– The 'win' rate so far this century: 83% –

By Simon Maierhofer, MarketWatch [1]

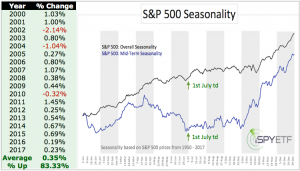

Here are stats on the most bullish S&P 500 Index trading day of the year since the beginning of the new century:

- When: First trading day of July (in 2018, that's July 2)

- Average return: 0.35% (see chart below for more details)

- Win rate: 83.33%

The win rate for the Dow Jones Industrial Average is 77.77%. The win rate for the Nasdaq is 72.22%. So the S&P 500 is the winner.

S&P 500 day traders may be content with 83.33% odds, but investors might be wondering if July 2, 2018, could be more significant longer-term.

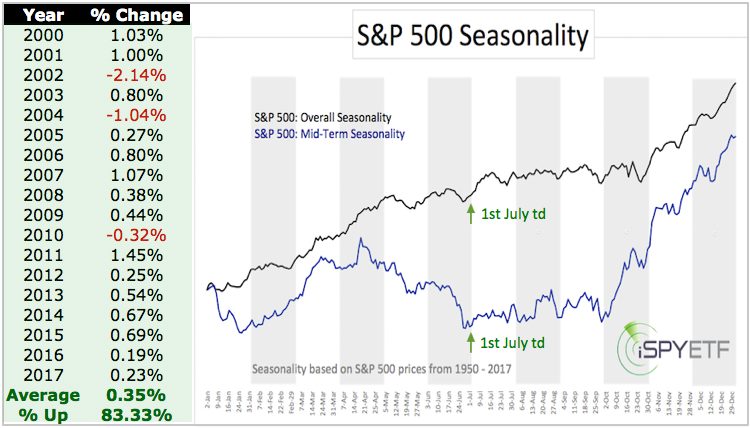

S&P 500 seasonality

It may come as a surprise that the best trading day of the year happens in the middle of what many consider a seasonally weak period of the year: the summer doldrums.

The chart below provides some clarification and context. The black graph represents S&P 500 seasonality based on all years since 1950.

The blue graph illustrates mid-term election year seasonality (2018 is a mid-term election year).

The first half of July tends to be mildly bullish, and often hosts a brief summer rally. Keep in mind, though, that the summer rally tends to be the weakest of all seasonal rallies.

In mid-term election years, the S&P 500 doesn't get going until October.

Based on seasonality, the best trading day of the year has the potential to kick off a one- to three-week bounce.

After this week's drop, investors may hope for seasonality to provide a "shot in the arm," but the truth is that seasonality is only one of many factors that affect stocks.

A more comprehensive S&P 500 forecast is available here: S&P 500 update [3].

Simon Maierhofer is the founder of iSPYETF [4] and publisher of the Profit Radar Report. He has appeared on CNBC and FOX News, and has been published in the Wall Street Journal, Barron's, Forbes, Investors Business Daily and USA Today.

From MarketWatch [1]