Sector & Market Reaction To Yellen's Fed

Asset Class Performance Following the Fed

After doing nothing all day leading up to the Fed announcement at 2 PM, the market woke up in the final two hours of the day as new Fed Chair Janet Yellen gave her first press conference. Interest rates on shorter duration Treasuries spiked right away at 2 PM, but stocks didn't take a big dip until just after 3 PM when Yellen commented that the Fed Funds Rate could start to increase as soon as six months after the taper has ended. Buyers did step in after the 3 PM fall, though, and ultimately the major indices ended down between 50 and 70 basis points.

Everywhere we have looked, the headlines are reading something along the lines of "Market Tanks on Sooner Rate Hike." We'd hate to see what they would have read had the market fallen more than a percent!

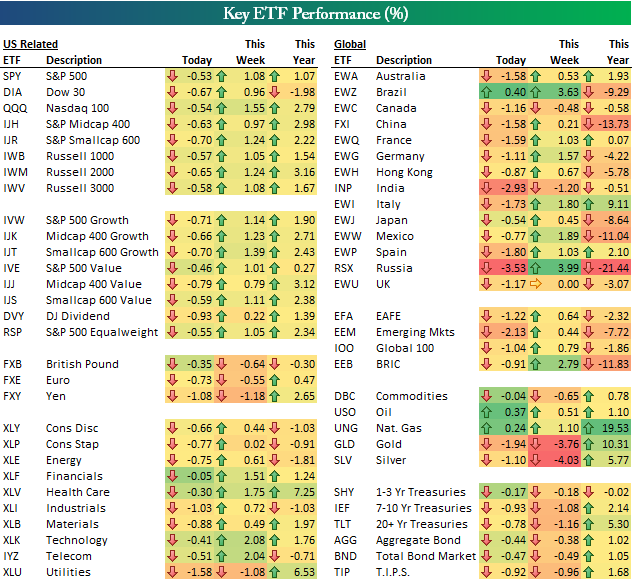

Below is a look at how various asset classes traded today using our key ETF matrix. We have also included performance so far this week and year-to-date so you can see where things stand.

As mentioned earlier, the major US indices all ended the day down 50-70 basis points, but the Utilities sector (XLU) really got hit hard with a decline of 1.58%. The decline in Utilities is to be expected as interest rates rise, but keep in mind that the sector is still up 6.53% on the year. The one sector that held up best was Financials (XLF) with a decline of just 5 basis points. We've been looking for the Financials to lead, and today's action was a step in the right direction.

Global ETFs took big hits following the Fed news. India (INP) and Russia (RSX) were down the most with declines of 2.93% and 3.53%, respectively, while most other countries fell 1%+. Oil (USO) and natural gas (UNG) both ended the day higher, but Gold (GLD) and silver (SLV) both fell more than 1% as the US Dollar index (UUP) rose. Gold is now down 3.76% on the week, but it's still up 10% on the year.

Courtesy of BespokeInvest