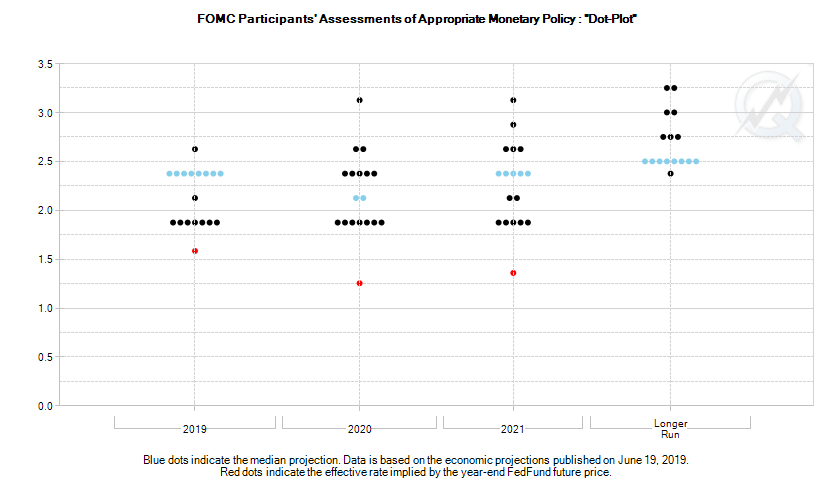

Last week, the Federal Reserve Open Market Committee, which sets the target Fed Funds Rate, all but said it was happy with the way things are, and believes things will remain as-is at least through the earliest part of next year. Not too hot, and not too cold, the voting members of the Fed maintained their target range between 2.25% and 2.5%. Though the FOMC has tentatively planned on the possibility of lower rates in 2020, even that outlook is far from set in stone. On average though, next year's average rate shouldn't be any lower than 25 basis points below this year's rate. Then in 2021, the Fed is expecting cause to up rates by a quarter point again.

The graphic below — the oft-discussed 'dot plot' — visually lays out the Fed's consensus outlook by (anonymously) marking each voting member's outlook.

Futures traders aren't as sure the Fed will be able to wait that long to stimulate the U.S. economy, however.

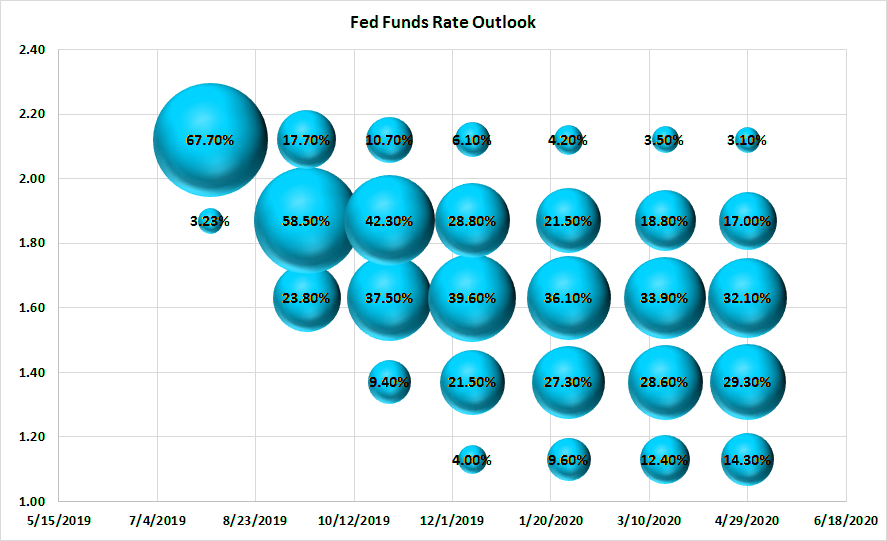

The data comes from the CME Group, aggregating all the futures market data regarding interest rate. The information is turned into odds of changes each time the Fed is scheduled to make an interest rate decision through the middle of next year.

And the CME Group's FedWatch tool is pretty good at predicting the future.

That's cause for concern for some, though encouraging for most. As of the most recent look at the CME Group interest rate futures open interest and trading activity, these pros are betting that by the end of the current calendar year, the FOMC will have ratcheted the Fed Funds Rate down to a range of between 1.5% and 1.75%.

That's what the other graphic illustrates. The size of the bubble indicates how heavily traders have bet on the Fed Funds Rate being at that level at that future date.

It's not necessarily an iron-clad assurance that the Federal Reserve will end up cutting rates, to that degree, or any degree. Some of these professionals may be using futures to hedge against falling rates, and may not entirely mind being wrong. They'll more than offset the losses on those trades with gains elsewhere.

On the other hand, this degree of doubt is significant. At least some of these bets are legitimate bets that rates really are on a downward trajectory the Fed can't yet acknowledge it sees on the horizon.

Between the steady-Eddie Fed and the doubting market, traders would be wise to start planning on dovishness. That means at least a slight shift in which stocks perform better than others, and better than the broad market.