil prices at sky-high levels in 2013 and 2014, the exploration and production arm of the energy sector simply ramped up too much… thinking those strong prices would last forever. They didn't, ironically, because of overproduction — too much supply relative to demand.

Nowhere is this more evident than on a chart of the country's stockpiled oil reserves, which also soared in 2015 as a bunch of new production capacity went online all in that year. The effect of that overproduction didn't peak until early 2017.

Once the market worked through that oversupply though, stockpiles levels began to fall — in a hurry — towards more historically-reasonable levels.

This dynamic may have been the most vexing for oil traders, including professionals. It's difficult (if not impossible) gauge how much oil drillers are going to extract and take to refineries, and it's equally difficult to determine how much is in transit at any given time. Never even mind the fact drillers and frackers were relatively undisciplined a couple of years ago.

Whatever the case, the supply appears to be in a freefall now, boosting crude oil prices. This downtrend in supply will take as long to stop, or even slow down, as the uptrend was.

Bottom line? Though there's little doubt oil prices will remain volatile, many of the fundamental clues point to higher prices for the foreseeable future. It's still not an optimism most analysts and onlookers share, though.