One of the most successful hedge-fund pros says we’re ‘nowhere near an overheated’ stock market

David Tepper of Appaloosa Management says stocks are still not too rich based on 1999 levels

--------------------------------------------------------------------------------------------------------------------------------------------------

Billionaire David Tepper thinks comparing this current stock-market environment with the overheated markets of 1999 is “ridiculous.”

The hedge-fund manager, who runs Appaloosa Management, told CNBC in a phone interview on Tuesday that the market’s record run, notwithstanding last week’s pullback for the S&P 500 index (SPX) Dow Jones Industrial Average (DJIA) and the Nasdaq Composite Index (COMP) doesn’t translate into over-the-top valuations for U.S. equities.

“Look at where multiples and rates were in 1999. I’m not saying stocks are screaming cheap, but you’re nowhere near an overheated market,” Tepper said. “Any comparisons to past overheated markets are ridiculous,” he said.

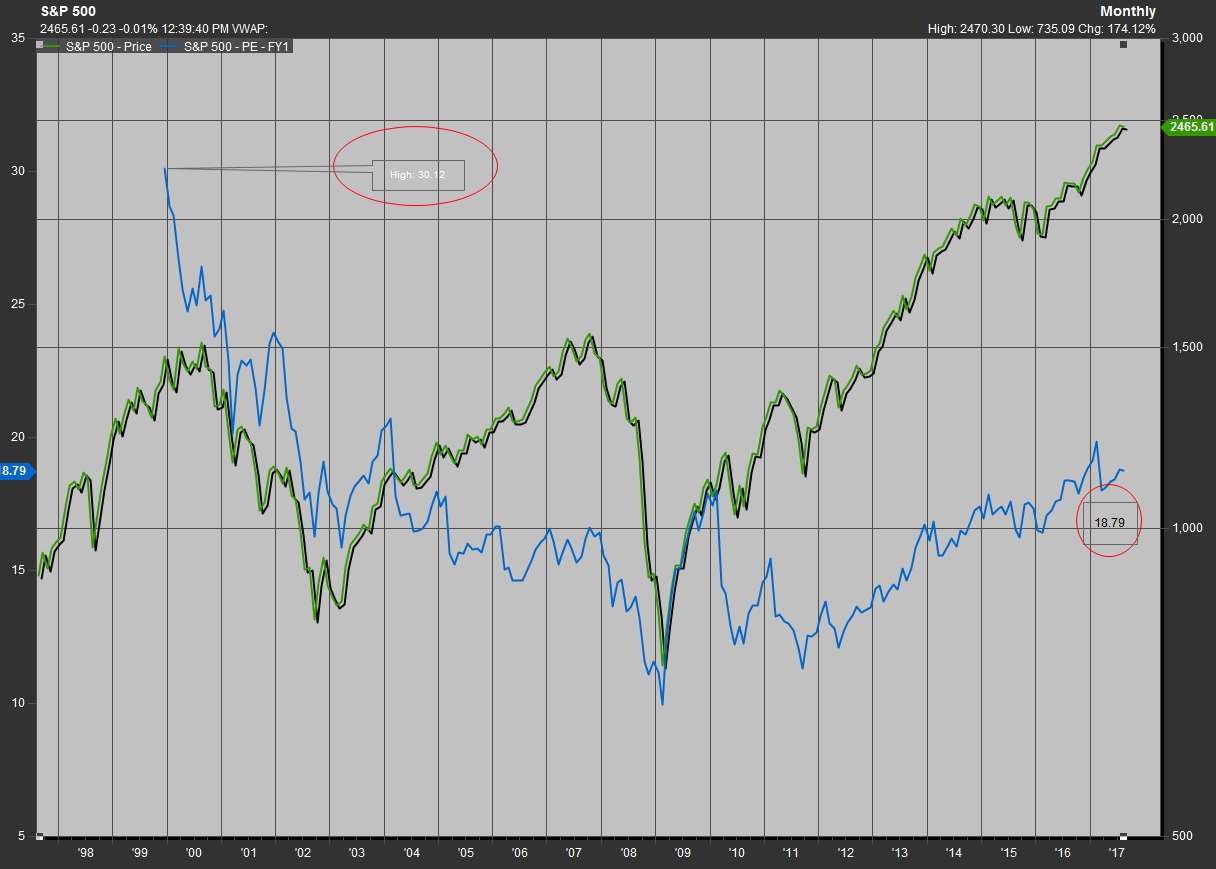

Back at the dizzying heights of the so-called dot-com boom, the S&P 500 index boasted a price-to-earnings ratio, a popular measure of equity value, at 30.12 times, compared with 18.79 times for the S&P 500 now, as the chart below illustrates, according to FactSet data:

So, on that measure, Tepper is right.

