Russell 2k 'Death Cross' Is Approaching

Bears eyeing Russell 2000 death cross

by Robert Hum

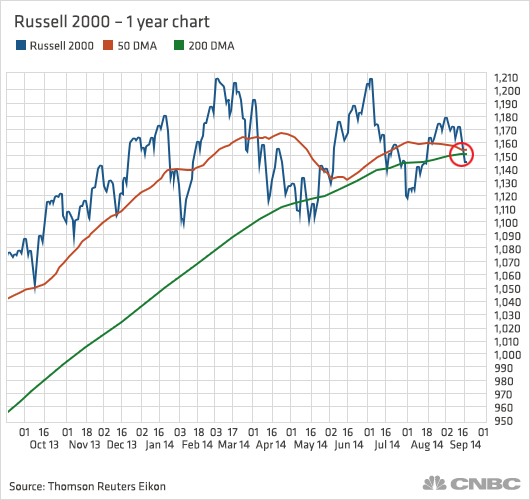

The Russell 2000 has been diverging from the broader market, and now technicians say it could be about to flash a potentially very bearish signal. For the first time in a month, the Russell 2000 on Monday closed below its 200-day moving average. Of more concern to traders and technicians: The small-cap index is approaching its first so-called death cross in more than two years.

A death cross occurs when a nearer-term 50-day moving average falls below a longer-term 200-day moving average. Technicians argue that a death cross can be a bearish sign.

The Russell 2000 is the only major U.S. index that is approaching its death cross as traders have already been quite bearish on the Russell 2000 so far this quarter. The small-cap index has far underperformed the broader markets during the quarter, falling 3.9 percent versus the S&P 500 up 1.9 percent and the Nasdaq composite up 2.9 percent over the last 11 weeks.

More evidence of the recent weakness in small-cap stocks: the Russell 2000 is currently more than 5 percent below its all-time high set at the start of the quarter on July 1, while both the DJIA (INDU) (DIA) and S&P 500 (SPX) (SPY) are within striking range of record closes.

Hitting a death cross could potentially propel the Russell 2000 lower and push the index closer to correction territory, a significant level watched by traders that is 10 percent below this index's all-time high.

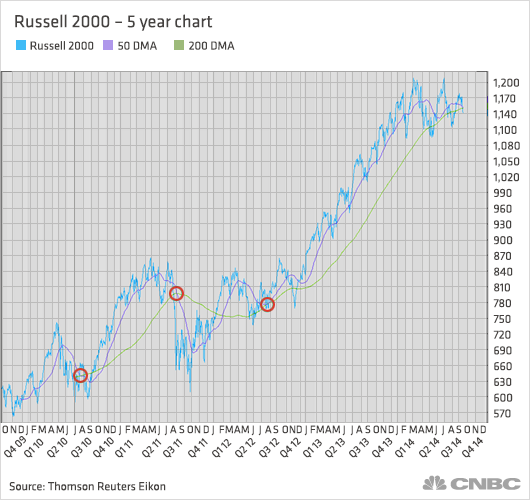

The last time the Russell 2000 hit a death cross was back in July 2012, but no selloff followed as the index quickly bounced off that level and continued its uptrend.

(Death crosses circled below.)

A year before that death cross though, in August 2011, the index hit a death cross and trended lower in the short term. However, that dip was headline-driven, spurred by Standard & Poor's stripping the U.S. of its AAA credit rating.

Courtesy of cnbc.com