Using Google Search Interest Trends As A Sentiment Indicator, Tech IPO Edition

Using Google Search Interest Trends As A Trading Indicator, Tech IPO Edition

Want to Buy Twitter Shares? Check Out These Charts First

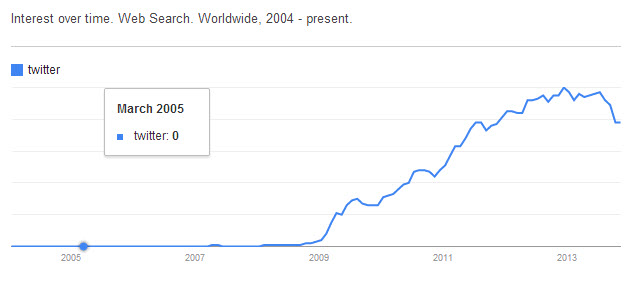

The Twitter initial public offering is upon us, and TWTR had a big gain on the first day of trading (compared to the pre-IPO price). But is it a worrisome sign that interest in the product has recently dipped, according to search trends on Google (GOOG)? On the first the chart below, you can see a level of 100 in June and 80 in October. That's a 20 percent drop in four months. (For each chart below, the company's peak search interest month is listed as 100, and every other month's number is a percentage of that peak -- all charts from google)

A reading of Twitter's search trends hasn't been this low in two years. Even all the news surrounding its IPO wasn't enough to give it a boost in public interest. W ithout the IPO news, the level might have even been lower. Let's compare Twitter with recent IPOs of other Internet companies. We'll see that the search trends leading up to the IPO actually did a decent job of forecasting the stock performance afterward.

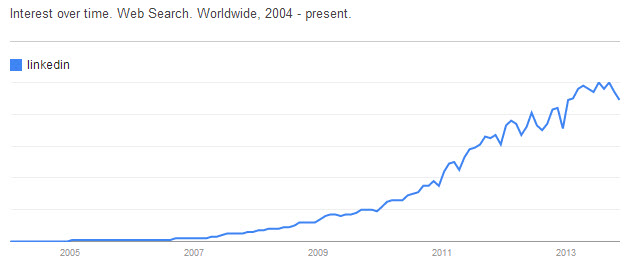

LinkedIn (LNKD) went public in May 2011 while still on a very hot growth streak. That streak continued in both search trends and the stock price, which has lifted the $71 initial offering to more than $220 today.

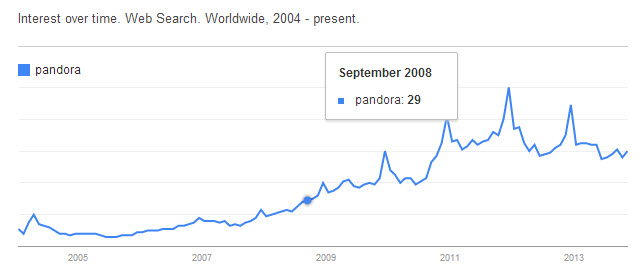

At the time of Pandora's (P) June 2011 IPO, the search trends on the company were generally going up each year. The stock performance has followed as well. Pandora now trades at more than $25 per share, a good return from the company's $16 initial offering price.

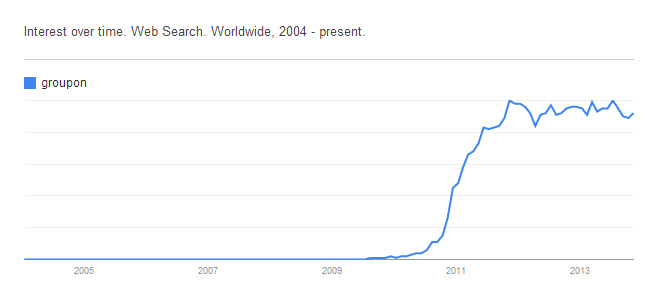

Groupon (GRPN) saw its trend reading soar just as it prepared to go public in November 2011. Perfect timing for the company-not so good for investors. The company experienced rapid growth in late 2011, never to be repeated again. Groupon's founder was eventually fired as chief executive, and the stock is still half the original $20 price, including a peak-to-trough drop of 90 percent in its first year as a public company.

After a two-year period of flat-to-negative growth in the trend chart, Zynga (ZNGA) went public in December 2011. This could have been a warning to investors, as the stock quickly cratered from $10 to $2. It's still less than $4 today.

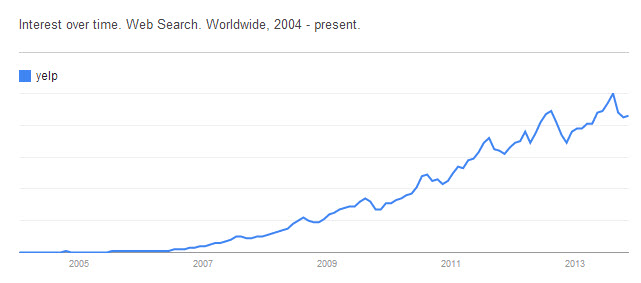

Yelp (YELP) was in the middle of a hot streak on search trends at the time of its March 2012 IPO. The stock performance followed, reaching $75 from an initial start of $15.

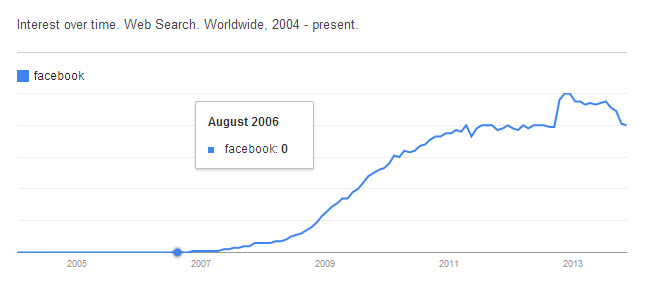

Facebook's (FB) May 2012 IPO came after nearly a year of flat growth in search trends. The post-IPO stock performance was historically bad and only recently recovered as the company's expansion into mobile has paid off.

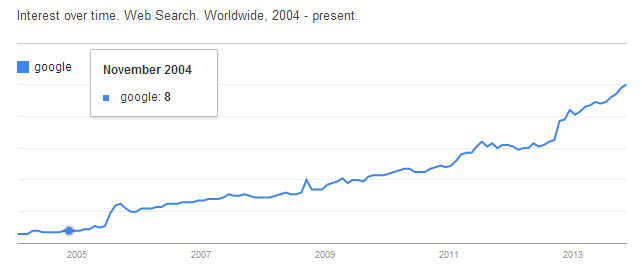

Finally, look at Google itself, which has shown nonstop increases in trends readings and share appreciation since its 2004 IPO. Even the first months of 2004 saw a 50 percent jump in search trends for the site, another example of the search data forecasting the stock growth to come.

Based on this entirely unscientific sampling of recent Internet IPOs, Twitter's recent performance on search trends would suggest that the performance of the IPO may not be what investors want. Obviously, there's a big difference between the curiosity of the general public and the investment interest of Wall Street.

A decline in search trends doesn't necessarily mean the IPO is bad for investors, but it's not the most promising sign. One huge attraction for investors to buy shares in an IPO is to get exposure to the potential upside of the company, and if it seems the company is stagnating in its public appeal, that has to be considered a potential risk.

Courtesy of Eric Chemi, businessweek.com