The past month and a half have been miserable ones for oil prices, and by extension, miserable for owns of energy stocks. Crude prices have fallen from a peak near $77 to a low near $56 per barrel – a 27% setback – marking not only a bear market for the commodity, but the biggest/fastest implosion in oil prices since late-2015/early 2016.

The explanations are plentiful, though geopolitical tensions are the underpinning for most of them. OPEC blames the U.S., the U.S. blames OPEC, and somehow China as well as Russia are being thrown under the bus by someone sometimes.

There's also a glaring reality… oil inventory levels are growing again, fast, and in spades. This unexpected rise in stockpiled crude levels has been shocking, as it wasn't supposed to happen. After the 2014/2015 debacle, U.S. energy outfits were supposed to have learned some restraint. But, it doesn't appear they have, even though most other countries and oil cartels have managed to keep their output in check.

Thing is, once this particular ball gets rolling, it's not easy to stop it. Things may have to get worse before they get better.

A handful of charts not only tell the tale, but prove the point.

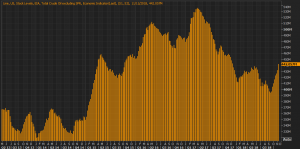

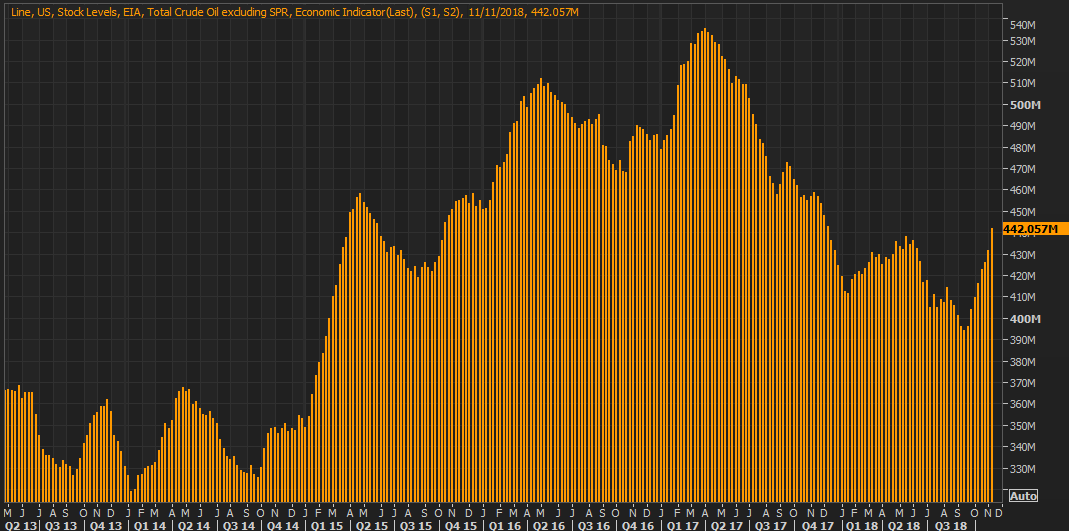

First and foremost, crude oil inventories aren't just rising… they're soaring. Last week's 442.0 million barrels in storage is the highest reading since late 2017, accelerating a rising trend. The rebound takes shape right at a time when it looked like stockpiles would finally peel back to pre-2014 levels that kept prices firm.

