A Very Lopsided Rally (and A Very Noteworthy Reason)

Think the rising tide of the Trump rally lifted all boats? Think again. The market's gains since early November weren't across the board. Indeed, more than a few stocks have struggled to even make a measurable gain since the November 4th bottom, though the S&P 500 is up 5.7% for that month-long period.

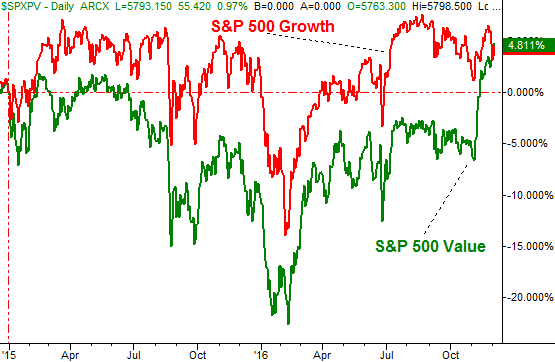

The even-more-amazing part of the story is how well defined and stratified the losers and winners are, by grouping rarely discussed any more. Since November 4th, growth stocks are up a mere 3.2%, while value stocks are up a whopping 12.2%.

For those who keep close tabs on the overall market's inner workings, you'll know why that seems so odd - value stocks have been lagging, considerably, since 2014. Over the course of the past four weeks, that gap has been closed, and then some.

The obvious follow-up question is, why? That's the less aggressive way of asking what is it about Donald Trump's plans and policies that bode so well for this group as opposed to growth stocks. The answer is, nothing... directly. The indirect answer is, however, Trump's growth plans and the likely result he's going to get will almost certainly prod at least one if not two rate hikes in the foreseeable future. If all goes well, in fact, the Federal Reserve may even have to impose several rates hikes over the course of the coming couple of years...

... and that tends to help value stocks a heck of a lot more than it helps growth stocks.

Giving credit where it's due, it was Jonathan Lewellen - a finance professor at the Tuck School of Business at Dartmouth College - who explained to Barron's last year "Growth stocks are valued on future earnings-when rates are on the rise, investors are less willing to pay high multiples. Value stocks, meanwhile, are the bird in hand, with strong existing cash flows. As rising bond yields reflect a healthier economy, more stocks participate, and investors grow sensitive to valuations."

And it's a tendency you can reliably take to the bank. As Patrick O'Shaughnessy, principal at O'Shaughnessy Asset Management, observed last year, value stocks have outpaced growth stocks in 14 of the last 17 rising-rate phases.

In other words, the highly disparate performance of the two groups is the market's way of saying interest rates are going to rise.

Was it Trump's election that tipped the scales? Probably. It was at least a big piece of the explanation.

As for what traders should do now, while the initial, knee-jerk move may be over with and done, the underpinnings are apt to persist as long as the prospect of rising rates looms overhead. That long-term trend will still provide a tailwind for short-term swings.