- Investors have shown a willingness to pay some of the highest multiples for future earnings in history.

- Consumer confidence measures in the extreme today relative to the future.

- Credit spreads assume ultralow default probabilities for the foreseeable future.

By Ardavan Mobasheri, CNBC [1]

Stock valuations are high, but not in bubble territory. Investor optimism is plentiful but not exuberant or extreme. The bull market will not end until buying becomes euphoric.

Anecdotal statements such as these are plentiful when bull markets are aged, but hard evidence to support them is rarely provided.

Here's the evidence we do have right now: Investors have shown a willingness to pay some of the highest multiples for future earnings in history; volatility forecasts come awfully close to assuming relatively safe high returns for equities; consumer confidence measures in the extreme for today relative to the future; and credit spreads assume ultralow default probabilities for the foreseeable future.

These signs are, in many instances, used by the bulls to justify their view that confidence in the economy and market is the driving force, not overvaluation or exuberance.

But historical experience tells us something else. In fact, economics tells us to ignore the "absolute" and instead concentrate on the "relative." While high levels of confidence are good, its power as a forecast lies in how high is it "relative" to historical experiences, and how markets have performed historically when confidence levels are this high.

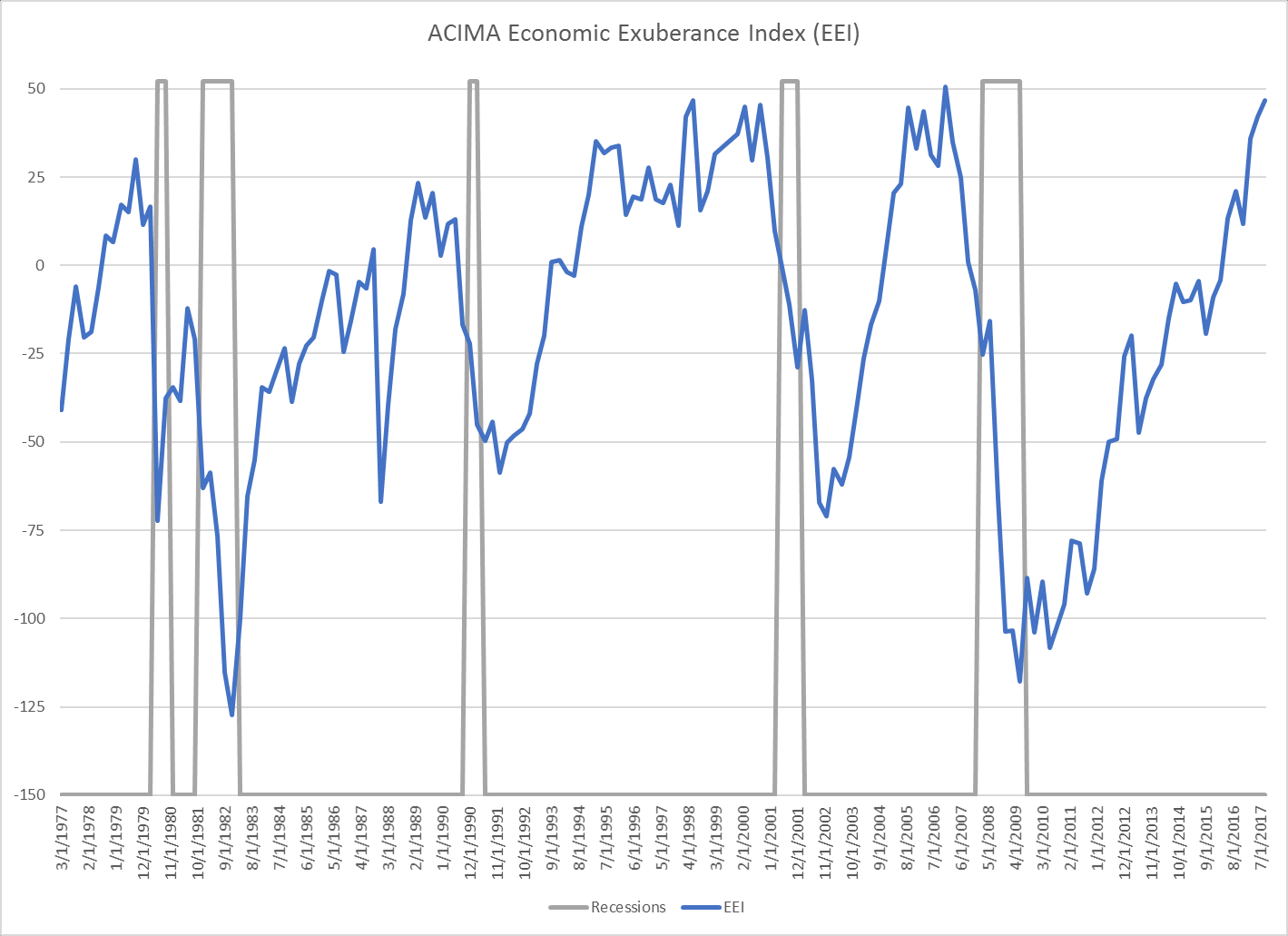

Let's try to quantify "euphoria and exuberance." We will consider price/earnings multiples of the S&P 500 and adjust them for volatility, consumer confidence levels for present conditions and adjust them for future expectations, and the yield curve of the U.S. Treasury market as proxies to neutralize the anecdotal noise around what is and what is not "euphoria and exuberance." The result is what is shown in the graph below.

Economic Exuberance Index 1997-present

[2]

[2]

Source: ACIMA Private Wealth

We consistently observe that over the last 40 years, readings at or above 25 correspond to periods of high equity prices and late stages of the economic cycle. More importantly, when the index value approaches 50, recessions occur within a short period.

While the last two recessions needed readings above 25 and for extended periods, the cycles of the '70s and '80s needed excitement readings barely at 25 before recessions occurred.

And how are we doing now? The index closed the third quarter at its highest level since December 2006 (exactly 12 months before the recession of 2008-2009) and higher than the highest it ever achieved during the boom of the 1990s. When looking at only valuations, we have exceeded the level of the 2000s cycle but are not yet at the level of the 1990s.

While not perfect, we believe quantifying anecdotal perspectives should always be the preferred route to any analysis, and this time should not be any different. Short of including the number of hours spent talking about the FANG stocks or the Trump trade over cocktails, we believe "euphoria and exuberance" for U.S. equities is as high as it has ever gotten over the last 40 years. The only question left is how much longer can we remain this excited?

Ardavan Mobasheri, is managing director and chief investment officer of Acima Private Wealth and adjunct professor at the Robins School of Business at the University of Richmond. He is the former chief economist at the American International Group (AIG). Follow him on Twitter @TheBizCyclist.

From CNBC [1]