With the shortest month of the year almost in the rear-view mirror and springtime right around the corner, investor mindsets are starting to shift. Augmenting the change-of-gear is a market environment that has us all keenly aware stocks can selloff, but also an environment that makes it clear the market's still mostly shrugging off blows.

Said another way, the S&P 500 is up 7% from the 10% tumble it took early this month. It's also holding on to those recent gains, so it may be a bit too early to head to the sidelines just yet. Indeed, March is usually a pretty good month for the market, with the S&P 500 gaining about half a percent on average for the month, and more if there's a bull market underway.

The hitch this time around? Stocks are a little bit ahead of where they'd normally be around the end of February, weighing against them. Then again, stocks have been feeling the weight of oversized gains for months now, and it hasn't mattered yet.

To that end, we'll do the best we can to ferret out the usual March tendencies by sector or industry, and then gauge how likely a repeat performance is. In not certain order…

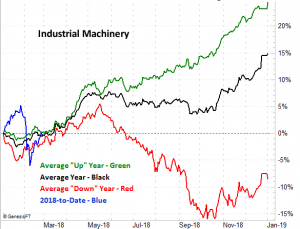

Diversified Banks

Diversified banks is a relatively inclusive term, encompassing major banks like Citigroup (C) and Bank of America (BAC) that do more than just banking. Whatever you call them and whatever they do, though, know that this group tends to dish out big advances in March… even in a bad year, or in a year with a bad start. On average, diversified banks rise about 3.9% in the month ahead. The only concern this time is that bank stocks are already well up for the year. With at least three (and maybe four) rate hikes in the queue though, this might be a ride worth risking.

Notice that the bullishness peters out pretty quickly, so don't tarry if you get your profits.

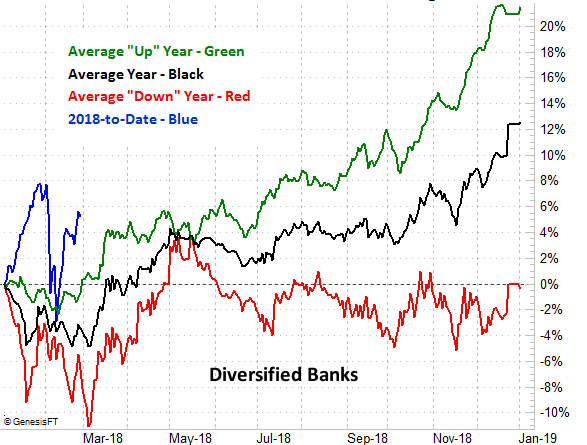

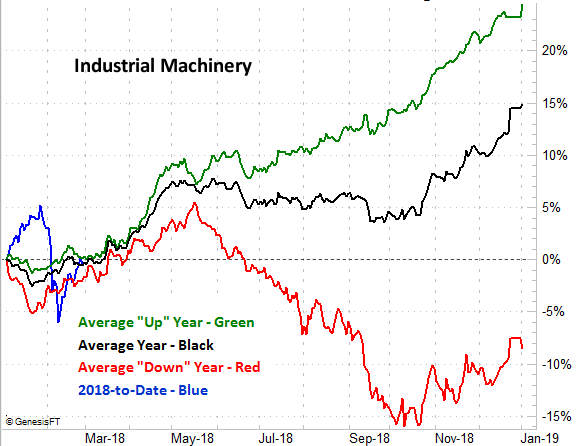

Industrial Machinery

Don't be fooled here. Industrial machinery stocks don't include names like Caterpillar (CAT) or Deere (DE). These are less conspicuous names like Danaher (DHR) and Parker-Hannifin (PH). This sliver of the market, for whatever reason (in good years and bad) tends to make nice gain in March, but logs even better gains through April. Ergo, this is more of a two-month trade if it's a trade at all. From the end of February to the beginning of May, the average move is an advance of 7.5%.

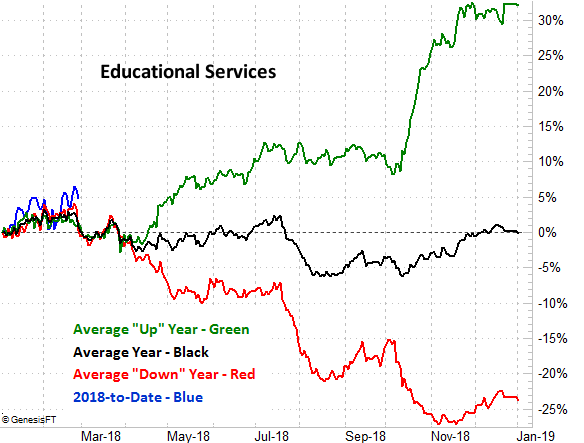

Educational Services

While the 2.7% decline they tend to suffer in March isn't jaw-dropping, in that it is one of the few arenas that does struggle for the month ahead, educational service stocks are worth pointing out here. Yes, these are companies like Strayer (STRA) and Career Education (CECO).

The weakness may or may not last, but given what can happen in April, this area might offer a good way for you to hedge against a marketwide seteback.

Consumer Finance

Nope, consumer finance is something distinctly different than banking, though there's no denying the two segments are part of the financial sector. Consumer finance names are more pure lenders though… think Capital One (COF) or Navient (NAVI). More important, know that this group typically gains 5.3% in March, and then extends that bullishness through April. After that, they're out of gas again until the end of the year.

