5 Stocks Likely To Boost Their Dividends Soon

5 Stocks Likely To Boost Their Dividends Soon

Five stocks that are about to boost their dividends

by Michael Fowlkes

As a dividend-focused investor, there is nothing I like more than news of a stock in portfolio announcing a dividend increase. Companies are always announcing dividend increases, and while the expected increase does not typically result in the stock price moving higher ahead of the announcement, shares are likely to trend a little higher just following the news.

When companies announce dividends, they also announce an ex-dividend date, which is the last day you can buy the stock and still be eligible for the higher dividend. Since there is a gap between the announcement and the ex-dividend date, investors have a window of opportunity to buy shares and still get to collect the higher dividend.

Dividends are a great way to grow a portfolio's value, especially when you use a dividend reinvestment program to put the distributions back into your stock. The compounded effect of reinvesting your dividend means that each quarter your payment is slightly higher than the previous payment, and if you focus on companies that are growing their dividends, once a year your payment really moves higher. That is why I am such a big fan of dividend stocks, and in particular those which have a track record of dividend increases.

Each of the following stocks are likely to announce dividend increases in the near future.

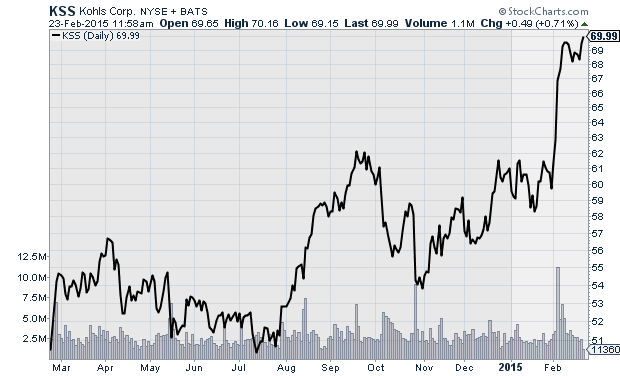

Kohl's

Retailer Kohl's Corp. (KSS) is likely to announce a dividend increase any day now. The stock currently has a yield of 2.2%, and has lifted its dividend each of the last four years. The company's payout ratio is a low 37%, so another increase this year is highly likely. Historically, the company has announced its dividend increases during the final week of February, so this year's increase should be coming soon. Last year, the company increased its dividend by 11.4%, and the previous year's increase was 9.4%. I would expect this year's increase to fall somewhere in the same range, with the quarterly distribution rising from 39 cents to 43 cents, which would mark a 10.2% increase. The stock should trade ex-dividend mid-March.

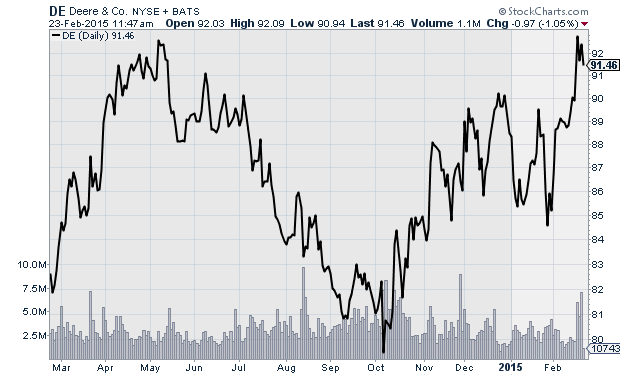

Deere & Co.

Heavy equipment maker Deere & Co. (DE) posted the results of its fiscal first quarter on February 20. The company tends to announce dividend increases about two weeks after its first-quarter report, so news of an increase is likely to come sometime in the next couple of weeks. Deere has a five-year streak of dividend increases, with a current payout ratio of 43.7%. As it stands, the stock's yield is 2.6%, with a quarterly distribution of $0.60 per share. The company continues to face headwinds from lower demand for its agricultural machinery, but the recent quarterly earnings came in above expectations. I believe the company will look to extend its streak of dividend increases to keep investors interested. Last year's increase was 17.6%, but I would not expect such a big increase this year. Look for the quarterly distribution to rise from 60 cents to around 67 cents, which would translate to an increase of 11.7%. The stock should trade ex-dividend during the last week of March.

