The booming stock market is in denial, economist David Rosenberg warns

Fresh stock market records could be creating a false sense of security in the market.

Gluskin Sheff's David Rosenberg, one of the first Wall Street strategists to turn bullish following the 2008 financial crisis, says investors could be taking on a lot more risk than they think by pouring money into U.S. equities.

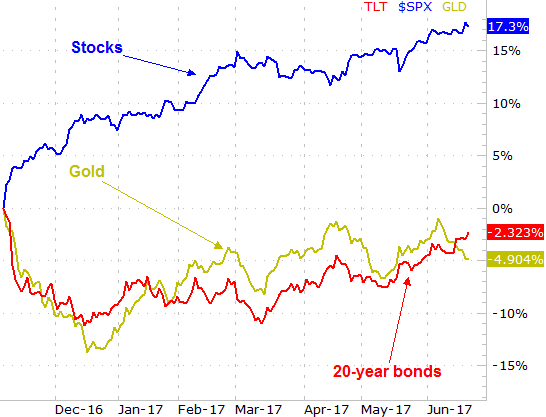

It comes as an anomaly continues in the market. Bond yields, a "safe haven" asset, have been falling while stocks have been rising.

"We all have to make up our minds as to which of these two asset classes has the right story," Rosenberg said Monday on CNBC's "Trading Nation." "It reminds me of the period in the fall of 2007 when the stock market was putting in a classic double top, and everybody thought that we were going to have the longest cycle on record. The bond market was telling you a different story altogether."

In a recent research note, Rosenberg wrote: "Mr. Market spent most of 2000 and most of 2007 in similar denial mode." Within a year, a recession hit the U.S. both times.

Rosenberg's latest comments come on a day when the Dow and S&P 500 closed at all-time records. Plus, the Nasdaq had its best day of the year, closing up 1.42 percent.

"The stock market is telling you that we're going to have a pickup in growth, reacceleration alongside pricing power throughout most of the economy," he said. "I think that really is going to be the part of the story that's got a low odds scenario attached to it."

Rosenberg, Gluskin Sheff's chief economist and strategist, has been warning a day of reckoning is coming. He has been telling investors since September that a "perfect storm" correction is coming.

It hasn't happened, but Rosenberg hasn't been backing down.

A major reason why Rosenberg isn't ready to turn bullish again: sluggish second quarter GDP growth expectations.

"I think the bond market is just basically responding to an economy that isn't really showing a whole lot of verve," said Rosenberg, who made the U.S. Institutional Investor All-America All Star Team several times during his career at Merrill Lynch. "And inflation data is coming in on the low side. So, I don't think the bond market is telling you an inconsistent story here. ... If you're taking a look at who's the odd man out here, it seems to be the stock market action that we're seeing."

The best opportunities, he said, are thousands of miles away. He said that for the first time in a long time that Europe is looking very interesting.

"That's been the case this year. We're all focused on the FANG stocks [Facebook, Amazon, Netflix and Google parent Alphabet], and yet very quietly the German DAX in U.S. dollar terms is up roughly 16 percent so far this year. That to me, if you're looking for a great reflation trade, [says] Germany seems to be one."

From CNBC