New Study Explores 'Good Trading Brain / Bad Trading Brain'

New Study Explores 'Good Trading Brain / Bad Trading Brain'

Original Cal Tech & Virginia Tech 40 page study is here.

It's long been known that the typical human brain did not evolve perfectly for success in stock trading and investing. There are probably many reasons, and many mechanisms contributing to this observation. Using fMRI imaging, researchers at the CalTech, the Virginia Tech Carilion Research Institute and the Wellcome Trust Centre for Neuroimaging University College London studied the brains of good traders and bad traders and found several differences.

In "They Discovered Something In The Brains Of Great Investors That Makes Them Do So Much Better," Rob Wile at Business Insider reports on the results.

Excerpt:

But according to a new study by Caltech and Virginia Tech behavioral economists, only certain people's brains are capable of acting on [Warren Buffett's advice to be fearful when others are greedy and greedy when others are fearful].

The researchers looked at the brain activity and behavior of people trading in experimental markets where price bubbles formed, using an fMRI scanner to track responses.

They found that only "wise" traders received an early "warning signal" from their brains, causing them to feel uncomfortable and urging them to sell.

The wiser traders had more intense activity in the insular cortex, which is associated with risk aversion - it's often activated when a person smells something rank. The much more common brain pattern the researchers found was one that made traders behave in a greedy way, buying aggressively during a bubble and even after its peak. These traders had much greater activity in the nucleus accumbens, or NAcc, which is associated with reward processing.

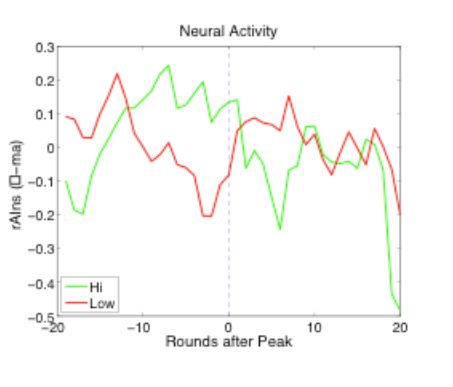

Here's the brain activity chart: The high earners, in green, saw significantly more insula activity as a peak approached. Meanwhile, the poorly performing traders' brains' regulation areas basically shut down.

Neural Activity Around Market Peak Chart

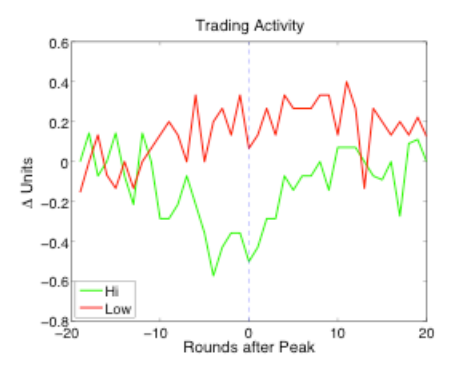

And here's the trading activity chart. The high earners, in green, curbed their trading activity significantly as they sensed peak pricing approach, then bought into the dip once it passed. The bad traders kept buying throughout the peak.

Trading Activity Around Market Peak Chart

Excerpt:

Brain Research Suggests an Early Warning Signal Tips Off Smart Traders

[A]ccording to the results of a new study by researchers at Caltech and Virginia Tech that looked at the brain activity and behavior of people trading in experimental markets where price bubbles formed. In such markets, where price far outpaces actual value, it appears that wise traders receive an early warning signal from their brains-a warning that makes them feel uncomfortable and urges them to sell, sell, sell.

"Seeing what's going on in people's brains when they are trading suggests that Buffett was right on target," says Colin Camerer, the Robert Kirby Professor of Behavioral Economics at Caltech.

That is because in their experimental markets, Camerer and his colleagues found two distinct types of activity in the brains of participants-one that made a small fraction of participants nervous and prompted them to sell their experimental shares even as prices were on the rise, and another that was much more common and made traders behave in a greedy way, buying aggressively during the bubble and even after the peak. The lucky few who received the early warning signal got out of the market early, ultimately causing the bubble to burst, and earned the most money. The others displayed what former Federal Reserve chairman Alan Greenspan called "irrational exuberance" and lost their proverbial shirts.

The researchers set up a simple experimental market in which they were able to control the fundamental, or actual, value of a traded risky asset. In each of 16 sessions, about 20 participants were told how an on-screen trading market worked and were given 100 units of experimental currency and six shares of the risky asset. Then, over the course of 50 trading periods, the traders indicated by pressing keyboard buttons whether they wanted to buy, sell, or hold shares at various prices.

Courtesy of BusinessInsider and Caltech