'Tis The Season For A Strong Calendar Trend

Did the Christmas Rally Start Monday?

With the stock market up big in 2013 and many participants speculating on a pullback in the next week or two, I have to say I am on the other side of that bet. Being a technical trader I focus on patterns, statistics and probabilities to power my trading strategies. So with 37 years of stats, the seasonality chart of the S&P 500 Index (SPX) (SPY) paints a clear picture of what is likely to happen in December.

If you do not know how to read a seasonality chart, I will explain as its very simple. They simply shows what the index has done on average through each month over the past 37 years. December typically has the strongest uptrend of any other time of the year.

SPX Seasonality Chart

The Big Board

The NYSE Composite, also referred to as the Big Board, is an index with the largest brand name companies. Most individuals do not follow this, but to me it's as close to the holy grail of trading than anything else I know. I use many different data points from this index (momentum, order flow, trend) for my ETF trading strategies.

You must follow the trend of this index if you want to be on the right side of the market. While I follow and track the New York Stock Exchange closely and it has its own ETF (NYC), I do not trade it per say. These big stocks are what really move the market, I always trade with this index trend in mind.

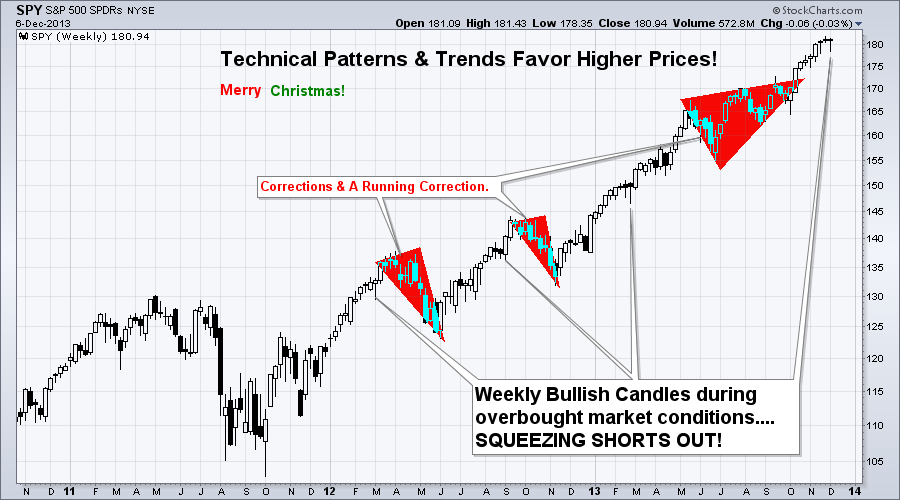

S&P 500 Weekly Outlook - Bullish

The chart below is self-explanatory I think... But let me recap.

The overall trend is up, so your stock & ETF trades should be to the long side buying on the dips. The chart below goes back three years so the candles are a little condensed and small, but what you need to know are these two points:

1. After a correction within a trend, probability says that price is more likely to continue rising than it is to reverse. Notice the market just had a running correction through the summer months.

2. A reversal candle on the weekly chart (bullish reversal candle) generally indicates a 2-3 week rally is likely to happen.

Conclusion: Seasonality says higher prices, weekly chart below shows bullish reversal candle

The Bigger Picture: 3 -6 Months Out

This is a quarterly chart and BIG picture outlook. Over the next 3-6 months we could see the stock market start to become choppy and rollover into a minor bear market for a couple years. That is the best case scenario I think... The other scenario is a major crash back down to the 700-1000 level on the SPX, which could cripple the baby boomers from retiring and getting a job would be impossible for almost everyone - full blown recession way worse that what everyone is saying we are in now.

Things are going to be really interesting over the next few years and you had better be prepared to profit in both directions.

Holiday Trading Strategies Conclusion:

In short, I think we have a couple good weeks ahead of us. Holiday season, quality family time and a rising stock market paints a nice picture in my mind.

Courtesy of Chris Vermeulen, www.GoldAndOilGuy.com