There's no denying the market's been unusually, almost dangerously bullish since November of last year. We've now gone 81 weeks without a correction of 5% or more, and it seems like the gains are accelerating. Making a bet based on nothing more than the calendar is never a bulletproof idea, but it's especially dangerous right now.

Yet, the reality is, we have to respect tendencies, and the odds. There are some industries and sectors that look like they may behave as they usually do this month, and the months after November.

They're few and far between, mind you. Most stocks are overbought. There's also the not-so-minor reality that several arenas have already bucked their calendar-based trend thus far, making it unclear as to what's next. Doesn't matter. There are still some nooks and crannies of the market that are looking well positioned for decidedly bearish and bullish moves. Here's a closer look at the best February bets, in no particular order…

Automobile Makers – Bearish

Truth be told, the usual February pullback from carmakers begins in mid-January. It also ends promptly at the beginning of March. Whether you're talking about a bullish year, a bearish year, or both though, February's generally tough for names like Ford and GM. These stocks collectively lose 2.0% for the month that just got underway, and they're starting this month out with a head of bearish steam.

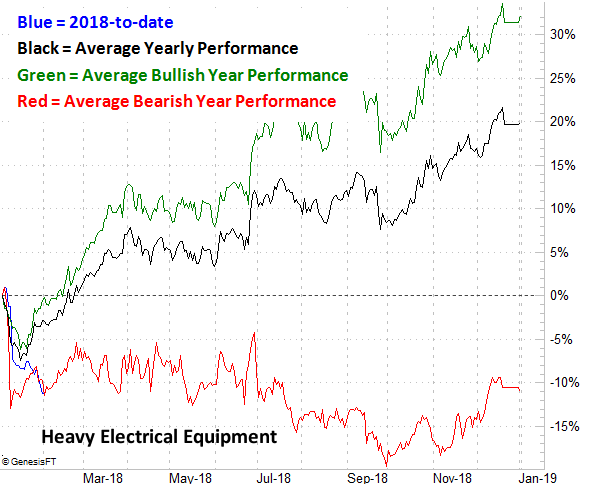

Heavy Electrical Equipment – Bullish

They almost always get off to a new year on the wrong foot. They almost always find their footing early on though, setting up a 3.2% rally in February that extends well into March. We're talking about heavy electrical equipment names…. Capstone Turbine, ABB and AZZ, just to name a few. This year's starting out looking like a carbon copy of the usual path these names take over the course of the usual year.

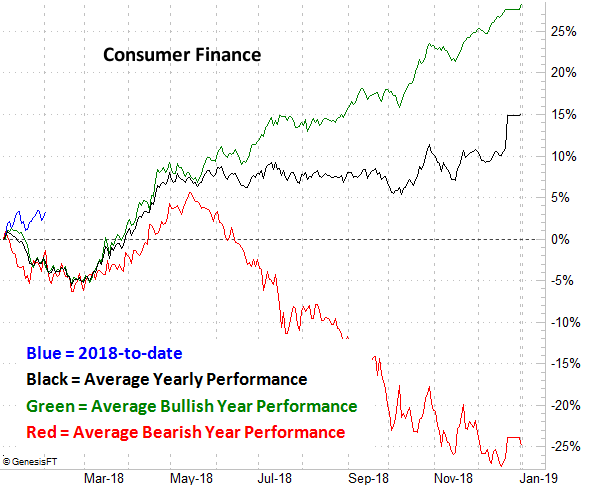

Consumer Finance – Bearish

It's another February trend that doesn't last into March. In fact, it completely reverses in March regardless of the environment, and that March bullishness lingers through April. Consumer finance names, however, generally lose 2.0% of their value in the month that just began, whether it's a good year or bad year.

