The 50 Stocks Most Owned By Large Hedge Funds & Q3 2014 Hedge Fund Reporting

Hedge funds increased equity exposure in Q3: Top buys Shire, eBay, AbbVie; Top sells Mallinckrodt, Apple; Top new position Alibaba

by FactSet.com

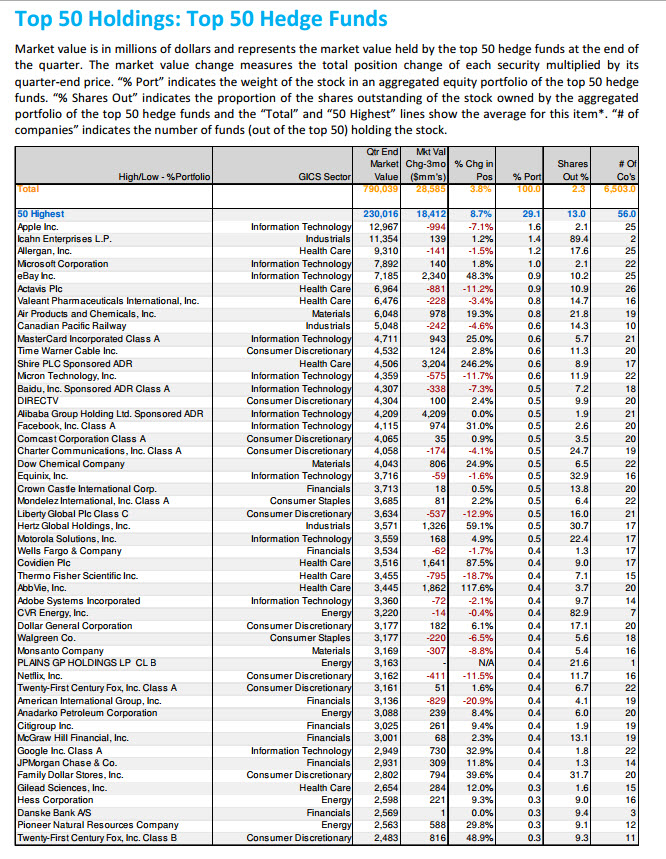

50 Biggest Holdings Of The 50 Biggest Hedge Funds Chart

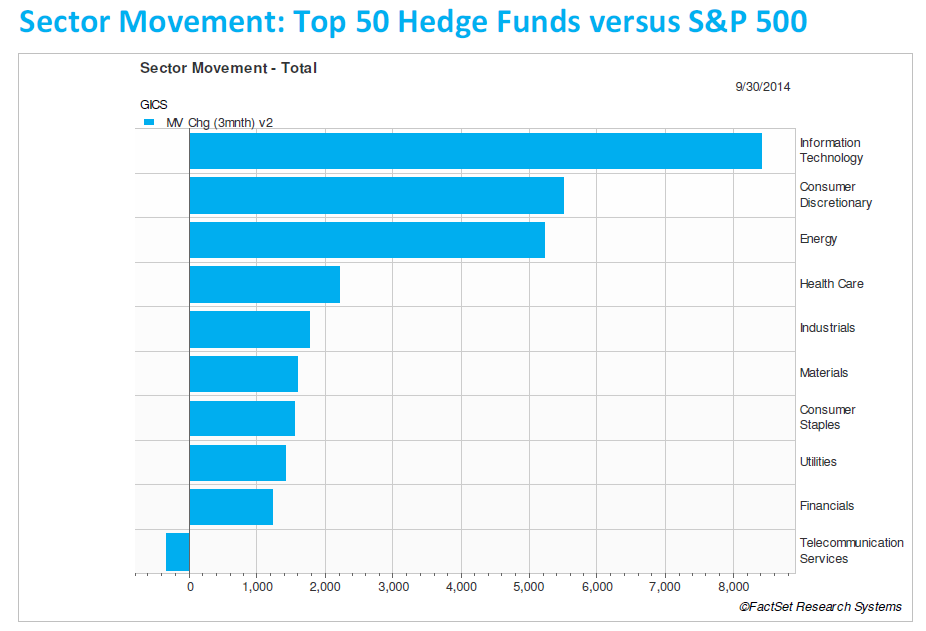

The 50 largest hedge funds increased their equity exposure by 3.8% in Q3 2014. At the sector level, the funds added exposure in nine of the ten sectors, led by the Information Technology (RYT) (IXN) (VGT) (IYW) (XLK), Consumer Discretionary (XLY), and Energy (XLE) sectors. It is interesting to note that the S&P 500 Information Technology sector recorded the second largest increase in value (+4.3%) of all ten sectors during the quarter, while the S&P 500 Energy sector witnessed the largest decrease in value (-9.1%) of all ten sectors during the third quarter. The only sector in which the largest 50 hedge funds decreased exposure in aggregate was the Telecom Services (IYZ) (XTL) sector.

In terms of individual stocks, hedge fund managers were particularly active in the Health Care (XLV) sector. Three of top six purchases by market value (Shire (SHPG), AbbVie (ABBV), and Covidien (COV)) and three of the top six sales by market value (Mallinckrodt (MNK), Actavis (ACT), and Thermo Fisher Scientific (TMO)) involved companies in this sector.

Shire PLC, which was the target of an acquisition attempt by AbbVie during the course of the third quarter, was the top purchase of the hedge funds for the quarter. The market value purchased in this company was nearly $1 billion more than the next closest company (eBay) (EBAY). Just prior to the start of the third quarter (June 20), AbbVie made a proposal to acquire Shire PLC, which was subsequently rejected by Shire PLC. AbbVie increased the value of its offer multiple times during the quarter, with bothcompanies entering an agreement on July 18. However, the agreement was ultimately cancelled on October 20. During the third quarter, the price of Shire increased 16.8%. Despite the ultimate failure of the acquisition attempt, AbbVie was the third highest purchase in aggregate of the hedge funds during the third quarter. The price of AbbVie rose by 2.3% during the quarter. Since the cancellation of the agreement on October 20, the price of AbbVie has increased by 14.3% through yesterday's close.

