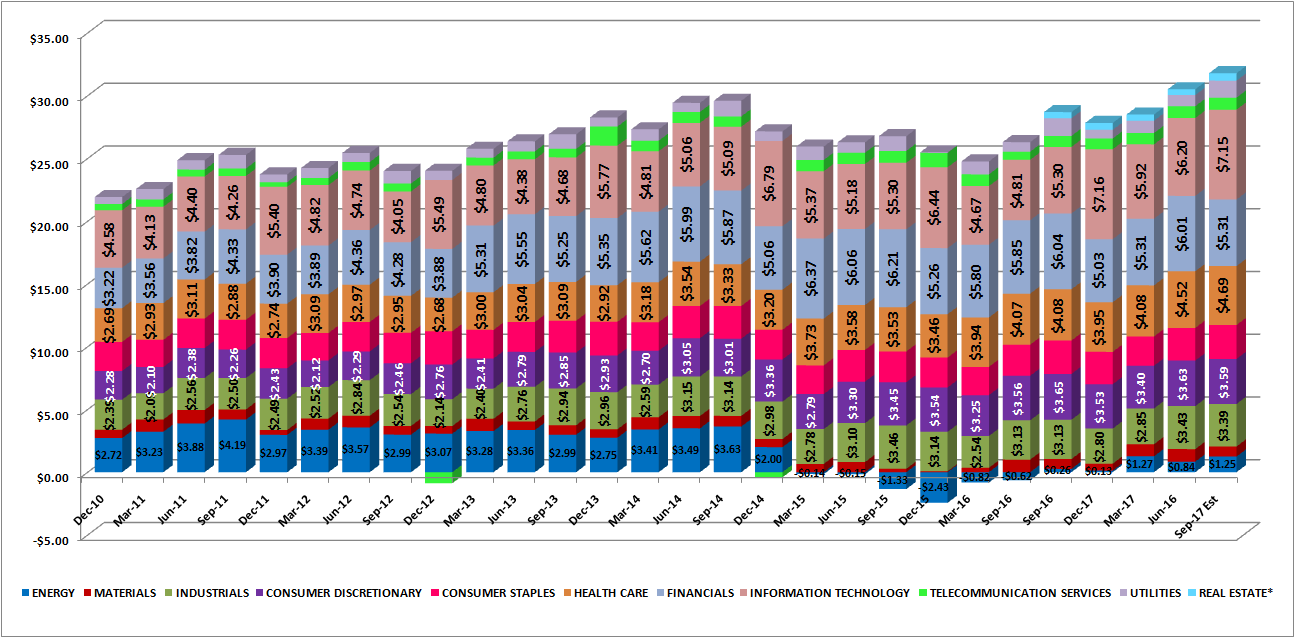

Almost two weeks ago we took a look at the broad market's Q3 earnings [1]. Though only 20% of the S&P 500's constituents had reported their prior quarter's results, it was enough of a look at how well companies did last quarter to start drawing some conclusions. At the time, the S&P 500 was on pace to earn $31.66 per share. That was down from the $32.90 the pros were expecting right at the end of the quarter, but a little more than 10% better than the year-ago bottom line of $28.69.

It's been a busy couple of weeks. As of the end of October, 69% of the S&P 500's companies have posted their Q3 numbers, and the projected earnings outlook for the index for the third quarter stands at $31.79.

The big question everyone is still asking: How much of that improvement stems from the energy sector's turnaround, and how well or how poorly is every other sector doing? We've got the answer to both.

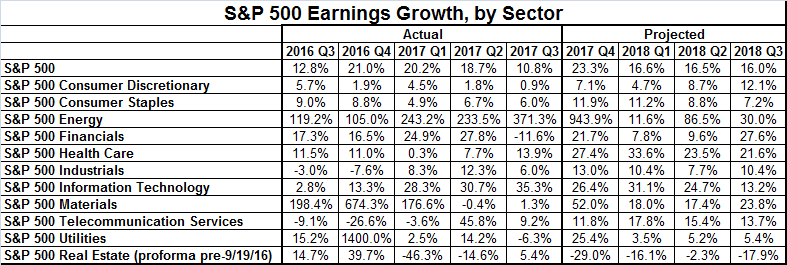

In short, the energy sector's ongoing turnaround continues to do the bulk of the market's heavy lifting, with the industry's bottom line up a whopping 371% year-over-year. Don't get too excited yet, as the year-ago bottom line was tiny and even modest success was relatively much better. Still, the energy sector's contribution to the S&P 500's bottom line grew from 26 cents in the third quarter of 2016 to $1.25 of the index's total this time around. That's still only about 4% of the S&P 500's total income for the third quarter, where it used to be about a 14% of the market's corporate profits. The earnings breakdown graphic below tells the tale.

That's encouraging. Problem is, it's one of the few things that's actually encouraging about last quarter's earnings. With the exception of the tech sector and the healthcare sector, all the other sectors failed to report double-digit growth. Two of them lost ground. And, the only reason the tech sector did so well was so great last quarter was because it was so lackluster in the third quarter of 2016.

The outlook for the next four quarters is considerably more compelling than the past four have been, prompting one key question – what's going to make the next year better than the last one was? Maybe there's an answer. Two quarters of GDP growth of or better than 3% is certainly a good sign, as is the impending tax relief. The tax overhaul isn't game-changing though, and it remains to be seen if the GDP growth pace is sustainable. It also remains to be seen if that will trickle down to corporate bottom lines.

In other words, the bar is set pretty high for all sectors. Indeed, the market may well be priced for perfection that's going to be impossible to actually deliver.

Of course, spotting the professionals' misguided outlooks is where traders find some of the biggest opportunities. If there's a good reason there's something inaccurate or overlooked about the trend and outlook — and you have good reason to believe in it — going against the grain could be the right move. It all starts with figuring out what the expectations are, and why they are what they are.

In the meantime, note that the overall earnings picture isn't all that thrilling.