By Sunny Oh, MarketWatch [1]

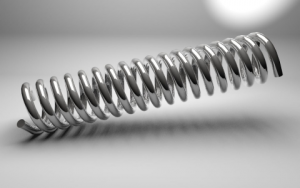

Bond savant Jeff Gundlach says “coiling markets” could prompt a surge in volatility as Wall Street’s so-called “fear gauge” remains at multidecade lows.

Gundlach, fund manager and founder of DoubleLine Capital, known for making accurate market predictions, said a breakout in bond yields to the upside, meaning selling in Treasurys, could lead to a pullback in stocks and drive up volatility.

He made his remarks during a Tuesday interview with CNBC. Stock prices tend to rise as bonds fall in value as investors see the assets represent two polar opposites in a continuum of risk. Although analysts say that the natural relationship appears to have broken at times, with equities and Treasurys seen traveling together for much of the year.

“The markets have been coiling so much. One way or the other, [the 10-year Treasury yield is] going to have to break to the upside. And when that happens it’s going to raise volatility in the market,”

The yield for the 10-year Treasury note has been trapped in a range of 2.40% to 2.20% in the past month, as volatility measures for government paper reach multidecade lows. While, the CBOE Volatility Index was most recently near a reading of 12 in Wednesday’s session, after geopolitical concerns over North Korea dragged the Dow Jones Industrial Average and the S&P 500 index down. But even the two-day surge puts it well below a historical average of 20, a level not seen since October.

Analysts suggest the puzzling absence of market equity-market corrections, or large swings lower of at least 10%, reflects complacency among stock and bond investors.

Gundlach has made similar remarks and is betting on a resurgence of volatility through five-month put options on the S&P 500 which could yield huge returns if equities slump. He said he would be “disappointed” if he made less than 400% off his hunch.

Put options make money if the underlying assets fall in value well below the so-called strike price. The more stocks fall, the more money the holder of the put can make. Put options give a buyer the right to sell stock at a set price within a specified time.

Gundlach said he expected a 3% pullback “between now and November,” enough to cause equity volatility to spike. But so far, the S&P 500 has avoided such a drop in more than 180 days, according to the advisory firm LPL Financial.

It can prove costly to bet against a trend that has lasted long as this one. But Gundlach feels that the eurozone could hold the key for investors to see the upshift in U.S. interest rates. U.S. and German government bonds tend to move in lockstep as they both enjoy lofty credit ratings, leading investors to perceive them as a haven for market turmoil.

He points out the similarities don’t end there. Germany enjoys the same inflation rate as the U.S., and growth rates for the eurozone’s annual economic output closely matches that of the U.S. The eurozone grew 2.4% in the second quarter measured by annual rate, while the U.S. rose 2.6%.

Yet the 10-year German government bond’s yield, also known as bunds, resides below 0.5%, while the 10-year Treasury yield sits at close to 2.24%. German bunds have “no business” being at a level when its growth and inflation rates suggest yields should be much higher, Gundlach said.

The persisting dislocation requires the European Central Bank to shift away from the easy-money policies that have arguably brought about the eurozone recovery, he said.

With a key meeting of central bankers in Jackson Hole, Wyo., in two weeks, where ECB President Mario Draghi is expected to prepare to point to an end to its bond-buying program, it may not be long before market participants can see Gundlach’s gambit put to the test.

From MarketWatch [2]