By Keris Lahiff, CNBC [1]

As Wall Street braces for Apple earnings after the bell Tuesday, some already foresee downside risk for its stock.

The problem, says one technician, is that the charts are telegraphing mixed signals.

"Anytime I have mixed readings we'd rather side cautiously," Ari Wald, head of technical analysis at Oppenheimer, told CNBC's "Trading Nation" on Monday. "We think there is some risk that Apple could be in store for some additional near-term losses."

Apple's already had a rough start to the year. The world's largest company by market cap has declined by more than 1 percent since the beginning of 2018. Its shares have fallen 8 percent from a 52-week high set in mid-March, putting them just outside of correction territory.

That weakness should continue, according to Wald's charts.

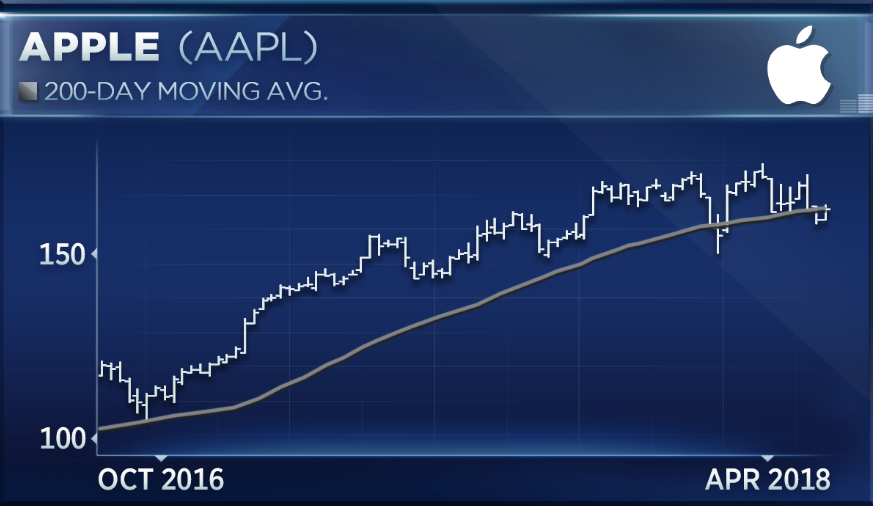

"The stock's 200-day moving average does a great job picking up what that trend is and we can see there's been a real noticeable slowing in that trend through the course in recent months," said Wald. "After a very strong uptrend in 2017 we're seeing the ascent of that 200-day moving day average begin to slow."

Apple fell below its 200-day moving average a week ago after holding above that level since the early February market sell-offs. It currently sits around 1 percent below that trend line. Its shares have seen a rising 200-day moving average trend line since September 2016.

"Once you start to talk about slowing momentum you do open up the risk that the slowing momentum could then turn into negative momentum," said Wald, adding that he would "stay away" from Apple at this juncture.

Wald isn't the only one expressing caution ahead of Apple's earnings. The options market is also showing a level of unease among investors, said Stacey Gilbert, head of derivative strategy at Susquehanna.

"If we look at the implied move, it's roughly 5 percent, and this is a touch higher than what we typically see for Apple," Gilbert said on "Trading Nation" on Monday. "Over the last four quarters, the close-to-close realized move has been closer to 3 percent and if you go back eight quarters, you're getting closer to 4 percent."

That there's extra risk being priced in this quarter is not a surprise to Gilbert. Heading into its earnings, analysts have raised concerns over slowing iPhone sales and revised their estimates accordingly. Those surveyed by FactSet anticipate the sale of 53 million iPhones over its March-ended quarter, up 4 percent from a year earlier.

"The majority of the flow is focused on protective puts," said Gilbert. "If Apple struggles to get over the already lowered bar expectation, I think investors are much more concerned about the downside here. We are not seeing much positioning at all for anyone looking for a relief rally."

Apple is scheduled to report fiscal second-quarter earnings after the bell Tuesday. The Cupertino, California-based company is expected to post a 25 percent surge in profit over the three months to March, slightly higher than the blended earnings growth rate on the S&P 500. Sales are forecast to climb nearly 16 percent.

Apple has beat earnings estimates for the past seven quarters.

By CNBC [1]