5 Rallying Stocks That Could Go Even Higher

The market dip in the first half of October put a lot of investors on alert, but fears about the market running out of steam quickly abated as the indices found their footing and headed to new record highs.

No one will question the fact that there are risks out there. China's economic growth is slowing, Europe remains on shaky ground, and Ebola continues to be a concern. While the risks are ever-present, the good news is that most analysts agree that the U.S. economy remains on solid footing.

Wall Street has definitely proven its confidence in the overall economy, but perhaps more importantly, so has the general population. Consumer sentiment and consumer confidence hit levels in October that we have not seen since 2007, which should lead to impressive holiday sales for retailers.

Retail spending is a major component of the nation's GDP. If the holiday season lives up to expectations, there is no reason to believe that the U.S. economy on the whole will not keep its momentum into next year. The National Retail Federation has forecast a 4.1% increase in holiday spending this year versus last year, compared with last year's 2.8% increase.

The Dow Jones and S&P 500 are both trading near record-highs, and the NASDAQ is just below its 52-week high. With the markets trading near their highs, it should come as no surprise that a lot of big-name stocks are currently trading near their 52-week, or even all-time highs. The real question is, which of these stocks have the potential to say the same by the end of the year? Let's look at a few stocks which I believe have a high likelihood of trading at recent highs, or even new all time highs, by the end of the year.

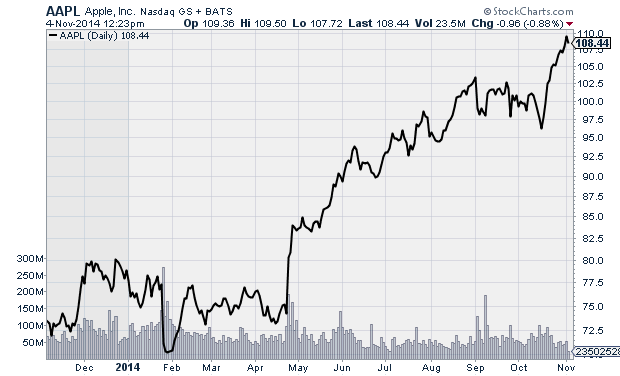

Apple

Tech titan Apple (AAPL) is definitely firing on all cylinders. The stock is currently trading just under its all-time high and I believe this is a stock that will most likely finish out the year near a 52-week high. The company recently launched its new iPhone 6 and 6 Plus and enjoyed record-breaking sales during the opening weekend. The new iPhone is likely to be a big hit this upcoming holiday season. The record sales for the new iPhone would be enough on its own to push the stock higher, but in addition to the iPhone's success, Apple also recently launched its new mobile payment system, Apple Pay, which has the potential to be a huge revenue stream moving forward. The stock is also likely to trend higher ahead of the upcoming launch of Apple Watch, which is coming early next year. With the iPhone 6 selling as quickly as it is, the stock has charged higher and is currently trading just below its all-time high. Apple has a lot going for it right now, and I believe the stock will close the year near its 52-week high.

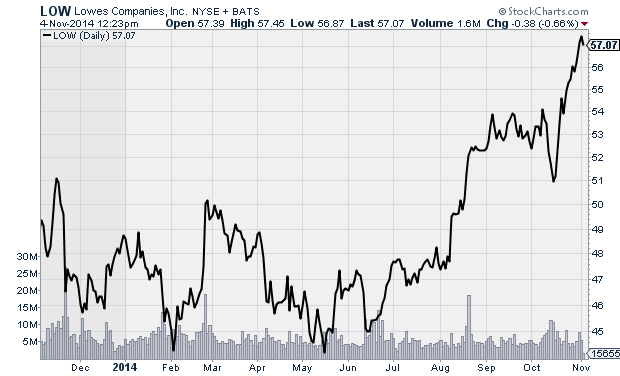

Lowe's Companies

Home improvement supplier Lowe's (LOW) has enjoyed solid returns in 2014, with shares currently up slightly more than 15% on the year. The stock is currently sitting just 0.6% below its all-time high. Lowe's reports earnings off-cycle, with its third-quarter report not scheduled until November 19, it will have to post strong numbers for its most-recent quarter in order to keep the stock trading near record levels, but analysts are taking a bullish approach on the sock at the current time. Research firm Goldman Sachs recently lifted its 2015 earnings guidance to a range of $5.20 to $5.85 a share, up from its previous range of $5.15 to $5.80. Goldman based its higher forecast on the fact that the extended housing recovery will lead to stronger earnings for the company, which should be reflected in an upbeat Q3 report and keep momentum behind the stock headed into the end of the year. Analysts expect the company to report Q3 earnings of $0.58, up from $0.47 during the same period last year, so keep an eye on the stock immediately following the upcoming earnings report. If results hit the consensus, expect the stock to close out the year near its all-time high.