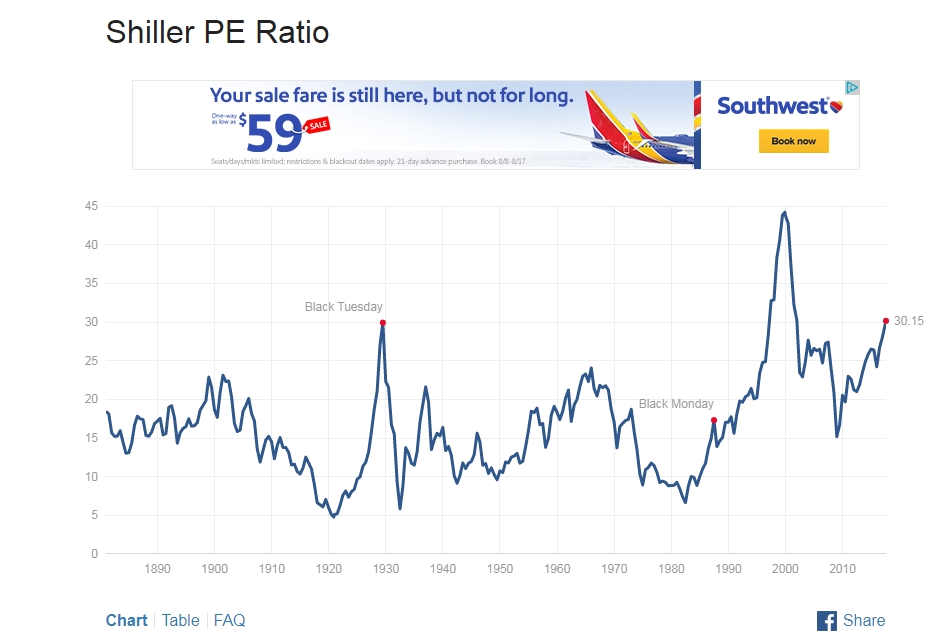

But by other measures, stocks, as gauged by the Shiller PE ratio, named after Nobel laureate Robert Shiller, are rich. Shiller PEs compare stocks against their average earnings over the past 10 years and put current levels at a ratio at 30.15 times. That represents nearly the richest P/E levels since the technology bubble and 1929, just ahead of the Great Depression, as the chart from site Multpl.com below shows:

For his part, Tepper has held a relatively bullish stance on equities because of his belief that President Donald Trump’s pro-business stance will be supportive for higher stock prices, despite the recent run to records. He also said central banks like the Federal Reserve will continue to underpin the bull run, keeping rates relatively low, despite efforts to dial up interest rates at a moderate pace.

Tepper also has said low levels of inflation, running beneath the Fed’s 2% target, and relatively low bond yields, with he 10-year Treasury note at around 2.26% may help to justify loftier equity prices.

Tepper is, perhaps, best known for making concentrated bets in the aftermath of the financial crisis in 2009 on the financial system (XLF) astutely citing the backstop provided by the U.S. central bank as a reason to hold beaten-down bank shares.

The stock market was trading relatively flat on Tuesday after all three U.S. stock benchmarks traded higher over the past two sessions as tensions between North Korea and U.S., which had been an impediment to higher moves in assets perceived as risky, abated somewhat.

Most recently, Tepper hasn’t been infallible. A recent regulatory report shows that the hedge-fund investor dumped 100,000 shares of Snapchat-parent Snap Inc. (SNAP) as of June 30, which has lost a third of its value since it went public back in March. Tepper also loaded up on other highflying technology, doubling up his stake in Apple Inc., (AAPL) and health-care names.