By Barbara Kollmeyer, [1]MarketWatch

The S&P 500 and Nasdaq managed fresh closing highs on Monday, with the latter nabbing its 32nd record close of 2017. That brings techs to a 14.24% gain so far this year, easily sprinting past a 7.3% gain for the S&P 500 and a 6.2% rise for the DJIA.

As many have pointed out, the bulk of the tech gains this year have come from the “Fab Five“ — Apple (AAPL) , Alphabet (GOOGL), Netflix (NFLX), Facebook (FB) and Amazon (AMZN), which just celebrated 20 years since it’s IPO.

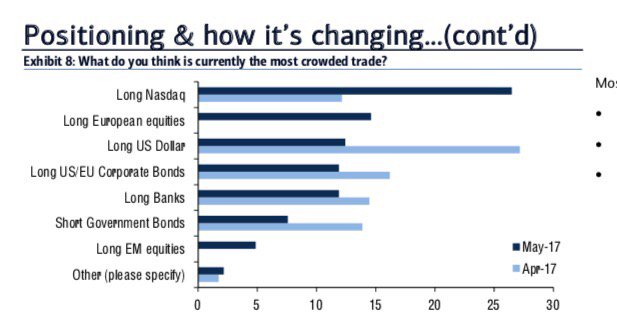

That has made some uneasy, and auto-tech darling Tesla (TSLA), up 48% this year, got a surprise downgrade yesterday. Are techs crowded? This chart from Bank of America Merrill Lynch’s monthly fund manager survey says some are thinking that way:

Keep your cool, going by our call of the day from Doug Ramsey, chief investment officer at the Leuthold Group. He says techs are definitely not frothing over right now.

“We’ll say it again. It’s not the excitement, nor the gee-whiz innovations like augmented reality or self-driving cars that make a technology bubble; the valuations must be ridiculous. But they weren't in 2014, and they aren't now,” says Ramsey.

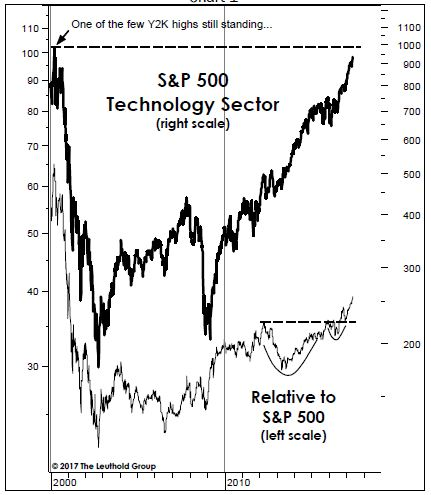

Here’s his chart of the less-prominent S&P 500 Information Technology Index. He notes it is less than 5% from its March 24, 2000 high, after a 16% year-to-date gain:

Ramsey says median S&P 500 tech valuations, as measured by price/cash flow, “have struggled to break above the 15x threshold that served as valuation floor during the 2002-07 bull market.” The 60%-plus gain in the S&P 500 Technology Index since the end of 2013 has occurred with that price/cash flow ratio hovering at a 15 multiple.

At the height of another bubble scare in 2014, when headlines were looking similar to those of the past few months, that price/cash flow gauge was at 14 times. And that feared bubble never popped, he notes.

“All of this is not to say the sector won’t fully participate in the next bear market … But use of the ’bubble’ label further degrades a term that’s already lost most of its meaning,” he says.

Courtesy of MarketWatch [4]