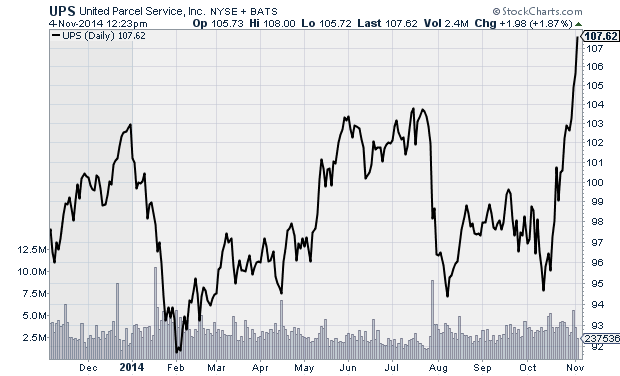

United Parcel Service, Inc.

United Parcel Service (UPS) has two things working in its favor right now. For one, the upcoming holiday shopping season is expected to be good, which will lead to large shipment volumes for shipping companies such as UPS and FedEx (FDX). The second thing working in the company's favor is lower fuel costs. Oil prices have been falling, which have resulted in lower gasoline prices. Fuel costs make up a significant amount of UPS's overall costs, so lower oil should give the company a nice earnings boost this quarter. UPS has already forecast the upcoming holiday season to be a record for the company, estimating it will handle around 585 million packages ahead of the holidays, which would mark an 11% increase over last year. On December 22 alone, the company plans to deliver 34 million packages. The National Retail Federation has forecast holiday sales will rise 4.1% versus last year, which will keep shipping companies busy. With strong holiday sales expected, and lower fuel costs, the stage is set for UPS to close out the year strong, easily closing the year near its 52-week high, which also happens to be its all-time high.

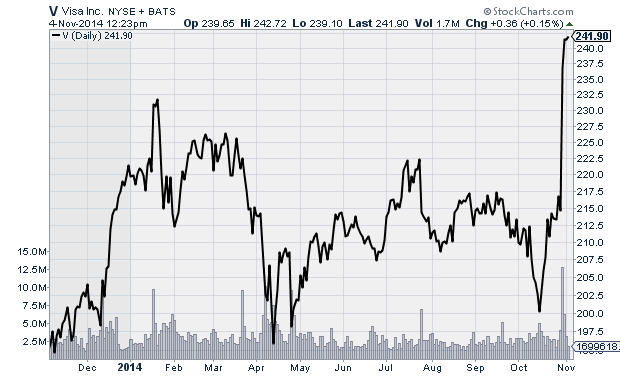

Visa

Payment processor Visa (V) has benefited from improved consumer confidence, and the stock is looking good to close out the year at or near its 52-week high. In October, consumer confidence hit its highest level since October 2007. Consumer sentiment is also running at pre-recession levels, with sentiment in October rising to its highest level since July 2007, buoyed by optimism about the overall economy, and stronger expectations regarding personal finances. With these two readings at 2007 levels, retailers are preparing for what could be a very good holiday shopping season, which of course would greatly benefit payment processors such as Visa. As long as a string of bad news regarding the state of the U.S. economy does not hit between now and the holidays, the outlook for payment processors through the remainder of the year is bright. With the recent run up in the stock, its valuation has become a slight concern, with shares trading 34 times earnings, so the upside may be a bit limited at the current time. While I believe there is limited upside, I expect shares to trend slightly higher through the remainder of the year, with the stock closing out the year near the 52-week high, which represents an all-time high for Visa.

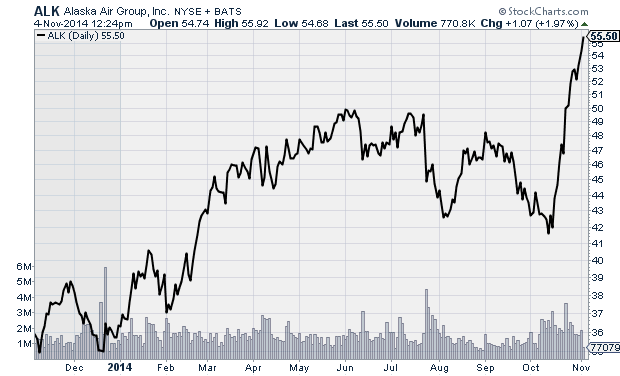

Alaska Air Group

Airliner Alaska Air Group (ALK) has made a recent strong move to the upside and with falling oil prices chances are high that the stock can finish off the year near its all-time high. The entire airline sector has been strong as of late, which really should come as no surprise considering how important fuel costs are to the industry. Not only have fuel prices been on the decline, but with the U.S. economy improving, there is no reason to expect any decline in tourism moving forward. Supply has been on the tight side in recent years, so analysts do not expect a quick drop in fare prices due to lower oil prices. Should oil remain at its current level, airfares will gradually inch lower. For now, prices are not on the decline. With fuel costs drastically lower than just a few months ago, and ticket prices holding firm, there is no reason why the entire industry, including Alaska Air, should not be able to close out the year near 52-week highs.

Courtesy of MarketIntelligenceCenter.com