By Keris Lahiff, CNBC [1]

The U.S. dollar just hit its highest levels since late December, a move that's planted it in overbought territory, according to one chart watcher.

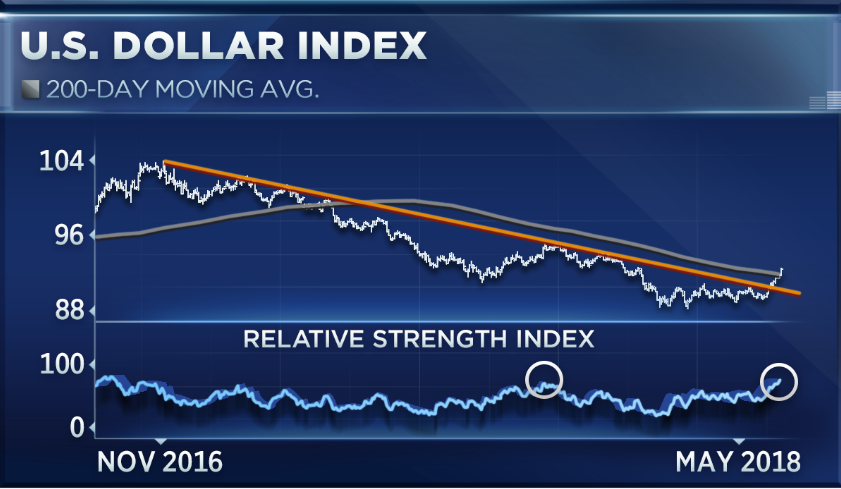

"On a very short-term basis it's getting a little ahead of itself," Matt Maley, equity strategist at Miller Tabak, told CNBC's "Trading Nation" on Tuesday. He noted that the dollar's relative strength index, a measure of momentum, hit 76.07 on Wednesday, surpassing the one-year peak hit in October.

"It's getting to a level, actually slightly above a level, that it reached last fall just as the dollar was starting to finish off its little bit of a rally here and then rolled back over and made new lows," said Maley.

The DXY U.S. dollar index tried to buck a nine-month downward trend in late September, but its short burst of gains did not last through to the end of 2017. The greenback broke higher in April after struggling for direction through the start of this year.

Unlike last year's attempt to rally, the technicals suggest gains over the past month are a little different, said Maley.

"The rally has been much stronger. It took it above its 200-day moving," he said. "Also, above its trend line going all the way back to the highs in very early 2017. When you combine that with the kind of positioning we see where a lot of people are very short the dollar and very long currencies like the euro, I think that this kind of next pullback will be a little bit more shallow and could take the dollar higher."

The dollar touched its 200-day moving average on April 27 and broke above it on May 1. The index has not traded above that key level since May 2017.

U.S. economic growth and the expectation for higher interest rates should also give the rally in the dollar more fuel, said Gina Sanchez, CEO of Chantico Global.

"We're well into the recovery at this point and, in fact, Europe has largely peaked out, Japan has peaked out," Sanchez told "Trading Nation" on Tuesday. "However, the U.S. is continuing to expand and I think that that is very, very supportive of the expectation for higher interest rates."

The U.S. economy grew at a 2.3 percent pace in the first quarter of this year, level with full-year economic growth in 2017. Japan's economy expanded 1.7 percent in 2017, while euro zone GDP increased 2.5 percent.

"We're actually seeing inflation come in at Fed-expected levels whereas European inflation is starting to disappoint," said Sanchez. "That's also going to be supportive of a higher dollar from here."

Higher inflation expectations in the U.S. have prompted more hawkish talk from the Federal Reserve. Markets anticipate at least two more interest rate hikes this year after an increase in March, according to CME Group fed funds futures. A fourth increase in December remains a possibility.

From CNBC [1]