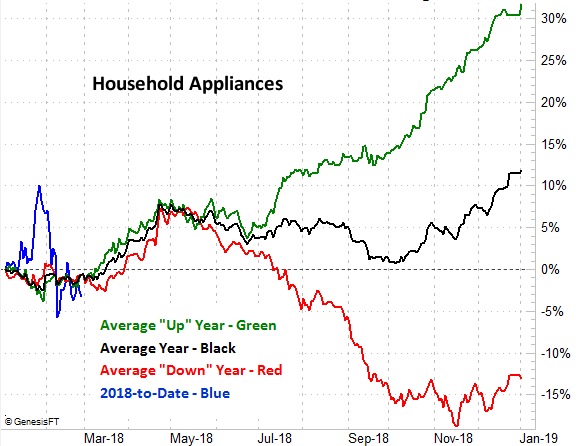

Household Appliances

Here's another group of stocks that tends to get going in March, but really heats up in April regardless of the market environment. All told, household appliance stocks gain, on average, 8.2% over the course of the coming two month.

Also notice that by late-April, the buying spree is over.

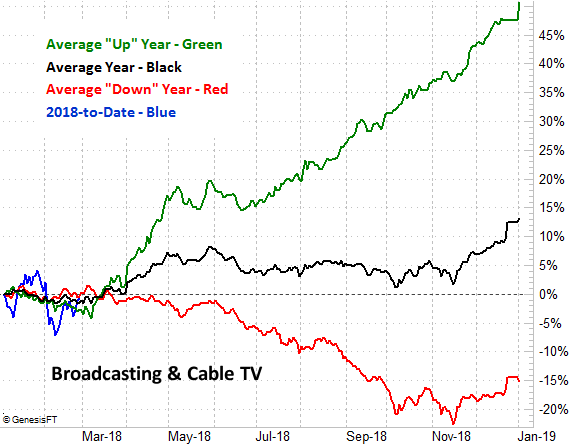

Broadcasting & Cable TV

Believe it or not, the cord-cutting movement hasn't killed every cable television company yet. On the other hand, there aren't many names that are purely in the "broadcasting and cable TV" market that are household names. The most recognizable names in the bunch are CBS (CBS) and Discovery (DISCA). Past that, and they start getting a little obscure…

… not that it's a bad thing. These names can do quite well in March, and then follow-through in April. The average two-month gain here is 7.6%, and the downside potential doesn't get very big until June.

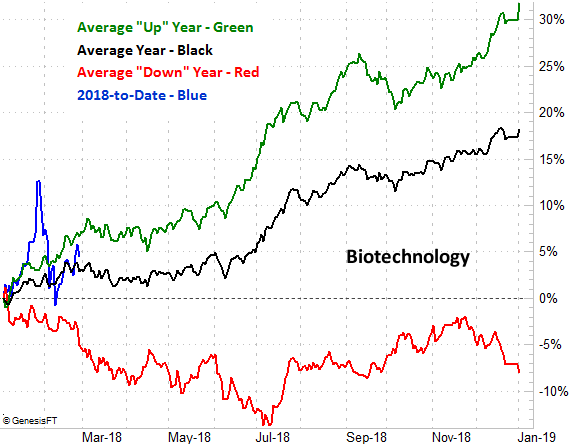

Biotechnology

Like educational services stocks, biotechnology stocks tend to lose ground in March despite a typically-bullish start to a new year. There's a reason too… most of the big biotech conference where these companies are able to tout their work happen at other times of the year. The FDA – just through sheer back luck of the calendar – isn't quite as busy this time of year. Whatever the case, the biotechnology sliver of the market tends to lose about 1.6% of their value in March. It doesn't matter what the bigger-picture undertow is.

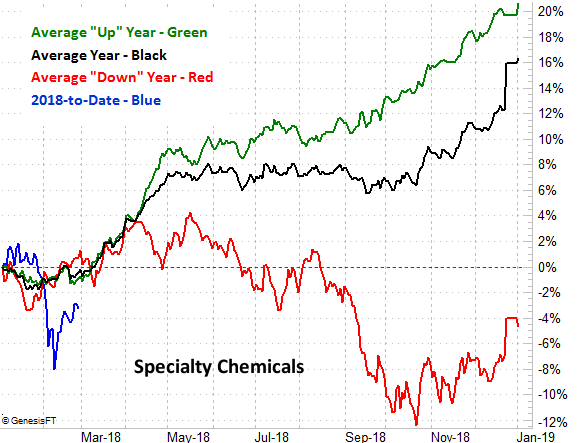

Specialty Chemicals

Another unexpected winner in March and April is the specialty chemical segment, which consists of names like Ecolab (ECL) and PolyOne (POL). On average these stocks advance 7.2% for the two-month stretch, though do note that sometimes, the bullish start can stop and reverse rather abruptly. And, in all cases the rally effort fades by May.

Homefurnishing Retail

Last but not least, you can generally expect big things from home-furnishing retail stocks like Pier 1 (PIR) and Bed Bath and Beyond (BBBY) in March, and a little through April. Just don't tarry too long, because the bulk of any of those gains are usually given up (and then some) between May and July.

There's actually an understandable – even if somewhat irrational – reason these stocks tend to do so well post-Winter and then fade as summer arrives. A lot of pent-up redecorating ideas are put into action around this time of year, but before consumers get too bogged down by vacations and the like. There's no discernible fundamental bump for these companies in March and April, but investors tend to gravitate towards companies they're thinking about as consumers.

Notice the rise and fall materializes in good years as well as bad.