– 'Decoupling' theme draws investors away from Europe, emerging markets: survey –

By William Watts, MarketWatch [1]

Global equity investors showed renewed love for U.S. stocks in June.

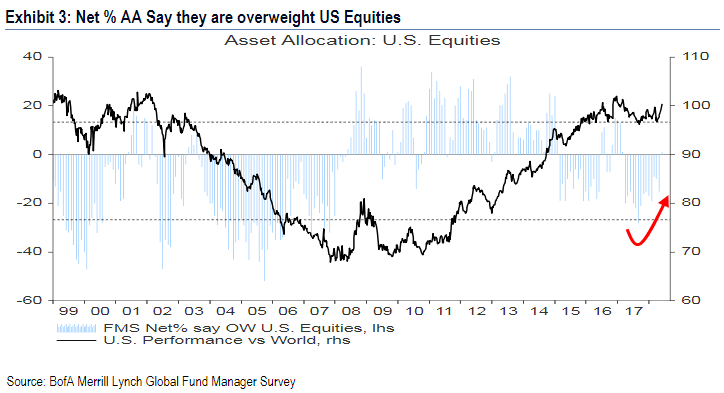

Bank of America Merrill Lynch said Tuesday that its June survey of global fund managers found equity investors are overweight U.S. stocks for the first time in 15 months (see chart below), with two out of three respondents saying the U.S. has the best outlook for corporate profits-a 17-year high. The increased U.S. weighting came at the expense of emerging-market and, in particular, eurozone exposure, the survey found.

The phenomenon appears to be part of the "decoupling" story that serves as a mirror image of the synchronized global growth narrative that helped underpin equity markets in 2017. Last year, strong growth around the globe was viewed as a pillar of a world-wide stock market rally. This year, worries about growth in emerging markets and in Europe contrast with growing confidence in the U.S. economy.

U.S. benchmarks notched a series of all-time highs in January, but a February downturn knocked the S&P 500 and Dow Jones Industrial Average into correction territory. While the Nasdaq Composite and small-cap Russell 2000 have returned to record territory, the S&P 500 and Dow have yet to return to all-time highs. Still, the U.S. benchmark S&P 500 is up 4.3% year to date versus a 0.4% fall for the pan-European Stoxx 600 index.

Among other survey highlights, bets on large-cap tech companies, specifically the "long FAANG+BAT" position, continue to be viewed as the "most crowded" trade, topping the list for a fifth straight month. The double acronym refers to the U.S. tech giants Facebook Inc., Apple Inc., Amazon.com Inc., Netflix Inc. and Google parent Alphabet Inc. combined with Chinese tech juggernauts Baidu Inc.m Alibaba Group Holding Ltd. and Tencent Holdings Ltd.

On the bearish front, BAML analysts said a record 42% of investors believe corporations are overleveraged, which implies downside risk for equities versus government bonds.

Also, investors identified "trade war" as the biggest "tail risk" for markets, the survey found, with BAML noting that "trade tensions" have been the dominant macroeconomic worry for investors in 2018.

Among other highlights:

- The survey found that cash levels dipped by 0.1 percentage point to 4.8%, which remains above the 10-year average of 4.5%. That is a positive for stocks, according to the survey's "cash rule," which holds that an average cash balance above 4.5% constitutes a contrarian buy signal. A cash level below 3.5% is viewed as a contrarian sell signal.

- Investors expect the S&P 500 to peak at 3,040, according to a weighted average of survey responses, upside of around 9% from Monday's close near 2,780.

- Investors don't expect a recession until the first half of 2020.

From MarketWatch [1]