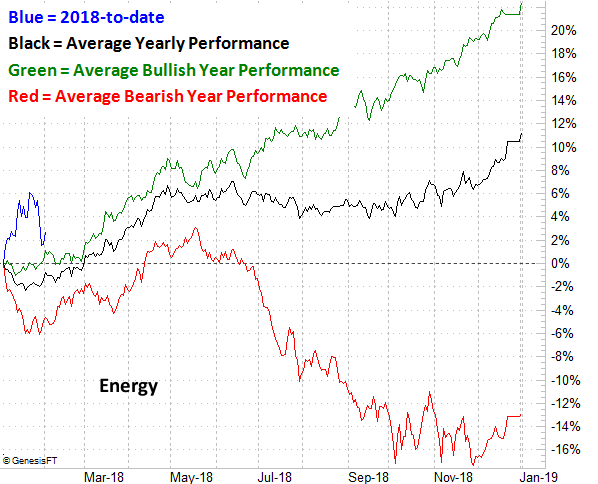

Energy – Bullish

Energy stocks have been rallying quite nicely for a while now… perhaps too nicely. We've been expecting some profit-taking soon, as oil prices go through a "reset." We have to acknowledge, however, that the recent dip from these names may be enough to clear the decks for the usual 1.2% gain these names dish out this month. Also take note of the fact that this uptrend lasts through April as well, even when the sector is en route to a loss for the full year.

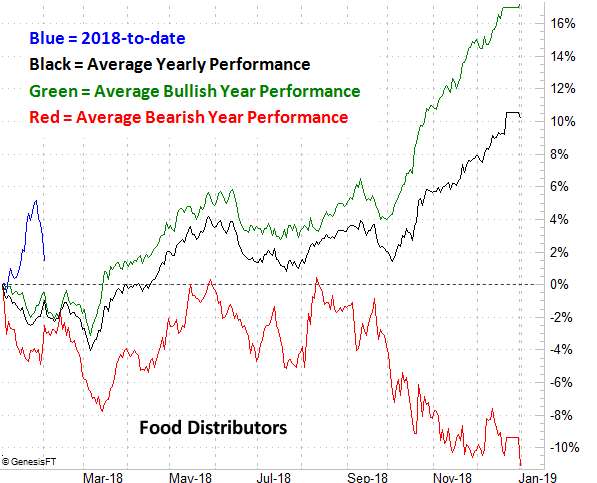

Food Distributors – Bearish

It doesn't matter what kind of environment we're in – February is almost always a loser for food distributor stocks like Sysco and The Andersons. They generally lose 2.4% for the period. In light of how big of a surge these stocks mustered during the first part of January and how much selling momentum they've developed over the course of the past few days, things could be even worse this time around.

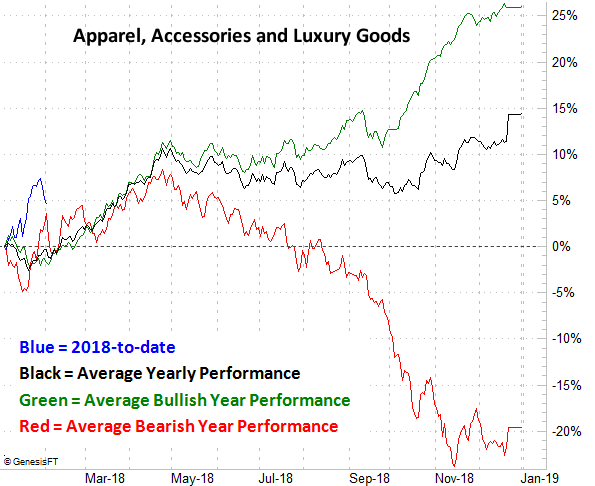

Apparel, Accessories and Luxury Goods – Bullish

They may have gotten 2018 started with a little too much bullishness, but in light of the fact that the February bullishness lasts all the way through April, that's ok – you'll just want to pick and choose any entry point very carefully, looking to buy on the dip. Either way, apparel, accessory and luxury brand stocks generally gain 2.6% this month, in good times and bad. The bearish/bullish divergence doesn't start to take shape until July.

