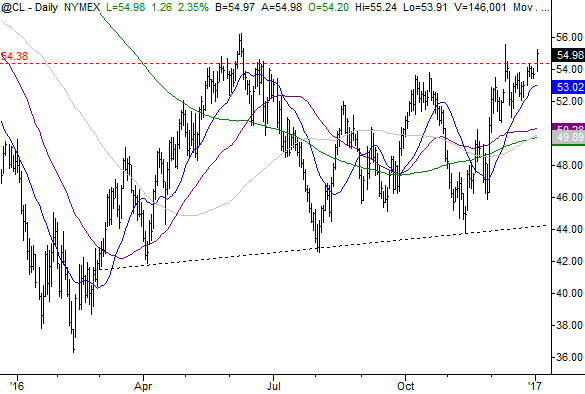

Crude Oil Rallies to 18-Month High as OPEC Output Deal Kicks In

Oil prices moved sharply higher on Tuesday on hopes OPEC’s deal to cut production that set in on Sunday will help stabilize the market in 2017.

Futures for West Texas Intermediate crude jumped $1.23, or 2.3%, to $54.95, setting it on track for its highest settlement since July 2015.

Brent futures climbed $1.27, or 2.2%, to $58.09 a barrel.

The sharp gains come after a solid 2016, when the U.S. benchmark futures contract saw a nearly 45% calendar-year rise, its biggest annual rise since 2009. The jump was fueled in part by expectations members of the Organization of the Petroleum Exporting Countries and other major producers will abide by an agreement to curb output. The output quotas kicked in on Jan. 1 and market observers are now waiting to see if both OPEC and non-OPEC producers will stick to their part of the deal.

“Firm indications of whether OPEC is really serious about cutting production will not be apparent until the end of the month when the production surveys for January are released. Until then, prices could remain at their exaggerated level,” analysts at Commerzbank said in a note.

“What’s more, the higher price level is making shale oil drilling in the U.S. attractive again,” they added.

Oil investors were also looking to China where data that showed the manufacturing sector expanded faster than expected in December. The Caixin manufacturing purchasing managers’ index rose to 51.9 from 50.9 in November, avoiding contraction territory for a sixth straight month.

Elsewhere in the energy spectrum, natural gas slumped 5.5% to $3.48 per million British million thermal units.

Gasoline climbed 1.5% to $1.70 a gallon.

Courtesy of MarketWatch