By Victor Reklaitis, MarketWatch [1]

It’s Friday the 13th and earnings day for three big banks, as the S&P 500 tries to flip green for the year.

Meanwhile, Russia is warning that American strikes on Syria could bring war, and China’s trade surplus with the U.S. just surged. President Trump is pardoning Scooter Libby, probing the postal service and probably not talking to Robert Mueller (and definitely not James Comey).

So perhaps today of all days — with apologies to “Dirty Harry” — you’ve gotta ask yourself one question: “Do I feel lucky?”

You maybe should, suggests our call of the day, which comes from David Templeton at Horan Capital Advisors.

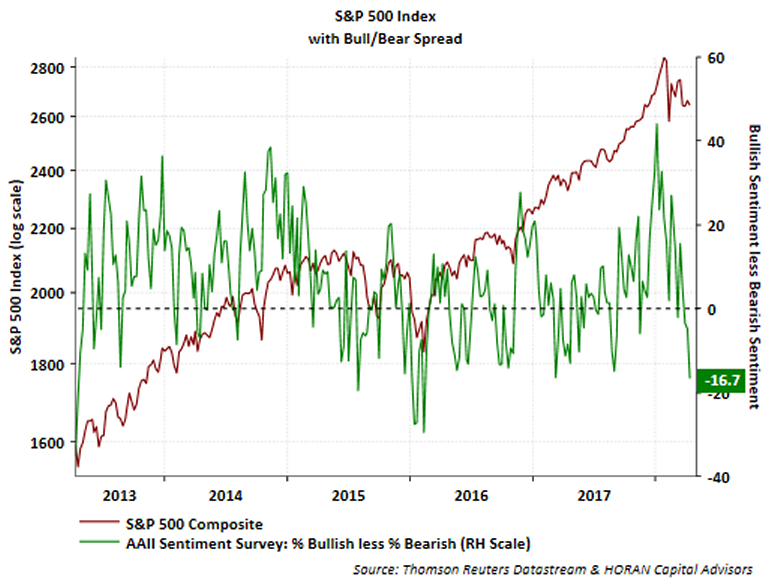

“With much of the sentiment now decidedly bearish, just possibly the market is nearing a bottom,” he writes in a blog post.

The latest figures on feelings from the American Association of Individual Investors have Templeton’s attention.

“Bearish sentiment jumped 6.1 percentage points to 42.8%, resulting in the bull/bear spread being reported at a negative 16.7 percentage points, the widest negative spread in more than a year,” he notes.

The AAII survey is often used as a contrarian indicator, meaning traders turn upbeat when its readings get gloomier. And that’s what the numbers just did. One respondent griped to AAII about “too much uncertainty coming from the White House” amid high equity valuations.

The bull/bear spread was last this negative more than a year ago.

Templeton highlights that a different survey — one from Investor Intelligence that tracks newsletter writers — also is showing far less bullishness.

On the other hand, Josh “The Reformed Broker” Brown doesn’t sound like he’s willing to call any sort of bottom for the S&P, even as he sees a recent floor around 2,550. He writes: “So the question is, if (when?) we revisit support, will it hold? And what will (most) people do if it doesn’t?”

Friday the 13th Stat

The S&P 500 does worse on average on Friday the 13th. On that date, there’s been an annualized 4.2% gain versus a 13% rise for all Fridays, according to LPL Financial data going back to 1928.

LPL’s Ryan Detrick says: “We aren’t in any way saying one day matters more or less than another. Still, wouldn’t you know it — Friday the 13th tends to be a weak day on average, spooky indeed!”

From MarketWatch [1]