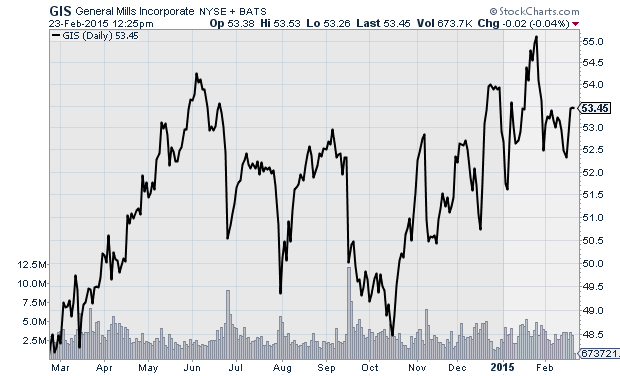

General Mills

Consumer goods maker General Mills (GIS) has an 11-year streak of dividend increases, a streak which it is likely to extend when it announces its next dividend increase in March. The company has a slightly high payout ratio of 58.0%, which means that any increases will be limited, but the ratio is certainly not too high to prevent another increase. Last year's increase was 7.9%, and I expect this year's increase is likely to fall around that same level. The stock currently has a yield of 3.0%, with a quarterly payment of 41 cents per share. Look for this year's increase to lift the payment to 44 cents, which would translate to an increase of 7.3%. General Mills tends to announce its dividend increases during the second week of March, with the stock trading ex-dividend early April and the dividend payable at the start of May.

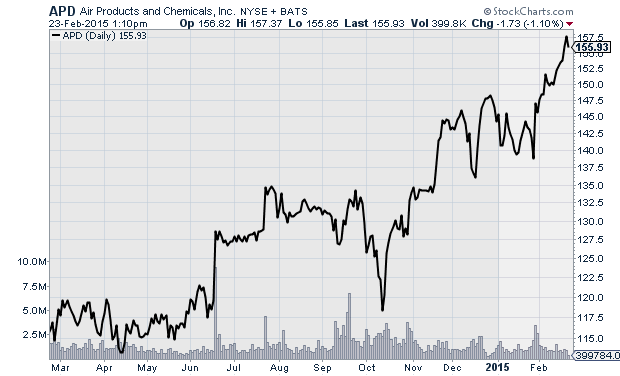

Air Products and Chemicals

Air Products and Chemicals (APD) has an impressive streak of dividend increases that spans 32 consecutive years. The current yield sits at 2.0%, and the company's payout ratio is 47.5%. Considering the long-running streak of dividend increases, chances are good that the company will continue to grow its dividend, with the announcement likely to come during the second half of March. While another increase is probable, investors should not look for a huge increase with this year's change. Last year's increase was 8.4%, and this year's will probably fall around that same level, maybe even a bit lower. The current quarterly distribution is 77 cents per share, which is likely to rise to 84 cents, which would be an increase of 9.0%. Look for the announcement mid-March, with the stock trading ex-dividend towards the end of March the dividend payable mid-May.

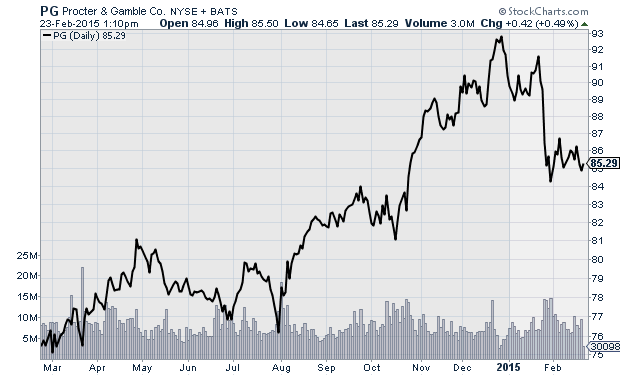

Procter & Gamble

Consumer goods maker Procter & Gamble (PG) is a true dividend aristocrat, having increased its dividend each of the last 58 years, a streak it is not likely to break this year. The payout ratio is a bit high at 64%, so a huge increase is not likely. However, with the stock already boasting a 3.0% yield, the stock does not need a big increase to keep investors happy. Last year the company increased the dividend by 7.0% to $0.6436 a share, and this year's increase will likely be similar, with the payout rising to around $0.685 for a 6.4% increase. Look for the announcement to come towards the start of April, with the stock trading ex-dividend during the third week of April.

Courtesy of MarketIntelligenceCenter.com