After Shire PLC, eBay was the second largest purchase in aggregate by hedge fund managers during the third quarter. During the quarter, the value of the stock rose by 13.1%. However, at the end of the third quarter (September 30), eBay announced the spinoff of PayPal to shareholders. Over the next few weeks (thorough October 16), the value of eBay dropped by 15.5%. Since October 16, the stock price has rebounded by 15.5% (through yesterday's close), but still stands below the recent peak price on September 30 (the day the spinoff was announced).

On the other hand, Mallinckrodt PLC was the largest sale in aggregate for the hedge funds during the third quarter. It was the top sale of two of the 50 hedge funds during the quarter. On August 14, it was announced that the company would be added to the S&P 500 index. From August 15 through September 30, the price of the stock rose 25.8%.

After Mallinckrodt, Apple (AAPL) recorded the second largest sale in aggregate during the quarter. It was the top sale of three of the 50 hedge funds during the quarter. Despite the decrease in exposure, Apple remained the largest holding of the aggregate portfolio, comprising 1.6% of all equity holdings. The stock was ranked 2nd (with eBay and Allergan (AGN)) on the list of companies with the highest number of hedge funds holding a position in the company (25) at the end of the quarter, trailing only Actavis (26). Apple was the top holding of 7 of the 50 hedge funds at the end of the third quarter.

In terms of new positions, Alibaba (BABA) was by far the top position added in terms of market value. The company held its initial public offering on September 26. It was the top buy of 5 of the 50 hedge funds during the quarter. By the end of the quarter, the company was the 16th largest holding of the aggregate portfolio, as 21 of the 50 hedge funds had a position in the company.

Hedge Fund Sector Activity - Q3 2014