A Bear Call Credit Spread Explained With a Real Trade

Ever wonder how a bear call credit spread works, or for that matter, wonder what a spread is? Don't worry - it's not as complicated as it may seem.

A spread is simply a two-option trade. One of the options is intended to drive the profits of a particular expected move from a stock or an index, while the other option is something of an insurance policy in case things don't pan out as expected. That 'other' trade serving as protection may ultimately limit a trade's upside, but in many cases, that's perfectly ok.

The catch: In a spread, one of the options is bought, and the other one is sold, or shorted; the short position -- or leg -- of the trade is generally the insurance policy, so to speak. The long or purchased option is the proverbial moneymaker.

There are all sorts of spreads, but we'll limit ourselves to just one example, using a trade issued by our Index Options Timer service as the proverbial guinea pig. Just bear in mind this is only one kind of several spread trades that can be entered.

First and foremost, the IOT service starts out with a simple enough assumption... that the value of the SPDR Gold Trust ETF (GLD) is apt to keep falling after it was knocked into a pullback on Wednesday. It's not a bad bet, either. The rally effort was stopped and reversed the past two times the 200-day moving average line (green) was tested, and on Tuesday, it only took a near-encounter with the 200-day average to put GLD back in pullback mode.

There are several ways to play such a move with spreads, but the ideal one here is a bearish call credit spread.

Don't panic by the verbose description. Let's take it one word at a time. That is, it's bearish in the sense we think the SPDR Gold Trust ETF, calls simply refer to the kinds of options we're using to make the trade (as opposed to puts), it's a credit spread because we're collecting money rather than paying money to enter the trade (we'll have to pay to exit it, though hopefully at a much lower price), and it's a spread just because we're playing it with two options... one long, and one short.

There are no two 'right' options to trade, as every situation is different. In this particular case though -- with GLD trading at $118.85 -- the ideal risk/reward scenario is in selling or shorting the GLD April Week 2 (04/13) 119.5 Call (GLD 170413C119.5) , and in buying the GLD April Week 2 (04/13) 120.5 Call (GLD 170413C120.5) . The former sells for $0.25, and the latter can be bought for $0.08. But, a good broker can work the order and get a net credit of $0.20, or $20 for each contract-pair traded. In fact, we got a credit of $0.25, though we were only looking for $0.20.

It matters which call was short and which call was purchased. We have to sell the call with the lower strike price since it's closer to being in the money, and as such is worth more. We buy the call with the higher strike just in case GLD pops above the $120.5 level. At that price, the $119.5 calls we were short would almost certainly be exercised, and we'd have to find GLD shares to deliver. Owning that 120.5 calls means we can find those shares at a price of no higher than $120.5 each. [That's what a call option contract does.]

The ultimate idea here, however, is to let both calls expire at the end of next week, which means our $0.25 credit (or $25 per contract) is ours to keep free and clear; until the shorted 120.5 call expires there remains a chance the call could be exercised against us. Hopefully the SPDR Gold Trust will remain below $119.50 for the next week and a half, which would ensure that outcome.

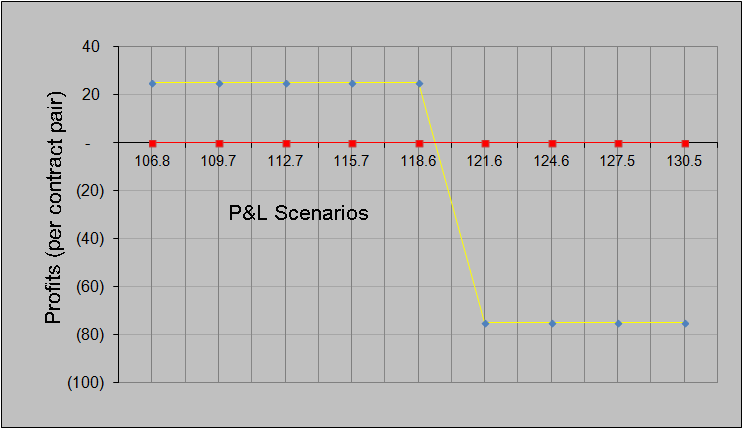

There's an "in between" possibility though. That is, GLD could meander around $119.50 but below $120.50, making our long 120.50 calls worthless by the end of next week, but making the 119.50 calls worth something to someone. If that looks as if it's going to be the case, we can simply close out the trade by simultaneously selling the GLD April Week 2 (04/13) 120.5 Call (GLD 170413C120.5) and buying back the GLD April Week 2 (04/13) 119.5 Call (GLD 170413C119.5) . We may not even have to spend our entire $0.25 credit to do so, if enough time passes between now and then. As such, we could still make a little money even if the SPDR Gold Trust didn't stay below $119.50. It would just depend where it was between $119.50, and how close to the expiration date we were. The sheer passage of time whittles down the value of all options. The profit-and-loss graph below tells the story.

So, the worst-case scenario with this trade would be a $0.75 loss, or $75 per contract pair. That's the $1.00 difference between the two strike prices, but subtracting the $0.25 credit we got for entering the trade.

That seems like a lot in light of the $0.25 credit, but the odds of GLD moving above $120.50 are actually quite low.

The best-case scenario, of course, is keeping the $0.25 credit for ourselves and letting both options expire. As long as the SPDR Gold Trust remains below $119.50 through the end of next week, that's the way it will pan out. Those odds are pretty good.

And of course, there's also the chance of this trade yielding something in between those two extremes. That would depend on how and where we closed out the trade.

These trades mathematically seem like they're not very advantageous in terms of the maximum risk and the maximum reward, but it's quite the opposite really. The odds of realizing the max gain are generally quite good, as time decay -- the natural devaluation of option values just because of the passage of time -- works in our favor even if the underlying stock doesn't help out. The odds of seeing the maximum loss are quite low, and we could pull the plug on the trade well before we got into that situation.

If you'd like to learn more about spread trades, or better yet, learn by doing, the Index Options Timer has helped a lot of people make money while learning about them from one of the best. Go here to learn more.