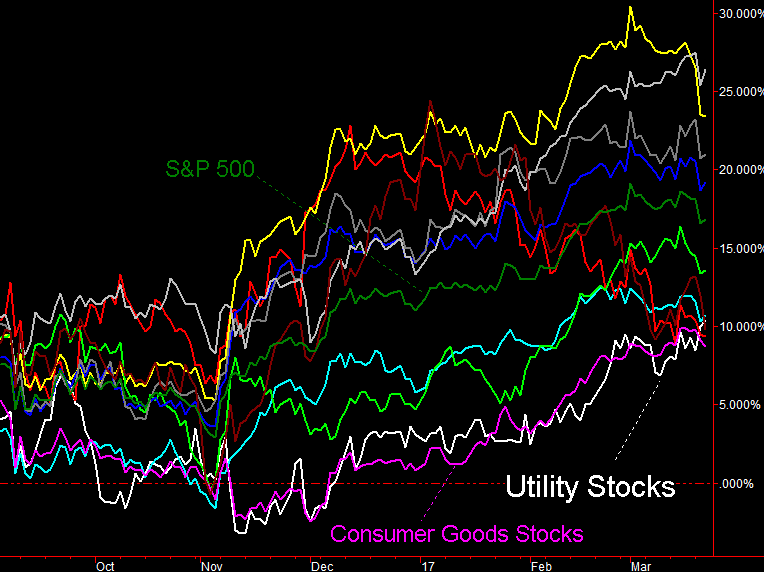

Think every sector out there is getting trashed? Think again. While the broad market may be losing its uphill battle — the S&P 500 is now down 1.5% since early last week. Worse, it's broken below some key technical support levels, opening the door to more selling. Not every stock or group of stocks is in trouble there. There's one group that's been strangely bullish of late, even while most others haven't. And, there's another 'honorable mention' sector you may want to latch onto sooner than later.

That stand-out sector is the utilities sector; the iShares US Utilities Fund (IDU) is up 14% since early November, putting it in second place for the timeframe… a position it didn't earn until this week, when everything else started to unravel. The winner for that timeframe is the iShares US Technology Fund (IYW), up 15.6%. More interestingly, the utilities sector is up 1.6% since the end of February. It's not much, but it extends a subtle uptrend that started to take shape more than a month ago, while everything else is down for that shorter period.

Sometimes, you just have to take the hint.

That being said, it doesn't come as a terribly big surprise to students of the market. When traders smell fear (whether or not it's materialized in the form of broad market weakness), they start to play defense. There's not a more defensive sector than utilities.

Even more impressive is that utility stocks have been advancing even in the shadow of rising interest rates. Better bond yields tend to drive utility stock values down, as that makes their dividend yields more on par with bond yields.

The trend could stop and reverse at any time, of course, with a simple recovery of 'everything else' that would rekindle a risk and growth-oriented mindset. In light of everything going on it this time though (like an overextended and overvalued market), counting on a reversal and trading against this grain isn't advisable. See, this shift has been brewing for a while. The utility sector has been quietly advancing since December, suggesting traders have been subconsciously planning for a market pullback for quite some time. They're apt to stick to the script.

As for the technology sector's strength, it's likely an outlier simply because Apple (AAPL) and other popular stocks — like the FANG stocks — are perennial market favorites whether or not their valuations are justified.