Late last week, (relatively) new President Donald Trump suggested the U.S. dollar has been too strong for too long for the U.S. economy's own good, and was in need of a pullback.

The premise seems confusing at first. The term 'strong' is a word Americans like to use in describing all aspects of its society, even if they don't fully understand its ramifications. As it turns out though, this is a matter where President Trump has a valid point. While a strong U.S. dollar means U.S. residents can buy a lot of goods made overseas for relatively little, the greenback has been so strong since 2015 that it's been difficult -- if not impossible -- for some foreign trade partners to purchase U.S.-made goods and services. Since 2015, several multinational companies based in the U.S. have reported adverse currency exchange rates have taken a toll on their bottom lines. Never even mind the fact that an uber-strong U.S. dollar is the crux of the reason crude oil prices were crushed beginning in 2014. [It's true. Oil's demise had little to do with its abundant supply.]

Good news, however, for the companies that have been waiting for the dollar to fall back under the stratosphere. That may be happening right now.

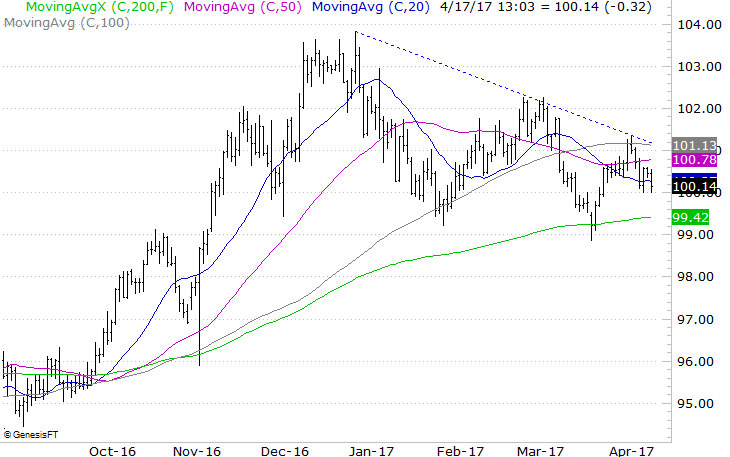

To be fair, we've been teased with the premise before. A steep selloff in the U.S. Dollar Index in January and another pullback in March were both ended before they could do any major damage. As of last week though -- even before Donald Trump began naysaying the dollar -- it was back into a downtrend after bumping into what has since become an established resistance line (blue, dashed).

It's difficult to suggest the greenback's strength is beyond salvaging now. Aside from the two fakeouts earlier in the year, the 200-day moving average line (green) has been and still is a key technical floor, spurring a bounceback whenever things start to go from bad to worse. In addition to the second higher low since January's peak though, March's low was a new low. The pattern has been established.

Just look for a fight at the 99.42 level for the U.S. Dollar Index, no matter what.

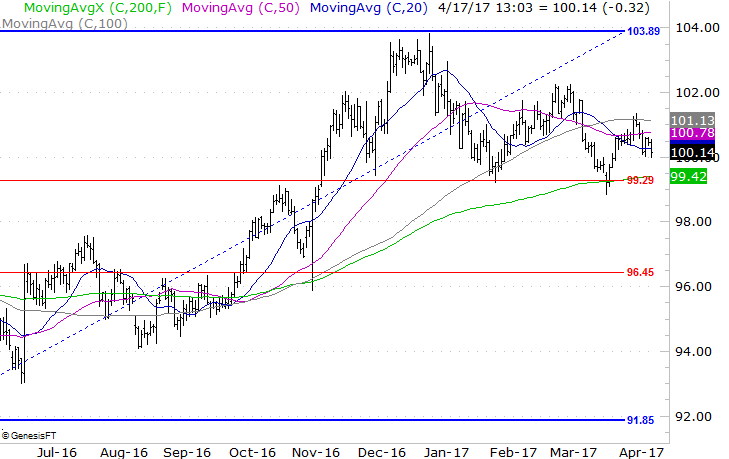

Should the dollar start to move meaningfully lower via a break under the 200-day moving average line, questions arise as to how for such a setback might bite. It was trading below 80 in early 2014, before the prospect of rising interest rates sent it on a one-year bullish journey that turned into a bullish three-year trek. That's not a terribly plausible target though. A more realistic floor from here is around the 93 area at the lowest. That's where the U.S. Dollar Index hit a major low several times in 2015 and 2016. Even more realistic than that, though, there's a key Fibonacci retracement line around 96.41 and another at 99.23, near where the 200-day moving average line currently lies.

Of course, both Fibonacci lines are apt to play some kind of role in the dollar's foreseeable future.

Whatever is in the cards for the greenback, know that it's on the defensive now. Maybe Trump kick-started that reality, and maybe he didn't. It doesn't matter. That's where things are now. A little more downside follow-through could be quite a game-changer.