The VIX Is Low, But How Low Historically?

A Historical Perspective on Current VIX Levels

The CBOE Volatility Index (VIX) (VXX) has been fairly low for most of 2014. I can admit that. When I hear comments like, "VIX is broken", due to the recently low levels for VIX, then I get to work.

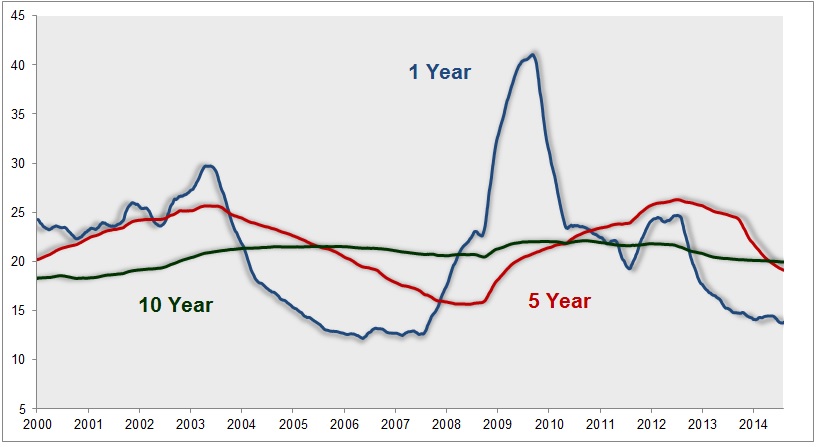

CBOE has data on VIX going back to January 1990. The average closing price for VIX from January 1, 1990 through August 11, 2014 has been 20.02. The average for VIX in 2014 has been about 13.65. That's the kind of comparison that has people thinking something is wrong with VIX. To show VIX is perfectly fine and behaving within the parameters of history I took a look at some different averages. The chart below shows the daily rolling 1, 5, and 10 year average of closing prices for VIX from January 1, 2000 through August 11, 2014.

The more active blue line represents what the 1 year average for VIX has been since January 2000. This rolling average has been as high as 41.16 and low as 12.30. On August 11th it was at 13.97. 13.97 is pretty high relative to 12.30 which occurred in 2006. You can take that as VIX really isn't that low or VIX can go lower - I'll leave that to your market outlook.

The red line shows the rolling 5 year average closing VIX level. The highest 5 year average is 26.38 while the lowest has been 15.83. This lowest level occurred in May 2008. I find it worth mentioning that less than six months after the 5 year average hit its lowest level, VIX closed over 80.00. The current 5 year average for VIX is currently at 19.24, which is pretty high when compared to the low back in May 2008.

The fairly tame looking green line shows the rolling 10 year average close for VIX which has ranged from 18.36 to 22.21. I love when I run numbers and the outcome has some sort of irony. The 10 year average is currently at 20.03, which is right in the middle of the average 10 year range and just 0.01 higher than the average close from 1990 through present.

So is VIX broken or too low? The numbers say, "No - VIX is low, but it is not really doing anything different than we have seen historically".

Courtesy of CBOE.com