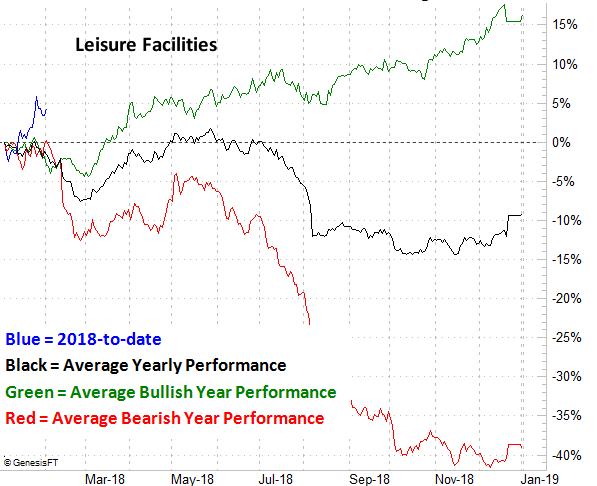

Leisure Facilities – Bearish

What's a leisure facility? Think amusement parks like Cedar Fair and Six Flags, or race tracks like International Speedway Corp. More important, think about the fact that these names lose an average of 5.7% in February, and lose ground even when they're on pace to dish out a full-year gain. It's not a weakness that lasts beyond February, but between the move into an overbought situation we've seen this year on top of the reliable weakness these stocks suffer, this is a tendency you at least have to respect.

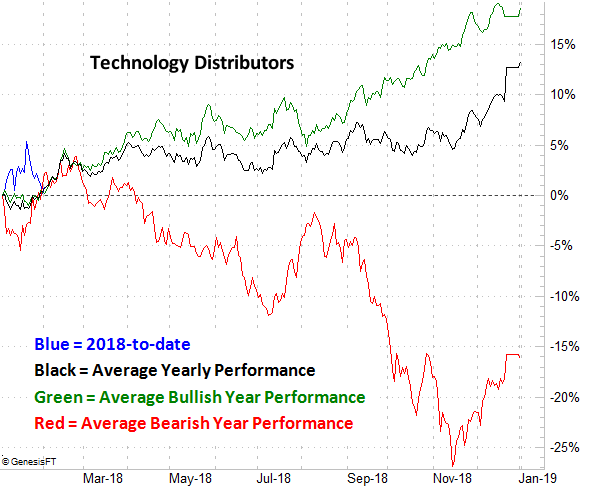

Technology Distributors – Bullish

Technology distributors enjoy an average gain of 2.3%, in bullish years and bearish years. Go figure. Past that, anything goes again – the divergence takes shape beginning in March. This is a good month for these names though, and we're starting 2018's February out in a good position to follow that same usual path. By the way, ePlus, Arrow Electronics and InfoSonics are examples of technology distributors. A lot of these stocks are going to be names you've not heard of.

Systems Software – Bearish

They're off to a great start this year, up 9.7% thus far. That gain from software stocks like Microsoft and Oracle, though, may only be a set up for an even bigger February selloff… a selloff that drags these names 2.6% lower, on average. It's rare, however, that even when the group is going to make a gain for the whole year that the group makes a gain. It's not weakness you can always count on to last longer than the month, but the one month itself is bad enough.

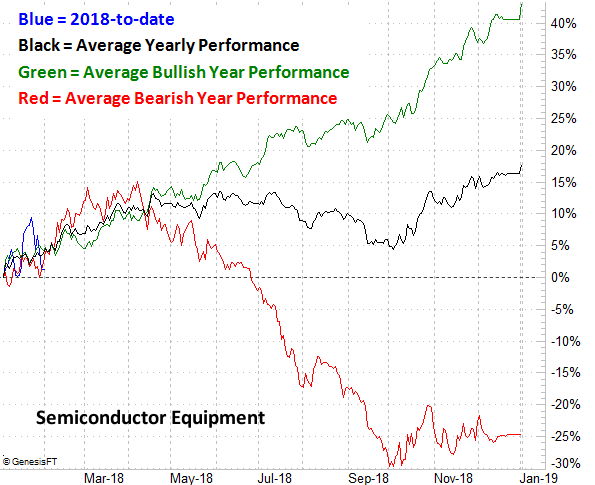

Semiconductor Equipment – Bullish

In all environments, en route to a full-year loss or full-year gain, semiconductor stocks do well in February. The average stock in this sector gains 3.0% this month, and though not forcefully so, continues to drift higher through March. You can't rely on that bullish drift past that point, but it's a decent couple of months that, ironically, is better when these stocks are about to roll over and log a full-year loss.

Bottom Line

Again, none of these historical averages and tendencies are etched in stone. The market loves and loves to throw curve balls at traders, in fact. This is just one piece of the puzzle; you should be looking at other information to come up with stronger conclusions. Still, the ten charts above plot trends nobody can afford to ignore.