If there was any lingering hope that the U.S. dollar was going to bounce back after Friday's selloff and finally push back from the brink of the cliff, it was wiped away today with a relatively small tumble that broke under a huge support level. Namely, the U. S. Dollar Index fell under the early August low and Friday's close of 92.5, reaching a new 52-week low in the process. There's only one potential floor left to keep the greenback propped up, and it's not one we can rely on.

The pullback's been underway for a while now, and for a variety of reasons. Chief among these is the fact that the U.S. dollar was heavily sought and bought in 2014 and early 2015 in anticipation of meteoric rate-hikes that never materialized as expected. Though interest rates are edging higher and should continue to do so, that move is nowhere near to the degree expected. Inflation is in check too, so there's no need for the Fed to be aggressive or hawkish.

There's also been some chatter than President Trump's policies as well as his political rhetoric ultimately make the greenback undesirable, though that's a largely-politicized theme without any meaningful, empirical support.

Regardless of the reason, however, the dollar has officially slipped into some serious technical trouble.

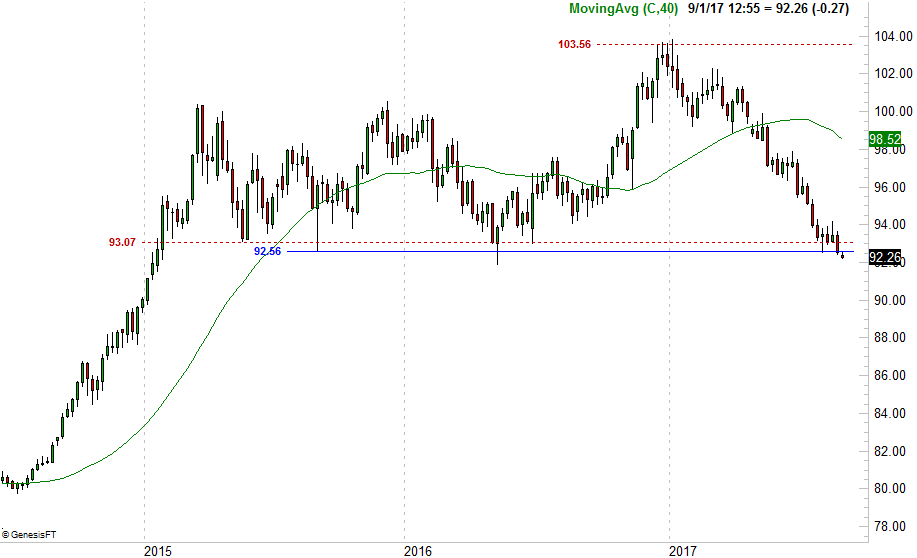

The daily chart of the U.S. Dollar Index partially tells the story. It's here we can see how important the 92.54 level had been of late, reversing a long-term downtrend in early August and stopping Friday's bleeding before it got out of control. The bears were more than happy to pick up today where they left off on Friday though.

One has to zoom out to a weekly chart of the U.S. Dollar Index, however, to fully appreciate just how critical the recent damage is. A secondary support level at 93.07 (dashed) has been broken, as has the line at 92.56. Both lines had tagged most of the major prior lows.

The ultimate low here is the mid-2016 low of 91.92, though we're not able to count on that mark as a floor. It was only brushed once, and as such hasn't been tested or confirmed as a support level. In fact, with as much bearish momentum as the greenback has developed since hitting its late-2016 high, it's tough to imagine anything stopping the selloff now… particularly in light of how much room there is between the current price and where the U.S. Dollar Index was before 2014's unmerited rally got going.

There are upsides to a weak or weakening U.S. dollar… and possibly more benefit than drawback. Not only does a weaker dollar make oil prices move higher for the beleaguered energy industry, it makes U.S.-made goods cheaper for foreign customers to buy. On the flipside, a weaker dollar makes foreign-made goods more expensive to U.S. consumers, though in many cases U.S. buyers have at-home alternatives that fuel home-grown growth.

However it all shakes out, the U.S. dollar just officially went from bad to worse. That will have an impact on stocks.