Key Factors That Contribute To A Positive Trading System

Key Factors That Contribute To A Positive Trading System

Trading Expectancy: The Power of an Edge

When you first started to trade, how did you judge your results? If you're like most novice traders you likely had little understanding of the concept of trading expectancy, so you focused almost entirely on your win rate in the early days. You were probably trying to win 80 or even 90 percent of the time and it was a constant struggle. You may have been able to achieve it for a short period of time, but your small wins just couldn't cover the big losses and once you hit an "unlucky" string of losing trades you just couldn't recover.

While very high win rates can be achieved by experienced traders or those with a system that allows huge draw-down, it's extremely difficult for most new traders to sustain these percentages as their various trading errors and impatience get the best of them.

From there you might have shifted your focus to your ratio of reward to risk. As long as you could win more on average than you lost, you could make trading work and be profitable. You might have been looking for 3 or even 4 times as much profit on a winner compared to a regular loss, but still the struggles continued. Your win rate dropped dramatically, and even the odd big win wasn't enough to pay for the strings of losses.

Here's the thing that you don't often hear on the trading forums - your win rate alone isn't that important on its own and neither is your reward to risk ratio by itself. What really matters is what happens when you combine the two to determine your trading expectancy.

What is Trading Expectancy?

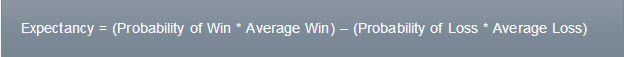

Simply put, your trading expectancy is the average amount you can expect to win (or lose) per trade with your system, when a large number of trades are taken (at least thirty to be statistically significant). To calculate your trading expectancy, you need to know three things - your win percentage, your average win, and your average loss. The calculation is as follows:

It's a simple equation, but knowing the size of your trading edge as shown by a large positive expectancy can be quite powerful. The impact this knowledge can have on a trader's confidence, patience, and discipline shouldn't be understated.

It's easy to understand the power of expectancy by thinking of a casino. The casino has many games which have a small positive expectancy in their favor. The edge for the casino is small enough that the players can go on long winning streaks and make good profits in the short term (thus inspiring false confidence), but if they continue to play over the long term the numbers will be in the casino's favor as, on average, they will make a few pennies for each dollar the player risks. The casino always beats the masses in the long run.

As traders, we can effectively be the casino while sustaining a much larger positive expectancy at the same time.

"At the heart of all trading is the simplest of all concepts - that the bottom-line results must show a positive mathematical expectation in order for the trading method to be profitable." - Chuck Branscomb

Calculating Trading Expectancy

Profitable trading systems can come in many permutations, so we will look at cases with different win rates, average wins, and average losses. We will also consider a system which has an extremely high win rate, but still fails to be profitable over the long term due to a negative expectancy.

For the sake of simplicity in these examples, let's assume we have a trader who is taking $100,000 positions and risking 1% of the position on each trade, or $1,000.

High Win Rate, Moderate Reward to Risk Trading System

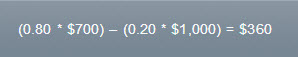

In this example, we see the kind of trading system results that many novice traders aim for but struggle to achieve. This system produces wins 80% of the time and the average profit (reward) is only slightly less than the average loss (risk). This leads to a strong positive expectancy as we can see. For each trade we take with a risk of $1,000, we can expect to make an average profit of $360.

The downside of this scenario is that it's often extremely difficult to replicate. Even armed with a system that should win a high percentage of trades if properly followed, a novice trader will have trouble achieving such a high win rate. Impatience, emotional fear, and a host of other issues are likely to interfere with a new trader following their trading plan, and even slight deviations from the high win rate can cause the positive expectancy of a system to disappear.

Moderate Win Rate, High Reward to Risk Trading System

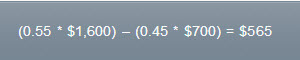

In this example we have a trader with a very healthy reward to risk ratio where the average win is just over twice as large as the average loss. The average loss has also been reduced as this trader is actively managing their overall risk and stop levels as trades develop (the last example had either wins or full losses), so while some losses still hit the maximum initial stop of $1,000, many of the losses are considerably less and reduce the overall average. While the win rate has been reduced to 55% due to aiming for larger average wins, we can see that the trading expectancy actually improves overall. For each trade we make with $1,000 risk, we can expect to see an average return of $565 in profit.

Unlike the previous example, a trading system such as this one is much easier for the novice trader to find consistency with. The pressure of maintaining a high win rate is reduced, a few rookie mistakes won't kill the trading edge, and the excellent reward to risk will quickly cover a small string of losing trades. These numbers in this example are close to what novice traders should strive for, though veteran traders may see a better win percentage due to their additional experience.

