By Myra P. Saefong, MarketWatch

Gold demand in November soared to its highest level since the end of 2011 as investors took advantage of a steep drop in prices for the yellow metal following Donald Trump’s win in the U.S. election, according to data from BullionVault released Tuesday.

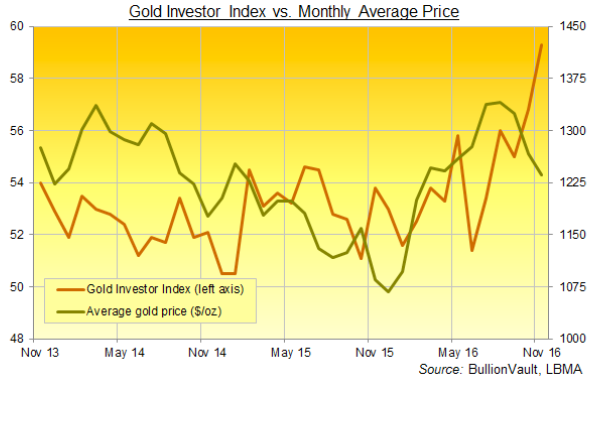

The Gold Investor Index, run by Internet-based metals exchange operator BullionVault, jumped to 59.3 in November—its highest level since December 2011. the index stood at 56.8 in October.

The gauge tracks the balance of private investors starting or growing their gold holdings on BullionVault, against those who cut or sold their holdings. A reading above 50 suggests that there are more buyers than sellers in the market for gold. September 2011 marked the peak for the index at a reading of 71.7.

BullionVault said it saw the number of people in November starting or adding to their personal gold holdings rise by 29.8% from October.

Meanwhile, gold demand grew at the strongest pace since November 2011—tacking on 0.8 metric tons to BullionVault users’ holdings to a record total of 37.1 metric tons.

This year continues to “shock the consensus and it’s been gold’s turn for an upset following the U.S. election,” said Adrian Ash, head of research at BullionVault. “Private investors are looking beyond this ‘Trump dump’ in gold prices to buy what many see as financial insurance at what looks a good discount given the risks ahead.”

Gold futures dropped last month to their lowest levels since February and posted a loss of about 7.9% for November, their largest one-month percentage drop in more than three years.

GDP growth in 2017 is likely to struggling to maintain this year pace, said Ash. “The hardening reality of Brexit and U.S. protectionism will likely add to volatility around key points of investment stress, led by the French and German election.”

Many market observers speculated ahead of the U.S. presidential election that a victory by Trump would lead to a rally in gold, viewed as a haven in times of uncertainty, and a steep drop in equity markets. Instead, the billionaire’s victory sparked a slump in gold, a rally in stocks and sent the dollar storming higher as yields on benchmark government debt rose to their highest levels in months, as investors focused on pro-market policies that Trump touted during his presidential campaign against rival Hillary Clinton. A stronger dollar and higher yields are bearish for dollar-pegged precious metals that don’t offer a yield.

Silver prices also declined in November—to their lowest level since June—but BullionVault’s Silver Investor Index fell to a reading of 56.2 in November from October’s 57.2 level, which was near a three-year high, BullionVault said.

Courtesy of MarketWatch.com