The Most Heavily Shorted Stocks Have Tended To Drop Recently

The Most Heavily Shorted Stocks Have Tended To Drop Recently

S&P 1500 Most Heavily Shorted Stocks: Mid-July 2014

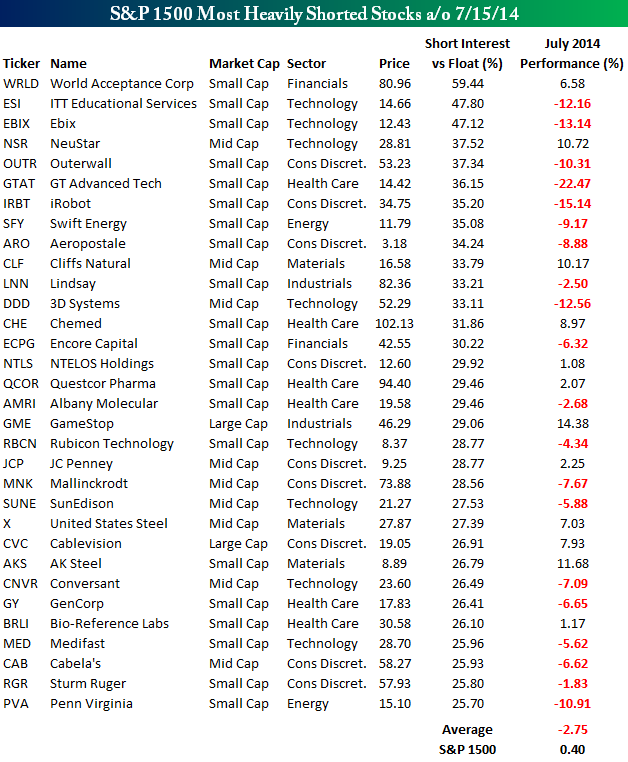

Short interest figures for the middle of July were released late last week, and below we have provided a list of the 32 stocks in the S&P 1500 that have more than 25% of their float sold short. As is usually the case, the majority of names listed in the table come from the small cap space. In fact, just two of the 32 names shown, GameStop (GME) and Cablevision (CVC) are in the S&P 500 (SPY) (SPX).

For each stock listed below, we have also included its performance so far this month. Of the 32 names shown, only 12 are up so far in July. Additionally, of the 20 stocks that are down, seven are lower by more than 10%. Overall, the average performance of the stocks listed is a decline of 2.75% compared to a gain of 0.40% for the S&P 1500.

Normally in a period when the overall market is up, stocks with the highest level of short interest outperform, so the fact that the most heavily shorted stocks in the market are down by nearly 3% in an up market has to make the shorts just ecstatic.

The strong underperformance of the most heavily shorted stocks in July continues a trend that has been in place for much of the last several months. With the exception of the month of June, we have repeatedly seen the most heavily shorted stocks posting returns that are well behind the overall return of the market. 2013 was a year to forget for short-sellers, but so far 2014 has been the year for shorts.

Courtesy of bespokeinvest.com