Chip-maker Nvidia (NVDA) is currently near 15% higher on Friday after reporting strong earnings, as the chip upgrade cycle and other trends seem to be weighing in their favor.

Revenues grew 7% year over year to a record $1.3 billion, GAAP operating income up 15%, quarterly dividend raised 18%.

The CEO pointed to the company's key role in these technology growth areas (quote from nvidia.com):

"Our record revenue highlights NVIDIA's position at the center of forces that are reshaping our industry, Virtual reality, deep learning, cloud computing and autonomous driving are developing with incredible speed, and we are playing an important role in all of them. "We continue to make great headway in our strategy of creating specialized visual computing platforms targeted at important growth markets. The opportunities ahead of us have never been more promising."

Many acknowledge Nvidia as the top maker of video gaming chips for some time now, and they appear to have maintained their lead over AMD (AMD) and others over the years. Graphic/video chips have usage in several growing tech fields. Other competitors include Intel (INTC) and Qualcomm (QCOM). Bloomberg summarizes as "Nvidia Corp., the largest maker of graphics chips used for personal-computer games, forecast sales that may exceed analysts’ estimates on demand for hardware that can handle the most visually intensive applications."

According to Yahoo Finance, NVDA is sitting at a forward P/E ratio of 26 currently, market cap $16.8 billion. The company's Profit Margin is 11%, Operating Margin 17%. Return on Assets is 7%, Return on Equity 12%. They have about $3 billion cash vs debt surplus -- a healthy cash per share with 540 million shares outstanding. Forward dividend yield showing as 1.73%, which is attractive for a tech stock.

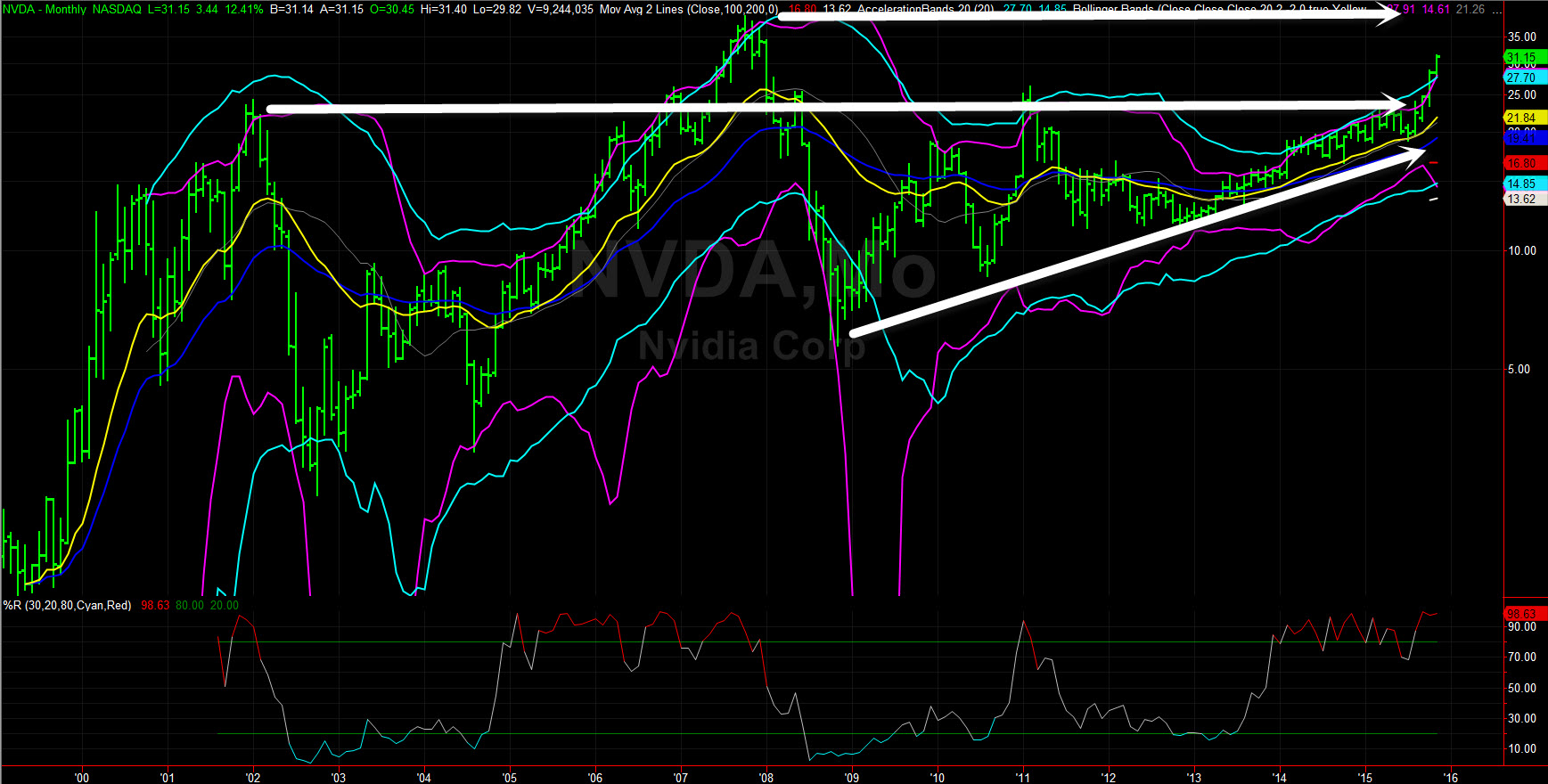

You can see on the long-term chart below that NVDA went public in 1999, not too long before the internet bubble popped. It's still below 2007 all time highs, but above key highs from 2001 & 2011. The cyclical nature of the chip industry upgrade cycle can be seen in this monthly chart, and is something to keep in mind when investing and/or trading in NVDA stock and options.

(Chart created with TradeStation)

According to Nasdaq.com, analyst sentiment on NVDA shares wasn't overly bullish heading into this earnings report. They show 7 'Strong Buys', 13 'Holds' and 1 'Underperform'. There has been at least 1 upgrade since the earnings report was issued, with a $36 price target.

As far as ETFs, according to etfchannel.com, the ETFs that hold the largest allocations of NVDA stock are iShares PHLX Semiconductor ETF (SOXX) 4.88% of assets, First Trust Nasdaq 100 Tech Sector Index Fund (QTEC) 3.34%, PowerShares Dynamic Semiconductors Portfolio (PSI) 3.27%, SPDR S&P Semiconductor (XSD) 2.87% and Market Vectors Semiconductor ETF (SMH) 2.50%.