The S&P 500 as well as the NASDAQ Composite both made technical breakouts last month. But, the Dow Jones Industrial Average hasn’t followed suit. Yet. It could happen soon though.

Take a look. Tuesday’s high of 34,331 is in line with Monday’s peak, as well as the early-February high, and as well as January’s peak. At the same time, investors have to appreciate the fact that the Dow Jones Industrial Average is now finding support at its 20-day moving average line (blue) after finding support at the 50-day line (purple) for the better part of the past couple of weeks.

If the Dow can just push up and off of the 20-day line one more time and hurdle the horizontal ceiling at 34,331, the forward progress trying to take shape here gets much easier.

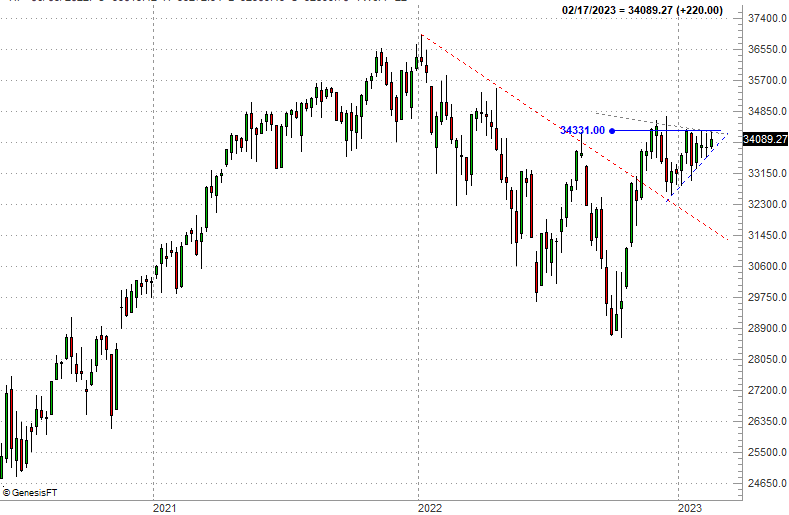

Here’s the weekly chart of the Dow Jones Industrial Average, just for a little added perspective. From this vantage point we can see the index has actually been getting squeezed into a converging wedge following a breakout that materialized all the way back in November.

This is actually a good thing. When indexes are converged into the tips of wedges like this, it gives a chance for the buyers and/or sellers to catch up with the trend. It also sets up breakout thrusts (or breakdown plunges) because the market doesn’t steadily move in a straight line. It moves in fits and starts. In this case, a break above the technical ceiling around 34,33 should mark the beginning of a major move that’s good for several hundred points.

This of course is no guarantee that it will happen. It’s just to point out that the last index to pass a major milestone is close to the point of doing so. Such a breakout is still a possibility as long as the Dow continues to find support at its 20-day and 50-day moving average lines. It could take some time to see it pan out.