Low Win Rate, Very High Reward to Risk Trading System

In this example we look at a trader who focuses on keeping their average wins as large as possible compared to their average loss. Although the system wins less than 1 out of 3 trades, the impact of an excellent reward to risk ratio allows for a substantial positive expectancy on their trades.

These lower win rate systems can be extremely powerful with a large positive trading expectancy, but they can also suffer from long periods of drawdown with strings of losses. Again, this is a difficult scenario for a new trader, as they will often find themselves changing their approach rather than giving the system time and allowing the trading edge to come through over a larger number of trades.

Many professional traders have built their careers off systems with a low win percentage, but with wins that are many times larger than their average loss. Most trend followers would be in this group. They may take a lot of losses when the market moves sideways, but once they hit a trend they take large profits that cover the losses and then some. As legendary trend following trader Ed Seykota says, "one good trend pays for them all".

Very High Win Rate, Very Low Reward to Risk System

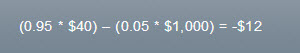

As you can see, even with an extremely high win rate (in this case 95%), success is not guaranteed. While it might seem a bit crazy to take wins that are only an average of $40 with average losses of $1,000, strategies similar to this are actually quite common.

Even when systems like this have a small positive expectancy, they can still run into major problems. In this example we only lose trades 5% of the time, but as unlikely as it is we will eventually have multiple losses in a brief period.

This kind of massive draw-down means a huge dent in your equity which is extremely difficult to pull yourself out of, especially if adjusting position sizing to a lower amount to compensate for the loss.

Your trading system should have a positive expectancy and you should understand what that means. The natural bias that most people have is to go for high probability systems with high reliability. We all are given this bias that you need to be right. We're taught at school that 94 percent or better is an A and 70 or below is failure. Nothing below 70 is acceptable. Everyone is looking for high reliability entry systems, but it's expectancy that is the key. And the real key to expectancy is how you get out of the markets not how you get in. How you take profits and how you get out of a bad position to protect your assets. The expectancy is really the amount you'll make on the average per dollar risked. If you have a methodology that makes you 50 cents or better per dollar risked, that's superb. Most people don't. That means if you risk $1,000 that you'll make on the average $500 for every trade - that's averaging winners and losers together. - Dr. Van Tharp

Additional Factors to Consider

While knowing our trading expectancy is important, there are other factors that come into play which can complicate things a bit. Here's a few things you should consider when evaluating the strength of your system and overall trading plan:

Trading Opportunity

If you have a large positive trading expectancy there's no doubt you've got a powerful trading approach, but you also need to consider how often trades will become available. Your system may have a great positive expectancy, but if it only finds a valid trade once or twice a month it may be inferior in terms of returns compared to a system that has a much lower per trade expectancy but trades 5 or 6 times per week. When position sizing and the possibilities of compounding are considered as well, the frequency of trading opportunities can have a huge impact on returns.

Trading Costs

Something a lot of new traders ignore to their peril is the impact of trading costs on their results. While the round-trip costs in terms of commissions and exchange fees may seem small on a single trade, when you trade often with a system with a small positive expectancy, it can quickly eat away your profits or even turn your expectancy negative. Your approach needs to have a large enough positive trading expectancy to handle your costs with plenty of room to spare.

Position Sizing

Expectancy and position sizing go hand-in-hand. Even with a large positive expectancy, erratic position sizing can quickly shift your results into dangerous territory. Keep your position sizing within tolerable levels and consistent and you will give your trading edge the time and quantity of trades it needs to properly play out.

Historical vs Future Results

It's important to keep in mind that if you are testing your expectancy using historical data, there's no guarantee that you will have a similar edge in the future. It's still vital to do this testing in order to build confidence in your methodology, but be wary of "curve-fitting" your approach to the historical data as things are unlikely to play out the exact same way for future trades.

Trading with Confidence through Positive Expectancy

One of the biggest mistakes that all traders make is that they enter the competitive battlefield that is the markets without knowing their trading edge. Just as it would be foolish for the samurai warrior to enter a battle without knowing the quality and condition of his chosen weapon and armor, a trader must know the quality of his or her trading edge. Without this knowledge, how can one be confident in the face of adversity?

Only through research, testing, and focused practice sessions can a trader be fully confident of their edge and overall trading expectancy. You need to have an intimate knowledge of your trading plan and confidence in your ability to execute it with precision if you want to succeed on the battlefield.

Many would-be traders have fallen due to a lack of preparation. Don't be one of them.

Know your trading expectancy, embrace your edge, keep your discipline, and carve out your piece of the market with confidence.

Courtesy of Cody Hind, samuraitradingacademy