Fed Tapering, SPX & Bond Yield 2014 Predictions From CNBC Survey

Fed Tapering, SPX & Bond Yield 2014 Predictions From CNBC Survey

Fed taper expected sooner: CNBC survey

[BigTrends.com note: We would note that general expectations for an end to Fed tapering have twice been premature and too early -- and that the Fed has been more unwilling in recent years to make tough decisions or those that could be perceived to hurt the economy and/or stock market.]

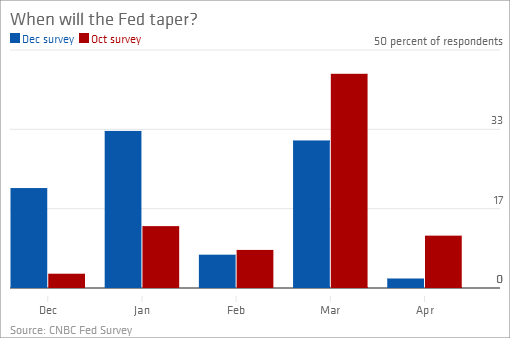

Wall Street has tightened its view of Federal Reserve policy in the months ahead and is now looking on average for the taper, or reduction in Fed stimulus to the economy, to come in February, according to the CNBC Fed Survey for December.

The expectation for February is two months earlier than the average in the CNBC survey in October, but most of the 42 respondents are actually more hawkish. A full 55 percent see the Fed tapering its bond purchases in January or December. That was the forecast of only 16 percent of respondents in October.

[The CNBC survey is of a small group of economists, strategists and money managers.]

"The budget deal makes a taper more likely," John Donaldson of Haverford Trust wrote in response to the survey. Fed Chairman Ben Bernanke "was very pointed during his September press conference that the budget/debt ceiling mess was a concern to the FOMC. This deal removes that concern and opens the door to a taper."

But not everyone agrees. More than 40 percent forecast a taper in March or later with this group believing the Fed has fought too hard to boost the economy to endanger it with a premature stimulus reduction.

"Federal Reserve officials are wary of removing the 'training wheels' too soon," said Lynn Reaser, Point Loma Nazarene University. "At some point, the economy will need to ride on its own, but policymakers are worried about inflicting too many scrapes and bruises along the way."

Yet there's evidence that the Fed has achieved its goal of convincing markets that tapering is not tightening.

Even while survey participants have brought forward the date of the expected taper, they have reduced their outlook for the Fed funds rate in 2015. The rate is now seen at 70 basis points, down from nearly a full percentage point in July.

John Lonski of Moody's points out that the high-yield spreads have been especially well behaved, hitting a new low for the cycle despite all the taper talk. They are, in fact, below where they were when the Fed began talking about tapering in June. He sees that as a sign fixed-income markets may not skyrocket on taper news.

John Ryding of RDQ Economics points to the improving jobs data and asks, "What else does the Fed need to see to announce a taper?" He notes job growth is running at 200,000 monthly and fourth quarter growth is looking stronger after a robust third quarter.

Survey participants believe their individual views on tapering are mostly baked into markets. When it comes to Treasurys, 75 percent of the taper is seen already discounted and 71 percent for the mortgage market. But only 63 percent of the taper is discounted in equities, suggesting stocks could either fall more or experience greater volatility when the Fed does move.

Respondents differed on the stock market impact. "Tapering is coming, and I expect QE to be reduced by 40 percent for the full year 2014 vs. 2013," said John Kattar of Ardent Asset Advisors. "But that's still a lot of money. After some early volatility around the taper announcement, stocks should have another good year."

On average, participants see the S&P 500 stock index (SPX) (SPY) falling to 1773 by year end and rising just 4 percent next year to 1857. The U.S. 10-year note yield (TLT) is seen ending the year at around its current level of 2.88 percent and rising to 3.44 percent next year.

"The belly of the Treasury curve is vulnerable to rate hikes getting pulled forward," Barry Knapp of Barclays wrote in response to the survey. "Equities will correct through this process as they have in every business cycle since WWII when Fed policy attempts to catch up to the improvement in the outlook that has already been discounted by the yield curve."

What's clear is that many participants don't believe the current QE program is necessary. When it comes to the first QE program, 70 percent called it essential, and 30 percent called it helpful. By contrast, not one respondent said QE3 was essential, and only 30 percent called it helpful. Almost half called it "not needed" or "harmful."

Somewhat contradicting that answer, 90 percent said the effects of the financial crisis still linger, with only 10 percent responding "it's over."

Meanwhile, respondents seem less inclined to believe that Fed Chair nominee Janet Yellen is the super dove they originally thought she was.

For example, in October, 15 percent thought she would be much more dovish than Fed Chairman Ben Bernanke. Now that figure is just 2 percent. In October, 44 percent thought Yellen would be somewhat more dovish, and that's grown to 52 percent in December. About one-third see no difference between the two.

In other findings:

* Survey respondents are sticking to their forecast of a gradual rebound in growth next year, to 2.6 percent from 2.2 percent.

* A majority think the holiday shopping season will be better than last year, an improvement from their October forecast.

* The chance of a recession has dropped for the first time since June. It stands at about 17.3 percent, down from 18.4 percent in October.

* Ninety-one percent believe the next debate over the debt ceiling will be less contentious than the one in the fall.

* Sixty percent say the economic effects of Obamacare will be negative both short and long term and that those effects will come primarily through higher health-care costs and lower employment.

Courtesy of Steve Liesman, cnbc.com