Sears Holdings (SHLD): Looming Disaster Sets Up a Certain Kind of Option Trade

Sears Holdings (SHLD) may be up today, but the knee-jerk response to the Q3 earnings beat wasn't built to last. The retailer is still bleeding cash, but this time around it doesn't have a clear path to refilling the coffers. The end may be nearer than most people think.

Vital stats: In its third fiscal quarter of 2016, Sears reported a GAAP loss of $6.99 per share, and an adjusted loss of $3.11 per share, versus the year-ago period's $2.86. Analysts were expecting a loss of $4.06 per share and revenue of $4.95 billion for the quarter in question. The retailer booked a loss of $2.86 for the same quarter a year earlier, on $5.75 billion worth of revenue.

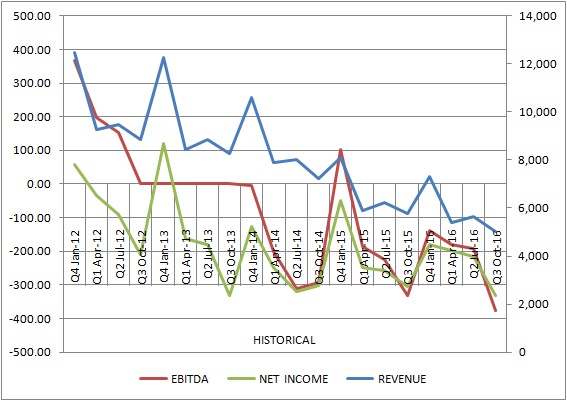

For all intents and purposes, it was a "more of the same" result... and not in a good way. Sears has been losing ground since 2007, partly because a string of divestitures and store closings has crimped the company's ability to grow sales, and partly because CEO Eddie Lampert is just failing to get the job done in his stores. Last quarter, Kmart's same-store fell 4.4%, and Sears' same-store sales were off to the tune of 10%. The last time Sears reported same-store sales growth was the first quarter of 2010. Take that one instance out of the equation, and same-store sales haven't grown any quarter for nearly a decade.

That persistently poor performance can't be chalked up to bad luck, a poor environment, or a changing market landscape. Sears is simply missing the mark.

That's nothing new, however. What is new -- and scary -- is that for the first time in.... perhaps ever, the EBITDA loss started to grow even though the company itself (and its capacity to book losses) continues to diminish. Last quarter, Sears lost $375 million on an EBITDA basis, versus a $332 million in the same quarter a year earlier.

The key difference-maker now is the fact that Sears is paying rent on the stores that it used to own. It sold about 250 units to Seritage Growth Properties (SRG) last year, forcing a new expense that didn't exist before.

It really can't afford to pay that bill; it can't even afford to service its debt.

Now that decision to raise funds by selling real estate to a REIT has come back to haunt Lampert. In a more philosophical sense, Lampert isn't getting much (if any) of a return on investment on all the fund-raising he's directed. He's only been buying time, without ever stopping the bleeding. Now though, the bleeding is accelerating because Sears simply lacks the much-needed scale/size it needs to operate profitably; an "economy of scale" is a two-way street.

The catch with turning this idea into a trade, and into an option trade specifically? For one, at a price of just under $13.00, it's a low-priced stock and as such its options don't move much even if SHLD makes a relatively big move. The other reason Sears Holdings is tough to trade is simply that, though it's doomed, it can and likely will take a long while for the stock to reflect that doom. Traders may have to suffer through some volatility and adverse price movement while they wait.

It's not an ideal situation for a conventional buy-low, sell-high option trade. Time decay could become a real problem, unless you were willing to buy a WHOLE lot more time than you'd ever need. The alternative (and lower risk) approach here would be letting time decay work for you, and setting yourself up with a trade that won't be damaged by short-term volatility.

A spread would do the job better than an outright put purchase might, from a risk-versus-reward vantage point. A credit spread may be particularly fruitful in this situation.

Spread trades on low-priced options also don't have the downside of minimal movement. The profit with a spread lies in the relative difference between the two legs of the trade.

Whatever the case, clear battle lines have been established for SHLD. There's a major support level at $10.50, and a minor one at $11.50. Conversely, there's a major resistance level in the 200-day moving average line (green) at $13.84, and a more immediate one with the 100-day moving average line (gray) at $13.04. The stock is rather well trapped in a zone here, which lends itself to spread trades and makes outright buys less advantageous.

Either way, with the clock now ticking and Sears not in a position to raise any funds (it's got $2.4 billion worth of real estate it could sell, but it may not be readily marketable, and nobody wants to lend to a crumbling company), the path of least resistance is downward, even under that key floor at $10.50. It's just going to take time to get there. Just be sure to make that time work for you rather than against you.

Need help finding credit spread trades? Try our Smart Options Spreads advisory service. This newsletter specializes in maximizing gains and minimizing risk through the use of spread trading.