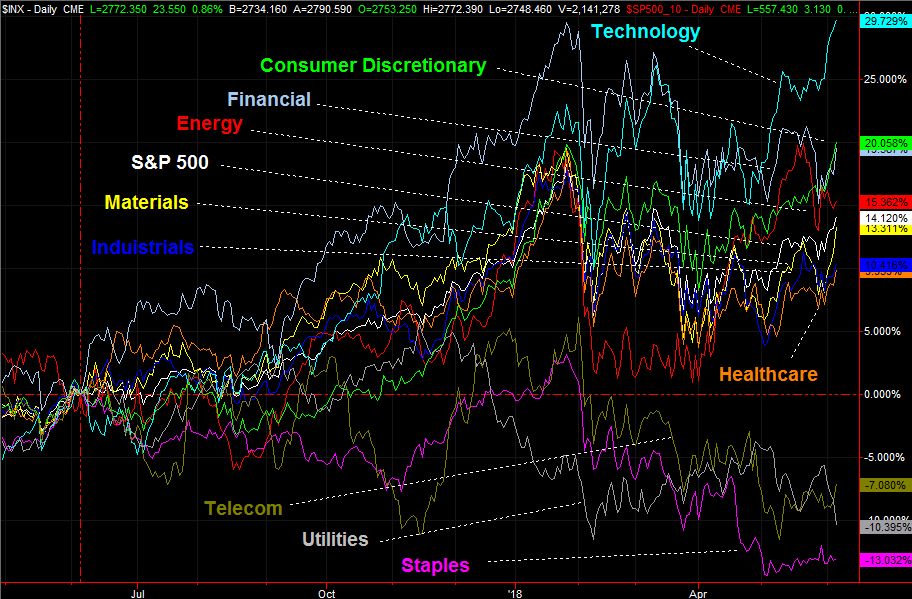

On Tuesday, TheStreet.com's celebrity commentator made the point that while the overall market was going like gangbusters, the technology sector was doing all the heavy lifting. It wasn't a situation that could last forever. Sooner or later, other groups would have to chip. That, or the rally would fade again and turn into yet another pullback.

His point was well taken, even if not entirely on target. Though the tech sector – and FANG stocks in particular – has been dishing out oversized gains for the better part of the past few weeks, some other groups were making forward progress. Not a lot, but some.

In retrospect, Cramer probably should have waited a day before saying anything. If he had, he might not have not floated the possibility that the rest of the market's lack of willingness was still a problem. On Wednesday, the financial stocks led the way, extending a pretty strong runup of their own. Healthcare and industrial stocks also topped technology's gains.

A fluke? Maybe, or maybe not. Make no mistake though. The rally has more sectors on-board than many traders may realize.

The question remains though… in other ways. Is there enough participation or belief in this rally to keep it going?

Actually, there is.

It's been one of our chief criticism of the rally efforts we've seen several times since the February tumble, and it may well be a criticism again. But, for the time being anyway, the marketwide bullish volume is finally starting to perk up, while the marketwide bearish volume is tapering off. It's an erratic divergence, but a divergence nonetheless.

Don't get too excited just yet. We've seen this hint before, often to no avail. On the other hand, this trend is developing with a lot less choppiness than we saw with February's, March's and even April's rebound efforts. This one isn't quite as inviting of profit-taking and mired in the same uncertainty those other breakout efforts were.

It's still not a breakout you'd want to blindly bet the farm on though. We're at a time of year that's generally tepid for stocks, at best, and at worst a loser for the market. The S&P 500 averages a 0.85% loss for the month of June, making it one of only two months that's usually a loser rather than a winner.

But the impending trade war doesn't look like it's going to materialize? No, it probably won't (if it was ever going to). That may not be enough to keep investors interested and on board though. It may get a rally started, but that may not be enough to keep it going. Only earnings growth can do that, and it's still not clear earnings are poised to get better organically.

None of that really matters in the short run, of course. But, the "short run" rally is now more than two months old. It's getting a little long in the tooth, leaving the bulls with a tough decision to make…and soon.

The ideal outcome would be a small retreat and then a less-heated renewal of the uptrend, using at least one of the key moving average lines as a support/reversal point.