'Mayan Temple' Rate Hikes Not Necessarily Bad For The Markets

'Mayan Temple' Rate Hikes Not Necessarily Bad For The Markets

by Alex Rosenberg

One of the market's biggest worries is the first hike of the federal funds rate, which many expect to come this year. But John Stoltzfus, chief market strategist at Oppenheimer, says investors who fret about it are missing the point.

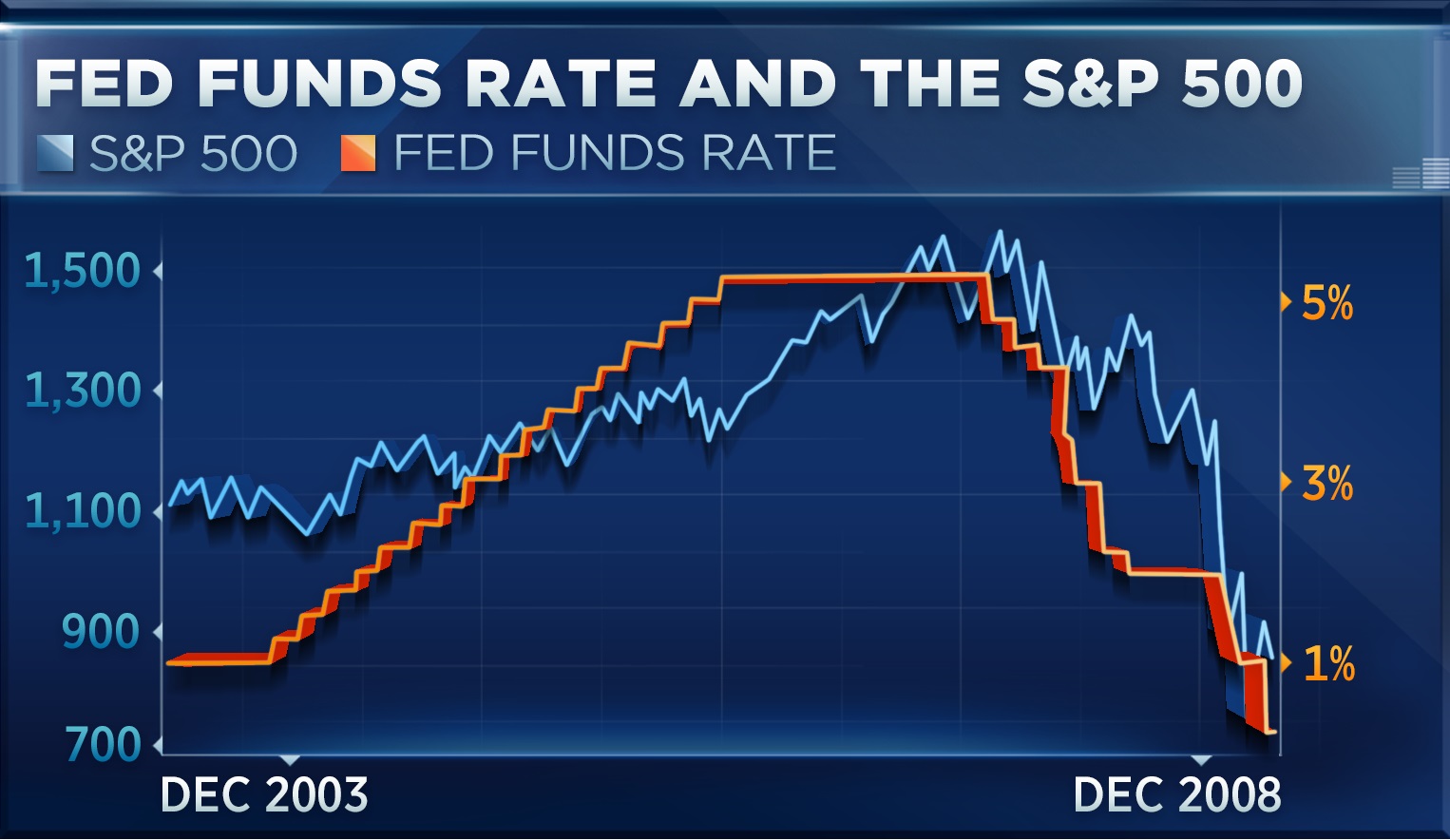

"So long as the pace of rate hikes and the levels of increase in rates are digestible for the markets once they begin, the market has opportunity to recognize that moderate, well-timed rate increases are confirmations of economic growth," Stolzfus wrote to CNBC. "The last 'hike-pause and cut' cycle saw stocks move higher as rates rose, and even after the Fed stopped raising rates and paused."

On the contrary, "It wasn't until the Fed began to cut rates that the markets began their decline. So, it was the cuts, not the hikes, that brought the market down last cycle," he said mischievously.

Stoltzfus furnishes a chart to illustrate what he terms the "Mayan temple effect" (presumably because the chart of the fed funds rate target resembles a Mayan temple).

Traders now expect the Federal Reserve to raise its fed funds rate targets around December, according to the CME Group's FedWatch tool. As rates increase, stocks and other "risky assets" become less attractive when compared to bonds.

Stolzfus' point is that the economic growth that occurs alongside rate hiking is good enough for markets that stocks tend to shrug off the rate rises.

But others warn that if the Fed ignores the slowing GDP growth and merely responds to the falling unemployment rate, stocks could be in big trouble.

"We see an increased risk of an equity selloff if the Fed hikes without a strong bounce in GDP this year," Bank of America Merrill Lynch rates strategist Ruslan Bikbov wrote in a note Friday. Further, Bikbov cautions that the central bank would not blink if equity markets dip.

The strategist recommends that investors buy bearish put spreads on the S&P 500 in order to hedge the risk inherent in holding stocks as the Fed looks to raise rates.

Courtesy of cnbc.com