By Bret Kenwell, TheStreet.com [1]

Facebook (FB) shares have been struggling as social media stocks remain in focus with the TikTok news.

On the surface, the risk for Oracle (ORCL), Walmart (WMT) and TikTok is that TikTok gets banned in the U.S.

This weekend, new downloads of TikTok may be banned, while a banning of the platform is still on the table later this year if a deal cannot be agreed upon.

While that is the surface risk, the risk to Facebook, Twitter (TWTR) and others is that other countries start to take the same approach to our social-media companies.

As Adam Mosseri, the head of Instagram, pointed out, the banning of a competitor may be a temporary benefit, but it will likely result in long-term issues.

Of course, that rationale is not likely the sole reason that Facebook stock is down on Friday. Rather, it's likely the selling pressure that most tech stocks – and in particular the FAANG group – has been feeling lately.

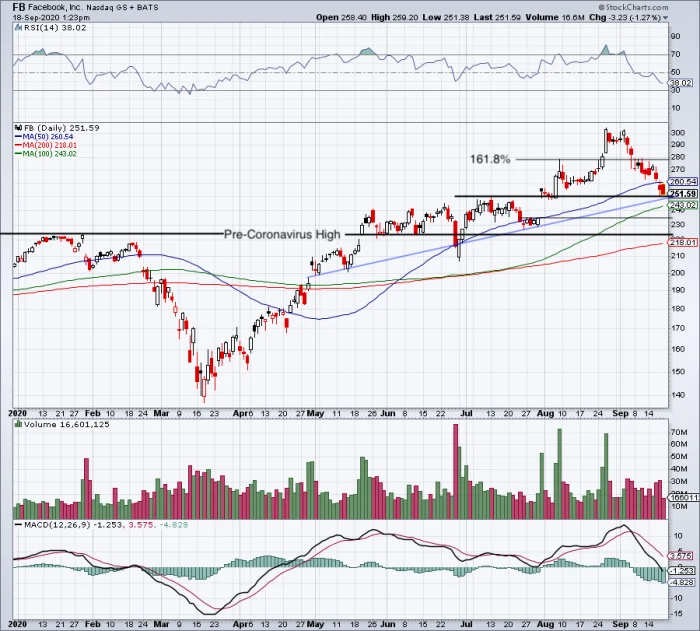

Trading Facebook Stock

Daily chart of Facebook stock.

[2]

[2]

Chart courtesy of Stockcharts.com

Earlier this week, I took a closer look at Amazon (AMZN), as it was showing signs of breaking down. Facebook isn't looking much better.

We've seen a massive move from the lows in Facebook, which isn't uncommon considering the strength in its peers. However, we've seen the shares unravel rather quickly.

The stock is now down six of the past seven trading sessions and in nine of the past 11. On a weekly basis, it's down three straight weeks. Put simply, the momentum just isn't there for Facebook stock.

However, we're coming into the key $250 area, which was gap-up support from earnings and a key breakout spot.

If this level holds as support, bulls need to see Facebook rotate higher and reclaim the two-day high and more importantly, the 50-day moving average.

Above opens the door to higher prices, specifically putting the 161.8% retracement and 20-day moving average in play near $278.

If $250 fails as support, we'll have to be open to more selling pressure. Specifically, we'll need to see whether the 100-day moving average is at all relevant. If not, it puts a potential gap fill in play near $235. Below that and $220 and/or the 200-day moving average could be next.

In short, let's see how Facebook handles $250. Above is more constructive, below is less so.

From TheStreet.com [1]