U.S. households are nearly fully invested in stocks

By Anora Mahmudova, MarketWatch [1]

U.S. households—despite trepidation about lofty stock valuations as the current bull market enters its ninth year—are dialing up their equity investments, which research shows has been highly correlated with poor long-term returns, according to one well-known market analyst.

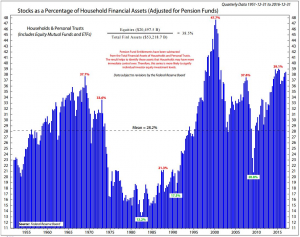

Households now have more than $20 trillion of equity holdings, representing 38.5% of their total financial assets, which includes houses and other tangible properties.

Those levels are now close to the peak seen in 2007, though still below the levels during the late 1990s dot-com bubble, when nearly half of U.S. household wealth was in stocks, said Ned Davis, founder and senior investment strategist at Ned Davis Research Group, in a note.

Excluding property and other hard assets, stocks represent 53.5% of holdings for U.S. households, above the 44.8% norm since 1952, according to Davis. Meanwhile, cash and bond holdings have decreased, with cash at 24.7%, compared with an average of 32.2%, and bonds presently at 21.8% versus an average of 23% over the past 65 years.

The emergence of flows to equity exchange-traded funds, followed by a rally since the Nov. 8 presidential election, may be one reason behind the elevated levels of stock ownership. According to Investment Company Institute, a trade association of U.S. investment companies, an estimated $45.67 billion flowed into mutual funds and ETFs investing in U.S. stocks in November and December, following President Donald Trump’s victory, which resulted in a monthslong stock-market rally.

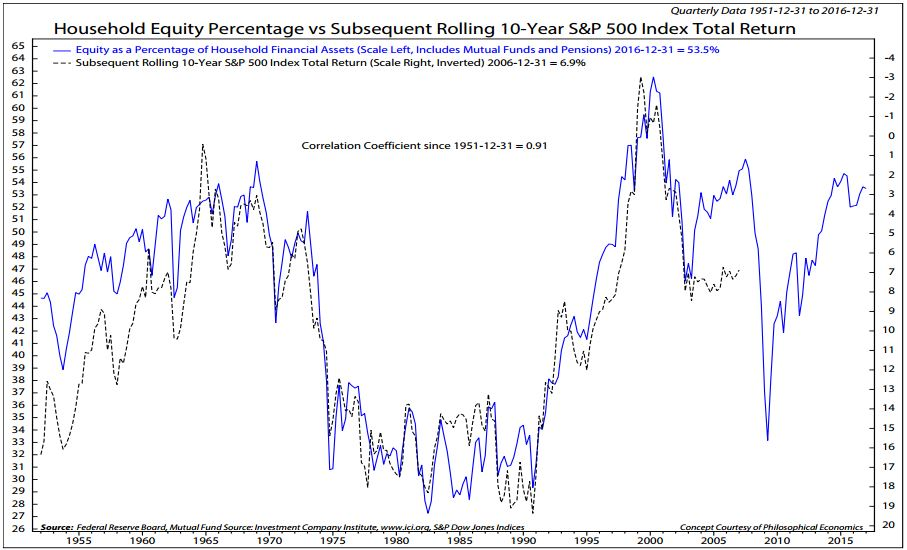

While none of these metrics are predictive of what the market will do, U.S. households scooping up stocks in droves ought to be a warning sign for market watchers, given the tendency for the market to underperform thereafter. Measured over the following 10 years after household ownership hits a peak, equity returns have usually been mediocre at best and negative at worst, according to Davis.

“When investors are pretty fully invested in stocks, the returns looking out 10 years are generally poor. Likewise, when investors have greatly avoided stocks, they have a lot of potential buying power, and 10-year returns have been superb on average,” Davis wrote.

In fact, when household-stock allocations are at or near their highest, which is the case with households right now, the worst return over the following 10 years is negative 3% and the best return is 8%, while the average is 3.7%, as seen in the chart below.

In the following chart, the correlation between stocks, as a share of household financial assets, with subsequent rolling 10-year S&P 500 total return (inverted) is very tight, showing the higher the stock ownership by households, the lower the returns in 10 years.

However, there has been a marked diversion over the past few years, where rolling returns were at a decent 7%-8% range, instead of the historical trend of low single-digits. Davis said this recent divergence can be attributed in large part to corporate buybacks over the past several years, which has supported stock gains.

“The main reason stocks have done so well this cycle and could still have further upside potential, even as stocks are overweight by both the public and institutions, is that corporations continue to be huge buyers,” Davis wrote.

Ed Yardeni of Yardeni Research, also came to the same conclusion. In a research note on Tuesday he said the current bull market has been driven largely by corporations buying back their shares.

According to Howard Silverblatt, senior index analyst at S&P Dow Jones Indices, the S&P 500 SPX, -0.16% corporations spent $3.4 trillion on buybacks since 2009. While buybacks have slowed in 2016 from 2015, large companies are still spending more than $100 billion every quarter on share repurchases.

The good news is large corporations have a lot of cash to both invest in capital expenditures and spend money on buybacks. The former will be supportive for stocks in the long term, while the latter will keep boosting prices in the short term.

And the better news still is that rolling 10-year returns rarely have negative returns and reward those who stay invested in good as well as difficult times. Investors, however, would be wise to accept that returns going forward may be less than stellar.

Courtesy of MarketWatch [5]