Economists were expecting a solid jobs report for April. They got a great one.

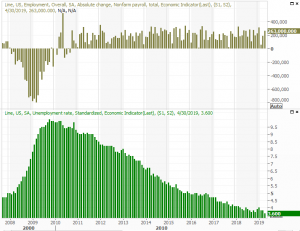

Last month, the U.S. economy added 263,000 jobs, driving the unemployment rate to a 49-year low of 3.6%. Analysts were only expecting payroll growth of 200,000, which likely would have left the unemployment rate at 3.8%.

Professional and business services led the job creation race with 76,000 new positions, while construction added 33,000. Healthcare improved by 27,000, bringing its 12-month total to 404,000, while financial positions increased by 12,000. The only weak spot was retail, which saw net job losses of 12,000, though that setback was easily more than offset… usually with a better-paying job.

Last month's heroic numbers weren't just reactionary to previous poor figures either. February's alarmingly low job-growth figure of 33,000 was pushed up to 56,000. The average monthly job growth figure so far this year is a healthy 204,000.

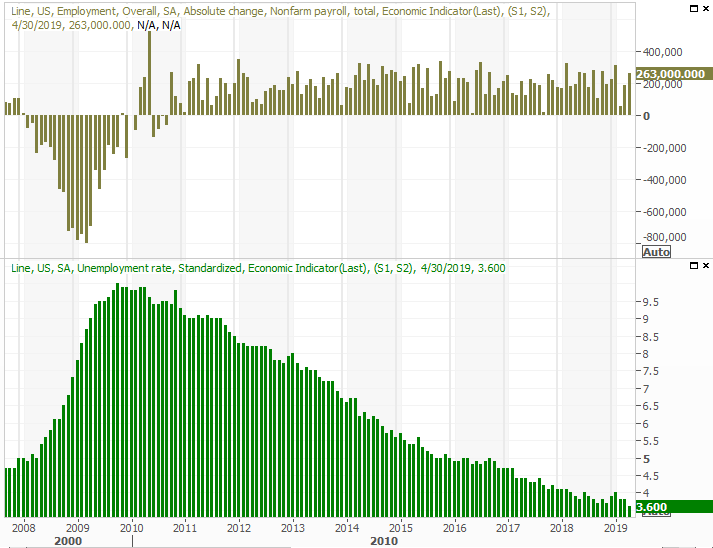

It was a legitimate victory too. The number of people with jobs improved slightly, to 156.654 million after sliding a little lower in March. The number of individuals without jobs though – those receiving unemployment benefits – fell to a multi-year low of 5.82 million. The number of people without jobs but not receiving benefits also fell to a multi-year low of 5.121 million.

Anybody who wants a job pretty much has one, and many have a choice of jobs should they want a different one.

They're being paid well to come to those new employers as well. Average hourly wages were up 3.2% year-over-year, extending a long streak of pay increased since 2015. Last month's 0.2% improvement from March's average hourly pay also reverses, for the time being anyway, a lull. The graphic below only indicates hourly wages through March, though the average workweek data at the bottom is through April.

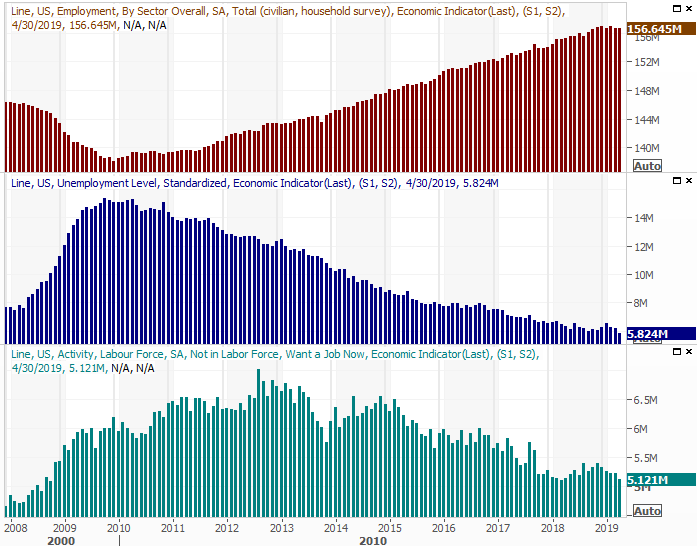

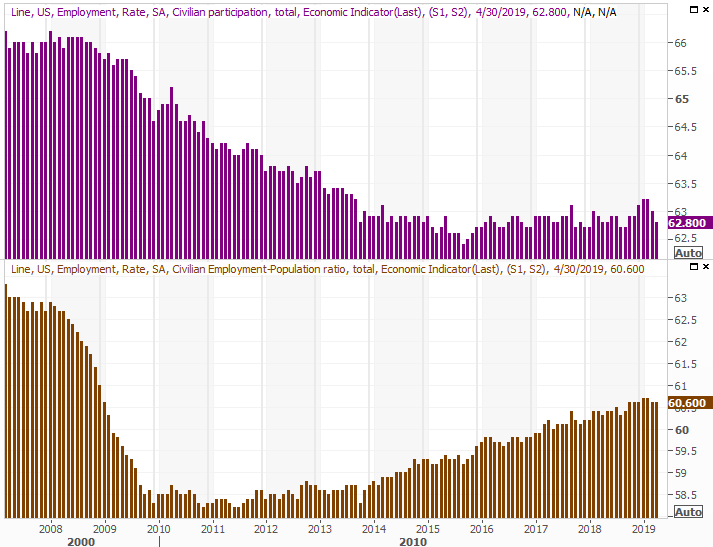

Given the breadth and depth of the jobs data so far, one would expect other job-related data to be just as solid. But, it wasn't. The labor force participation rate fell back to 62.8% after surging late last year and early this year. It's possible that figure was sent lower due to retirements… people removing themselves out of the job market. It's also possible that two-income families are voluntarily paring their employment back to one income, now that the one income is adequate enough to support that family.

Whatever the reason, the labor force participation rate's lull doesn't jibe with the employed/population ratio. It held steady at 60.6%.

The mass exit of baby-boomers from the workplace is still underway, making it entirely possible we'll never see either rate reach 2007/2008 peak levels. Yet, we still don't know what the 'right' or 'good' level is.

We also know it may not matter right now. All other data is about as firm as we could reasonably expect, but not so strong that we drive the very inflation we've been worried about, but not yet seen.

Giving April's jobs report a school grade would earn it a B. Wages could improve a little more, and it would be nice to see the total number or people with jobs grow at a faster clip. But, it's possible there may simply not be enough of the right people in the right place to fill all job openings. That may drive wage growth at a faster clip than we've seen of late, though even then, there have to be available workers willing to take those positions.

Given the alternative, investors will most definitely take a job report like April's.