– Extreme outperformance by momentum stocks tends to presage a downturn –

By Ryan Vlastelica, MarketWatch [1]

For U.S. stock-market investors, one strategy in particular has worked in 2018: the same thing that has been working.

Momentum investing, or the idea that stocks that have recently risen will continue their trend over the medium term, has been one of the strongest bets for months. However, the outperformance has been so great that momentum could be at risk of turning sharply lower.

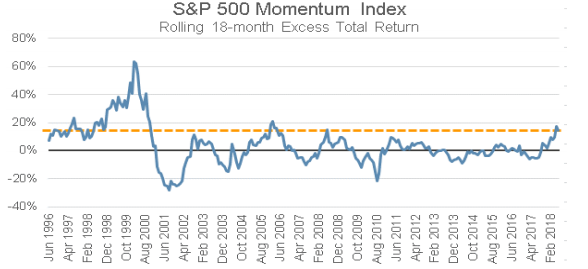

Since the start of 2017, according to S&P Dow Jones Indices, the S&P 500 Momentum index has outperformed the S&P 500 by 15% on a total-return basis. This is "a figure that has rarely been exceeded historically and, when it has been exceeded, has tended to predict a subsequent period of weakness for the strategy," S&P Dow Jones Indices wrote in a report.

The last time the factor saw such excess returns, on a rolling 18-month basis, was in early 2008, as the financial crisis was gaining steam. After the peak it turned sharply lower, and didn't bottom until mid-2010.

[2]

[2]

Courtesy S&P Dow Jones Indices

Thus far this year, the momentum index is up 8.9%, compared with the 2% gain of the S&P 500 over the same period.

The gains have largely come as some of the market's biggest gainers-including the FAANG stocks, or the quintet of Facebook, Apple, Amazon, Netflix and Google-parent Alphabet-have continued their longstanding outperformance over the broader index. All five have outperformed the S&P 500 thus far this year; even the weakest performer-Alphabet, up 7.2% in 2018-has seen gains that are more than three times as large as the benchmark index. More notably, Amazon has jumped 46% while Netflix has more than doubled.

According to Goldman Sachs data, such stocks by themselves contributed about half of the S&P 500's 2.9% gain over the second quarter.

From MarketWatch [1]