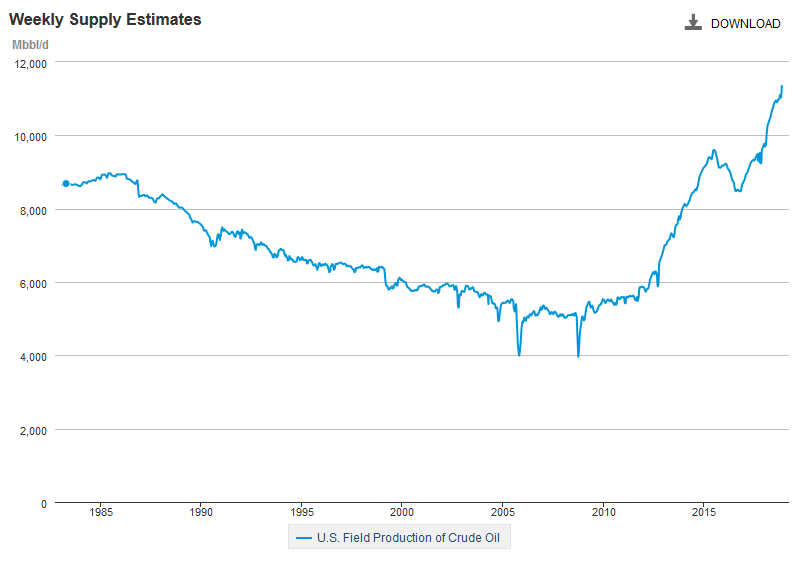

The country's producers have, simply put, not practiced any restraint, having not remembered the lessons that should have been learned three years ago. The U.S. has averaged weekly output of 11.3 million barrels per day for the past four weeks, versus peak output of 9.6 million per day in mid-2015.

Where's it all going? The majority of the excess (though just barely) is being sold to overseas buyers. Even so, the output still far exceeds the actual need.

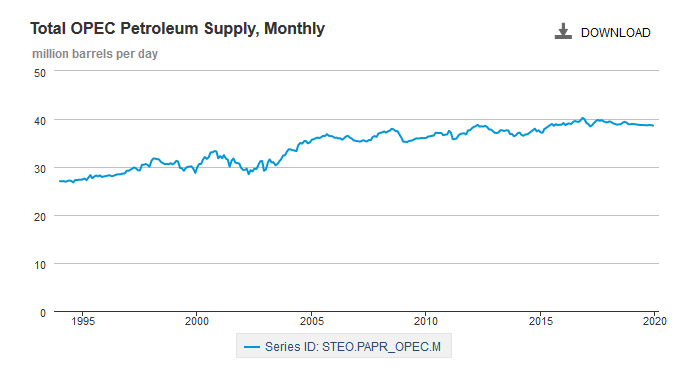

The next obvious question: What's OPEC's role in all of this? It's innocent. OPEC's output has actually dwindled, and stayed repressed, since 2016.

The $64,000 question: When might this inventory swell stop and reverse? There's the rub… not anytime soon, if it stops at all.

One of the nuances that should be apparent (but still isn't to most companies or investors) is that there's a significant delay between ramped up production and rising inventory levels. It could take weeks if not months for new spigots to finally make an impact on stockpile levels. But, while waiting, more and more capacity is being added. By the time anyone realizes output is too strong, there's already a massive amount of backlog… a huge number of spigots that should have been shut off weeks ago.

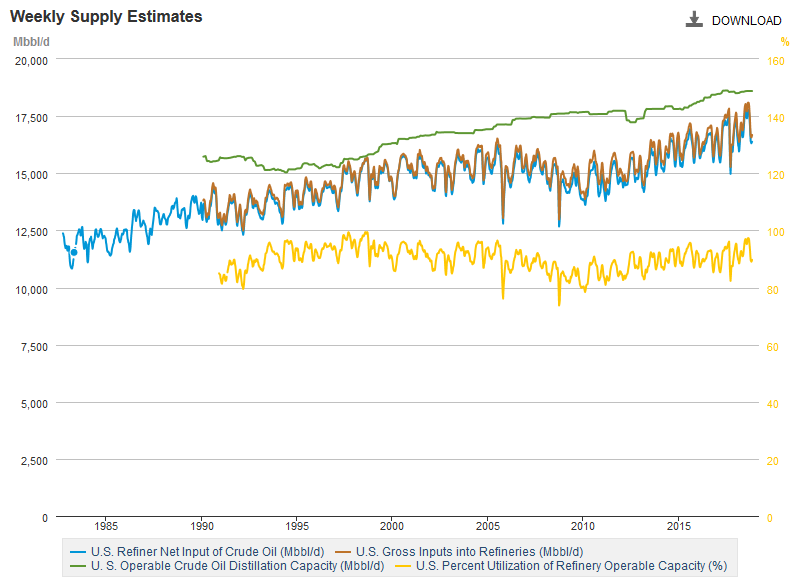

And that's a reality that should alarm any lingering bulls right now. As much as inventory has exploded lately, there's even more that's yet to make its way from oil fields to refineries to storage tanks. And FYI, capacity has almost never been higher, and we're using as much of that refining capacity as we ever have. We're taking more to refineries than we ever have, but a lot of that has yet to be processed and put into the storage tanks used to measure inventory levels.

Just something to think about before planning to blindly step back into oil stocks on this sharp selloff. There may not be a huge bounceback in the works.

As always, take the daily clues at face value, but understand the backdrop too.