Don't look now, but risk appetites just improved. That is to say, investors are leaning more towards aggressive sectors again, and less towards the more conservative, defensive arenas, reversing a trend that started to develop a couple of weeks ago.

The premise is simple enough… the sectors investors choose to buy or sell can often serve as a barometer of what they expect in the foreseeable future. Shunning technology and plowing into utility names implies an expectation that things are slowing down for the economy and growth opportunities will be limited. Conversely, avoiding financials and wading into consumer goods suggests the best game in town is selling consumers the goods they have no choice but to buy… food and soap.

The ebb and flow of the sectors are also somewhat predictive in and of themselves though. See, once a body is in motion it tends to stay in motion, meaning when new trends emerge we have to assume they'll remain in place until proven otherwise.

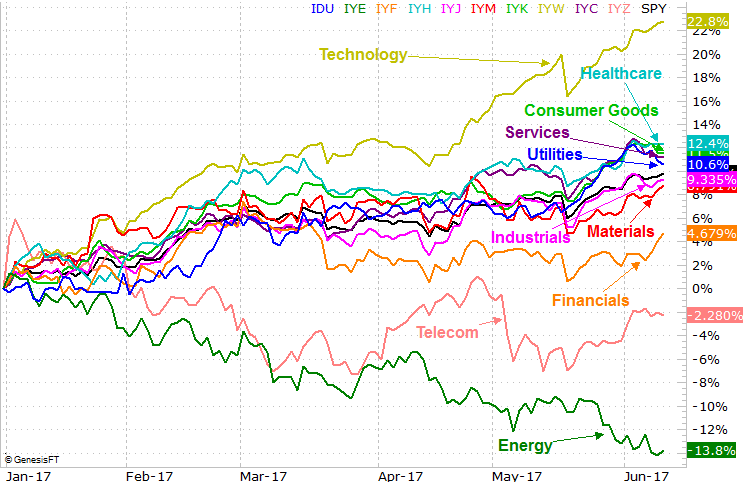

With that as the backdrop, notice that tech stocks have rekindled their unlikely uptrend this week, while financial stocks are testing the waters of higher highs. At the other end of the spectrum, consumer goods, utilities, and healthcare have all rolled over this week.

The graphics below tell the tale. This one lays out the specific numbers in tabular form…

…while this one plots each sector's progress relative to one another since the beginning of the year.

They're all small and subtle moves thus far, and there are certainly no guarantees the budding trends will further solidify. In this particular case though, there are clear winners and losers… and the winners are doing so at the expense of losers. This is all more calculated and thought-out than in may seem on the surface. Indeed, the very people doing the buying and selling may not even be aware they're making it happen. That doesn't change the fact, however, that it is happening.

Flaws remain, the biggest of which is the sheer fact that stocks are overvalued. The S&P 500 is now priced at a trailing P/E of 21.8, and doing so in front of at least one near-term rate hike and another one slated for later this year. While traders justified high earnings multiples because interest rates were uber-low, that argument is losing its potency.

There's also the calendar. The S&P 500 usually only gains an average of 1.2% over the course of June, July and August, and September is usually a loser. Throw in the fact that the index is already tracking at the limit of its year-to-date historical bullishness, and it's tough to imagine there being much more room for marketwide upside. Stocks have a tendency to do the unexpected though, and the unlikely.

This isn't a "set it and forget it" idea. In the current environment nobody can afford to take their eyes of the market for a second. Right now though, the sentiment really is turning bullish, and that's a key short-term driver.