– Returns are expected to fall across assets going forward –

By Sue Chang, MarketWatch [1]

Investors beware, there is pain ahead, says Goldman Sachs. The only question is whether it will happen fast or slow.

The Wall Street bank is warning that after years of stretched valuations, a day of reckoning is near.

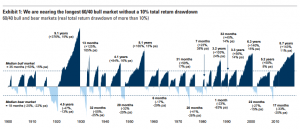

“We are nearing the longest bull market for balanced equity/bond portfolios in over a century, boosted by a ‘Goldilocks’ backdrop of strong growth without inflation. A 60/40 portfolio has not had a drawdown of more than 10% since the great financial crisis,” wrote Christian Mueller-Glissmann, a London-based equity strategist, in a Wednesday note.

At the same time, the average valuation percentile across stocks, bonds, and credit is highest since 1900, he said.

“It has seldom been the case that all assets are expensive at the same time—historical examples include the Roaring ‘20s and Golden ‘50s. While in the near term, growth might stay strong and valuations could pick up further, they should become a speed limit for returns, in our view,” he wrote.

As a result, there are two possible scenarios in this bull market’s future:

Mueller-Glissmann believes the first scenario is more likely than a full-fledged bear market but investors should still brace for depressed returns as growth slows and inflation accelerates. They should also take into consideration the possibility that it will take a much more dramatic “growth shock” for central banks to return to loose monetary policies, removing a surety that has made equities one of the best bets since the financial crisis.

“While we think investors should lower duration and run higher equity allocations in scenario 1, they should consider hedging at least the risk of smaller equity drawdowns in the near term,” said the strategist.

His views are decidedly more bearish than the upbeat outlook issued by his colleague David Kostin, who last week projected that the stock market will continue to test higher levels over next three years on “rational exuberance” as earnings growth support both prices and valuations.

“The current equity market valuation is certainly stretched in historical terms but it does not appear unreasonable based on the high level of corporate profitability,” said Kostin, who predicted the S&P 500 will hit 2,900 by the end of 2018.

After surging to fresh records in the previous session, a selloff in tech shares weighed on the S&P 500 and the Nasdaq even as the blue-chip Dow Jones Industrial Average finished at a new record.

From MarketWatch [1]