Q2 Earnings Preannouncements Analysis

Lowest Number of S&P 500 Companies Issuing Negative EPS Guidance Since Q4 2012

by John Butters

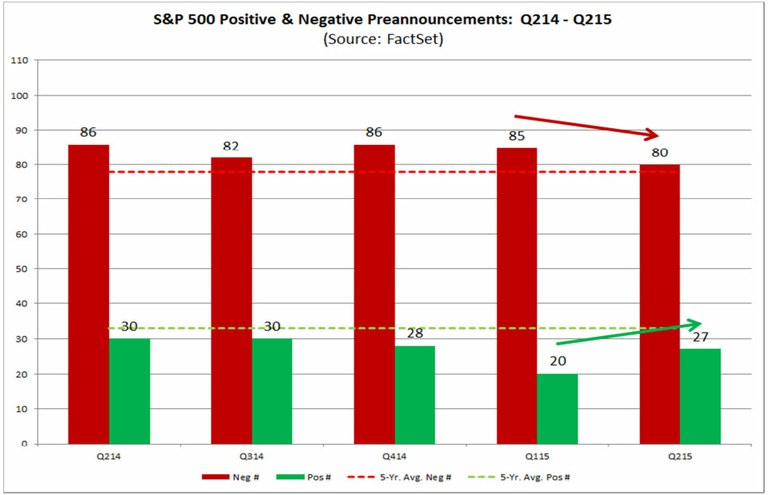

For Q2 2015, 80 companies in the S&P 500 have issued negative EPS guidance and 27 companies have issued positive EPS guidance. If 80 is the final number of companies issuing negative EPS guidance for the quarter, it will mark the lowest number since Q4 2012.

Positive Shift in Health Care, Materials, and Information Technology Since Q1

Companies in the S&P 500 have issued fewer negative EPS preannouncements and more positive EPS preannouncements for the second quarter of 2015 relative to the first quarter of 2015. For Q2 2015, 80 companies have issued negative EPS guidance and 27 companies have issued positive EPS guidance. The number of companies issuing negative preannouncements for Q2 is below the number for Q1 (85), and the number of companies issuing positive preannouncements for Q2 is above the number for Q1 (20). If 80 is the final number for the second quarter, it will mark the lowest number of companies issuing negative EPS preannouncements for a quarter since Q4 2012 (79).

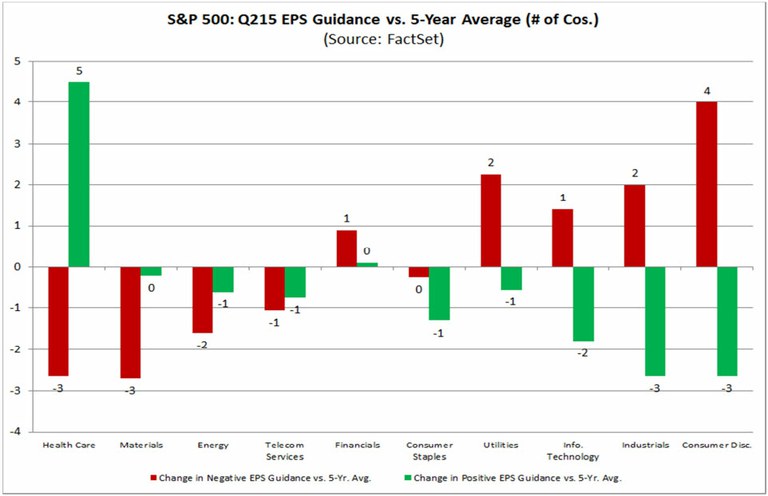

At the sector level, three sectors have led the positive shift in EPS guidance since last quarter: Health Care (XLV), Materials (XLB), and Information Technology (XLK). The Health Care sector (+4) sector has witnessed the largest increase in the number of companies issuing positive EPS guidance since Q1 2015, followed by the Information Technology (+3) and Materials (+2) sectors. The Health Care (-3) and Materials (-2) sectors also have seen the largest declines in the number of companies issuing negative EPS guidance compared to Q1 2015.

Percentage of Companies Issuing Negative Guidance for Q2 Still Above 5-Year Average

Despite the positive shift in EPS guidance for Q2, it is important to note that the number of companies issuing negative EPS guidance for Q2 2015 is still above the five-year average (78) for a quarter, and the number of companies issuing positive EPS guidance for Q2 is still below the five-year average (33).

At the sector level, the Consumer Discretionary (XLY) sector has not only witnessed the largest increase in the number of companies issuing negative EPS guidance (+4) relative to its five-year average, but also has seen the largest decrease (along with the Industrials sector) in the number of companies issuing positive EPS guidance (-7) relative to its five-year average.

On the other hand, the Health Care sector has not only recorded the largest increase in the number of companies issuing positive EPS guidance (+5) relative to its five-year average, but also has seen the largest decrease (along with the Materials sector) in the number of companies issuing negative EPS guidance (-3) relative to its five-year average.

The percentage of companies issuing negative EPS guidance for Q2 2015 is 75% (80 out of 107), which is above the five-year average for a quarter (69%), but below the percentage recorded for Q1 2015 (81%). At the sector level (with a minimum of five companies issuing quarterly EPS guidance), the Industrials (92%) sector has the highest percentage of companies issuing negative EPS guidance for the quarter.

Surprise Percentage (-7.1%) for EPS Guidance Below 5-Year Average

The 107 companies that have given EPS guidance for Q2 2015 have guided earnings 7.1% below the expectations of analysts on average. This percentage decline is smaller than the trailing five-year average of -10.4%.

Courtesy of factset.com