The fate of the S&P hangs in the balance - and these 3 factors should decide it

By Barbara Kollmeyer, MarketWatch

The "slower summer season" is nearly upon us. For investors, that means if this market isn't crashing, then it's bullish.

So says Cracked Market blogger Jani Ziedins, who thinks the path of least resistance for equities remains an upward one, largely because (a.) scary trade headlines don't have the bite they did months ago and (b.) the sell-the-news crowd largely bailed out weeks ago. (A reboot on that war of words between North Korea and the U.S. ahead of the on-again, off-again summit may be another matter.)

While Ziedins seems fairly at ease about this stock market's direction, and futures have an air of summertime laze about them, you might want to sit near the lifeguard based on our call of the day.

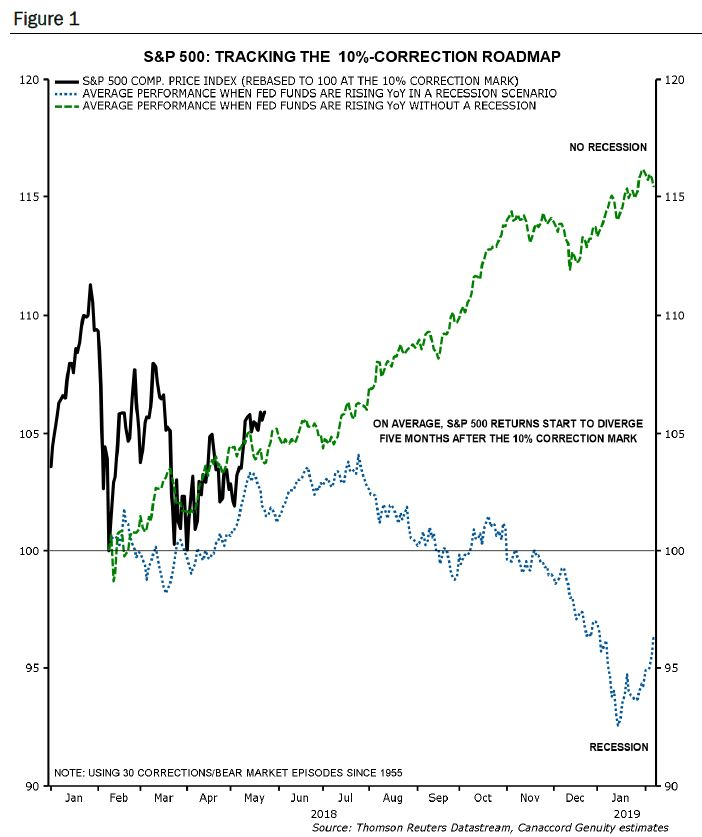

It comes from Canaccord strategists Martin Roberge and Guillaume Arseneau, who say the S&P 500 has been following a "correction road map" since the 10% February pullback, but now faces a fork in the road that will be decided by the performance of three big assets.

They see the S&P headed for some choppy waters over the next few weeks before that definitive move higher or lower, which is laid out in this chart:

The S&P 500's fork in the road

They mark out two diverging directions for stocks based on Fed tightening scenarios. The green line indicates a bullish scenario for equities, predicated on Powell and the Fed gang managing a so-called soft landing - interest rates rise enough to keep inflation under control and not trigger a recession. The blue line shows a "hard landing" scenario - rate hikes trigger a recession and equities pull back.

Canaccord analysts are betting investors will get path No. 1, but aren't turning their backs on a hard landing. They say a combination of three things - 10-year bond yields above 3.25%, oil prices atop $75 a barrel and the ICE Dollar Index above 95 - would trigger a recession and hence a slide for stocks.

"This does not mean that stock markets would peak right away. Nevertheless, we believe equities would become a higher-risk proposition," say Roberge and Arseneau.

For now, they have no worries about bonds or a bigger dollar blowout, but are keeping an eye on the oil-price "wildcard."

From MarketWatch