While stocks continue their journey along the edge of the cliff — though not yet slipping over it — and bonds continue their trek higher as yields drift lower, there's no denying both bonds and equities are a bit of a crapshoot right now. That is to say, both are a coin toss at this point, and traders can't afford to get married to either.

That's a key part of the reason gold has done so well of late. While at least of the three key assets does well as any given time at the expense of at least one of the other two, right now gold is doubly attractive simply because it's the only one of the three that can be reasonably handicapped.

The question remains, however… how high can gold climb? There are a couple of logical key levels to watch, and the uppermost of the two is seriously "up there."

The image below puts things in perspective. While stocks are the clear winners over the course of the past twelve months, investors are clearly began to have doubts about equities by December. That's when gold and bonds started to reverse course and start a bullish trek. While stocks continued to climb, defensive minded investors actually drove even bigger gains from bonds and gold since the beginning of this year.

There's a reason for the disparate and largely unreasonable outcome — investors aren't nearly as enthused about owning stocks now as they superficially seems to be. With that as the backdrop, gold may have only just begun a healthy rally.

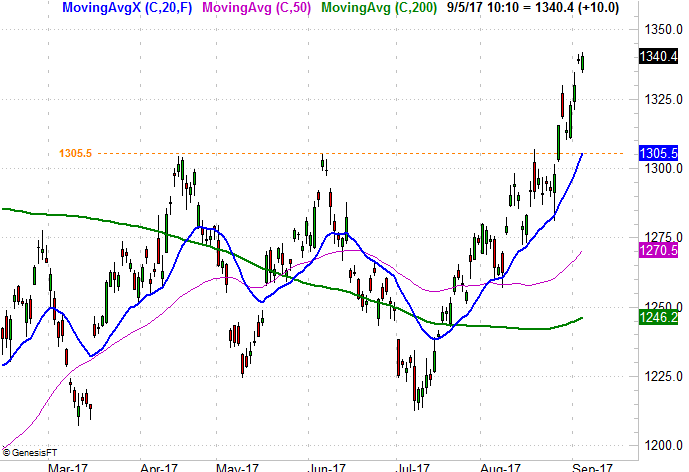

The trigger for the current breakout is the move above $1305, which had capped a couple rally efforts early in the year and looked like it was going to do so again late last month. The bulls persisted though, and with the help of a pushoff of the 20-day moving average line (blue) finally punched through the ceiling at $1305.

That's not the most important line in the sand for gold right now, however.

To really appreciate where gold is and where it's going, however, you have to take a step back and look at a longer-term chart's Fibonacci lines.

Fibonacci lines are, in layman's terms, the market's organic, natural ceilings and floors… the point where traders collectively reach the psychological "enough is enough" turning point in both bearish and bullish ways. They're great for figuring out a chart's make-or-break levels, particularly when there's no other technical context for drawing those lines in the sand.

And as it just so happens, there's a major, pivotal Fibonacci line for gold at $1420. That's 38.2% retracement of the loss gold suffered between its 2011 high of $1973 and its 2015 low of $1077; 38.2% is one of the big Fibonacci numbers. It also happens to — and this isn't likely a coincidence — where we saw gold make a pretty important peak right before another big (though final) meltdown over the course of 2014.

The $1420 line isn't necessarily a technical ceiling for gold. Just think of it as a checkpoint target, or a place where we'll want to reassess the trend's undertow. Should gold prices push through the $1420 mark though, there's not another key technical ceiling until we reach the 61.8% retracement line around $1631.

That's not to say gold prices will move in a straight line up to $1420, or move in a straight line should they exceed $1420 and start a journey to $1631. Indeed, it would be odd if gold did move in a straight line – set your expectations accordingly. By that same token, don't confuse short-term volatility with the long-term undertow.

Either, it's just worth noting how we've already seen a string of higher lows from gold since the October-2015 low, as well as some minor higher highs. A move above $1420 would likely be sees as a bullish catalyst by all the traders on the sidelines, creating the very rally they aren't sure is going to unfurl just yet. There's nothing wrong with taking a swing on the possibility of a self-fulfilling prophecy.

Whatever the case, take a step back and look at gold's bigger picture. It's heating up in a big way, and could really start to soar of the U.S. dollar dishes out the breakdown it's toying with.